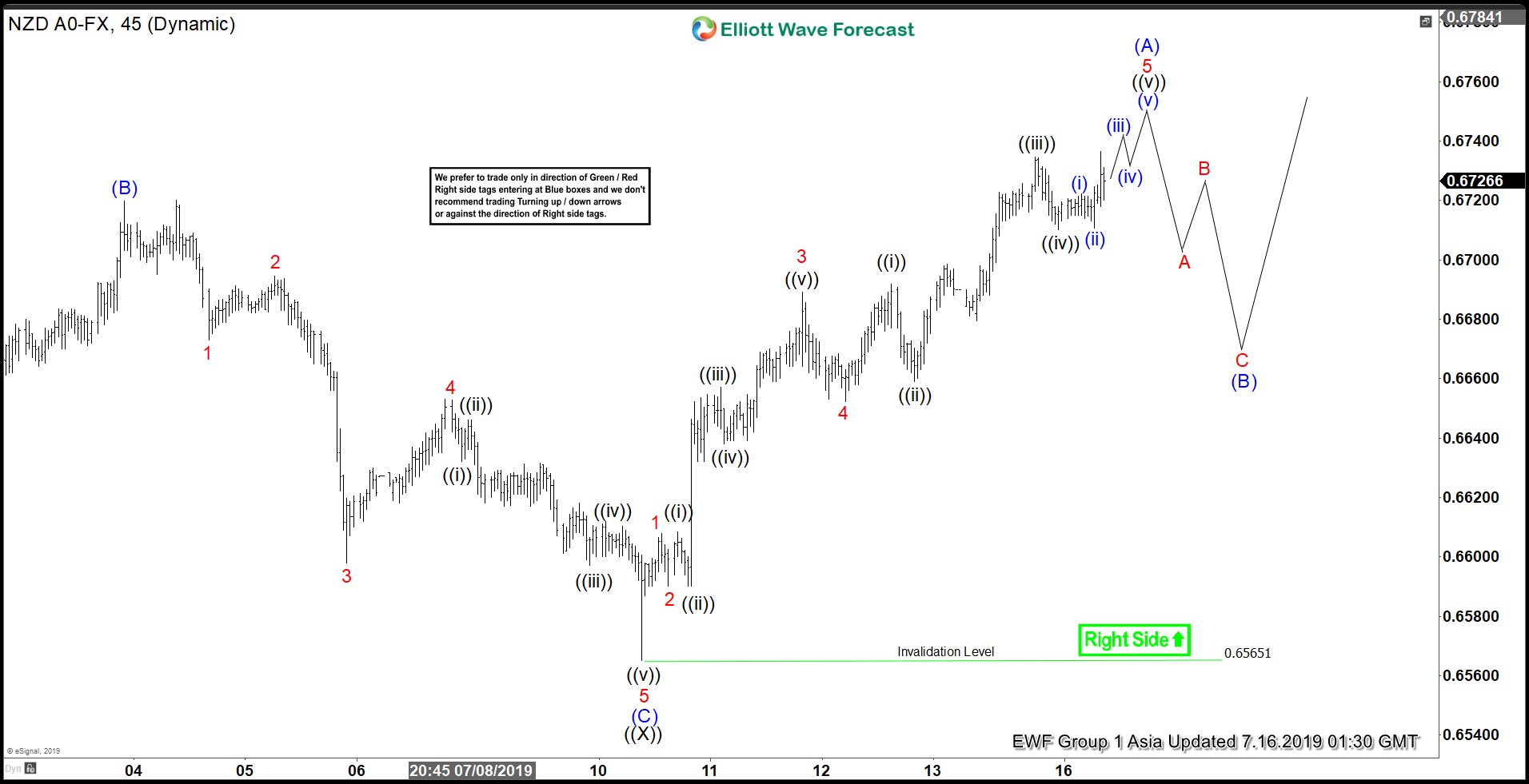

NZDUSD has an incomplete 5 swing sequence from May 23, 2019 low favoring further upside. Short term Elliott Wave view suggests the pullback to 0.6565 on July 10, 2019 low ended wave ((X)). Pair then rallies from there as a zigzag Elliott Wave structure where wave (A) of this zigzag is in progress as an impulse. Up from 0.6565, wave 1 ended at 0.6608 and wave 2 pullback ended at 0.659. The pair then rallied higher in wave 3 towards 0.6689, and wave 4 pullback ended at 0.6652. Expect pair to end wave 5 soon and this should also complete wave (A) in higher degree.

Pair should then pullback in wave (B) to correct cycle from July 10, 2019 low before the rally resumes. Pullback is expected to develop in the sequence of 3, 7, or 11 swing and as far as pivot at 0.6565 low stays intact, expect pair to resume higher. We don’t like selling the pair and favor further upside against 0.6565 low in the first degree. Potential target to the upside is 100% extension from May 23, 2019 low which comes at 0.681 – 0.687 area.

NZDUSD 1 Hour Elliott Wave Chart