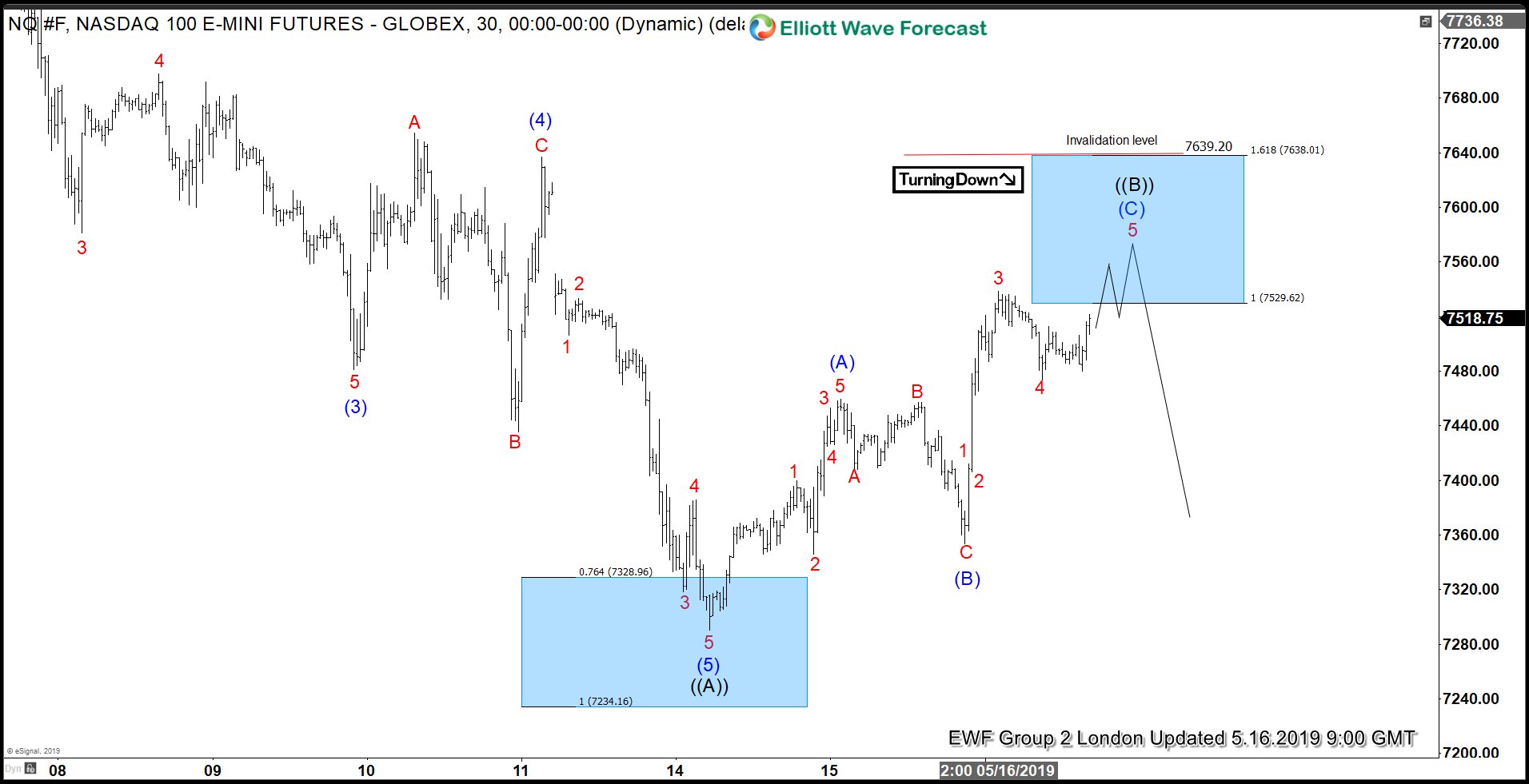

Nasdaq (NQ_F) decline from April 25 peak (7879.93) unfolded as an impulsive Elliott Wave structure and ended wave ((A)) at 7290. The internal of wave ((A)) unfolded as a 5 waves impulse. Down from 7879.93, wave (1) ended at 7682.25 and wave (2) ended at 7872.50. Wave (3) ended at 7481, wave (4) ended at 7637, and wave (5) of ((A)) ended at 7290. Subdivision of wave (1), wave (3), and wave (5) also unfolded as 5 waves as the chart below shows.

Wave ((B)) bounce is in progress to correct cycle from April 25 peak. The internal of wave ((B)) is unfolding as a double zigzag Elliott Wave structure. Wave (W) ended at 7459.50, wave (X) ended at 7353.75, and wave (Y) of ((B)) potential area is 7529.62 – 7638.01. The Index has reached the 100% at 7529.62 but another leg higher still can happen as other U.S. Indices have not reached 100% in the 3 swing rally.

We don’t like buying the Index and expect rally to fail in 3, 7, or 11 swing for more downside or at least 3 waves pullback. This view remains valid as far as pivot at 7879.93 high stays intact.