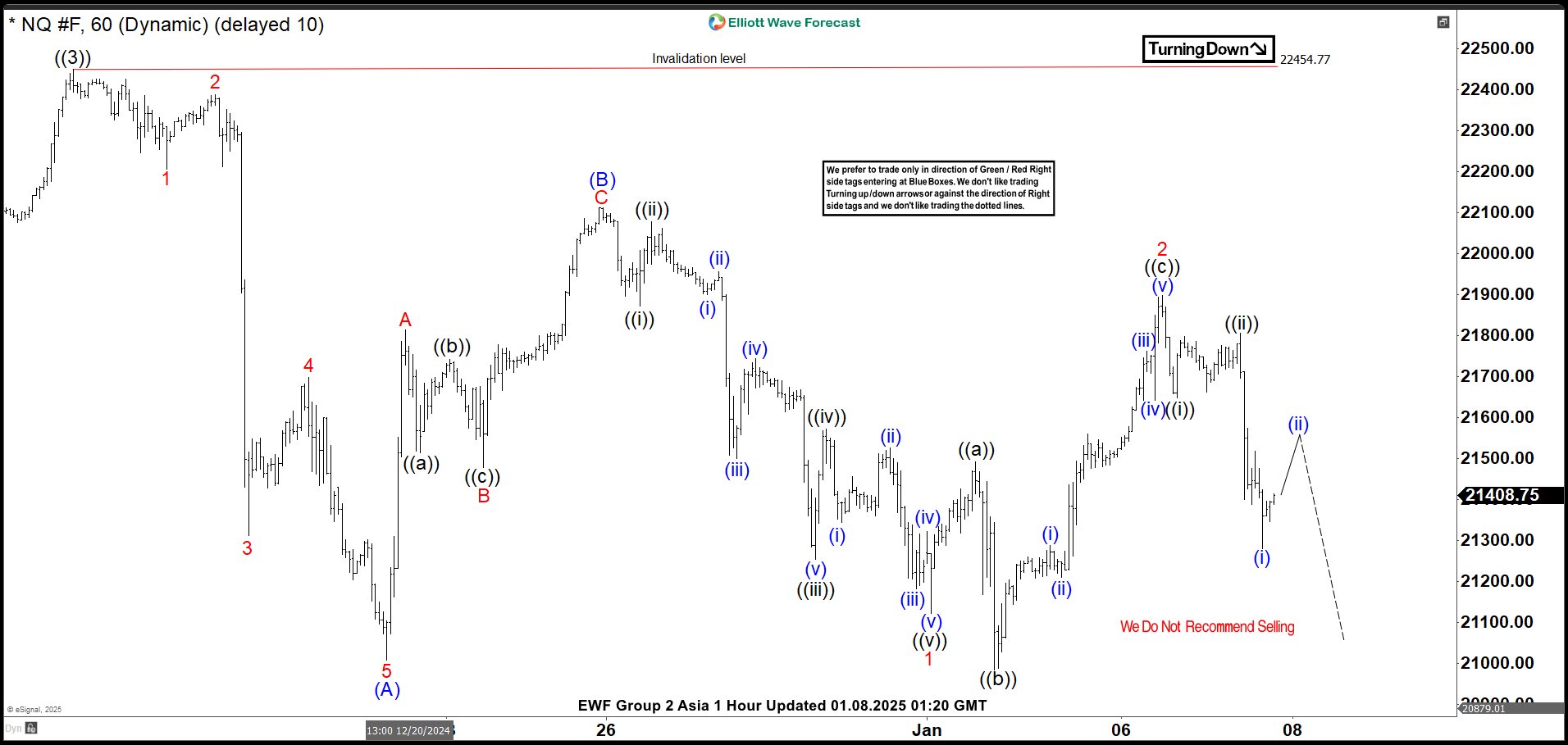

Short Term Elliott Wave view in Nasdaq (NQ) suggests rally to 22454.7 ended wave ((3)). Pullback in wave ((4)) is now in progress as a zigzag Elliott Wave structure. Down from wave ((3)), wave 1 ended at 22206 and rally in wave 2 ended at 22387.75. The Index resumed lower in wave 3 towards 21311 and rally in wave 4 ended at 21697.75. Final leg wave 5 lower ended at 21006.5 which completed wave (A). Rally in wave (B) unfolded as a zigzag structure. Up from wave (A), wave A ended at 21812.25 and wave B ended at 21476.75. Wave C higher ended at 22111.25 which completed wave (B) in higher degree.

The Index has turned lower in wave (C). Down from wave (B), wave ((i)) ended at 21870.25 and wave ((ii)) ended at 22076.25. Wave ((iii)) lower ended at 21253 and rally in wave ((iv)) ended at 21571. Wave ((v)) lower ended at 21121.75 which completed wave 1 in higher degree. Rally in wave 2 unfolded as an expanded flat where wave ((a)) ended at 21490.5 and wave ((b)) ended at 20983.75. Wave ((c)) higher ended at 21896.75 which completed wave 2 in higher degree. The Index then turns lower again in wave 3. Near term, as far as pivot at 22454.77 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.