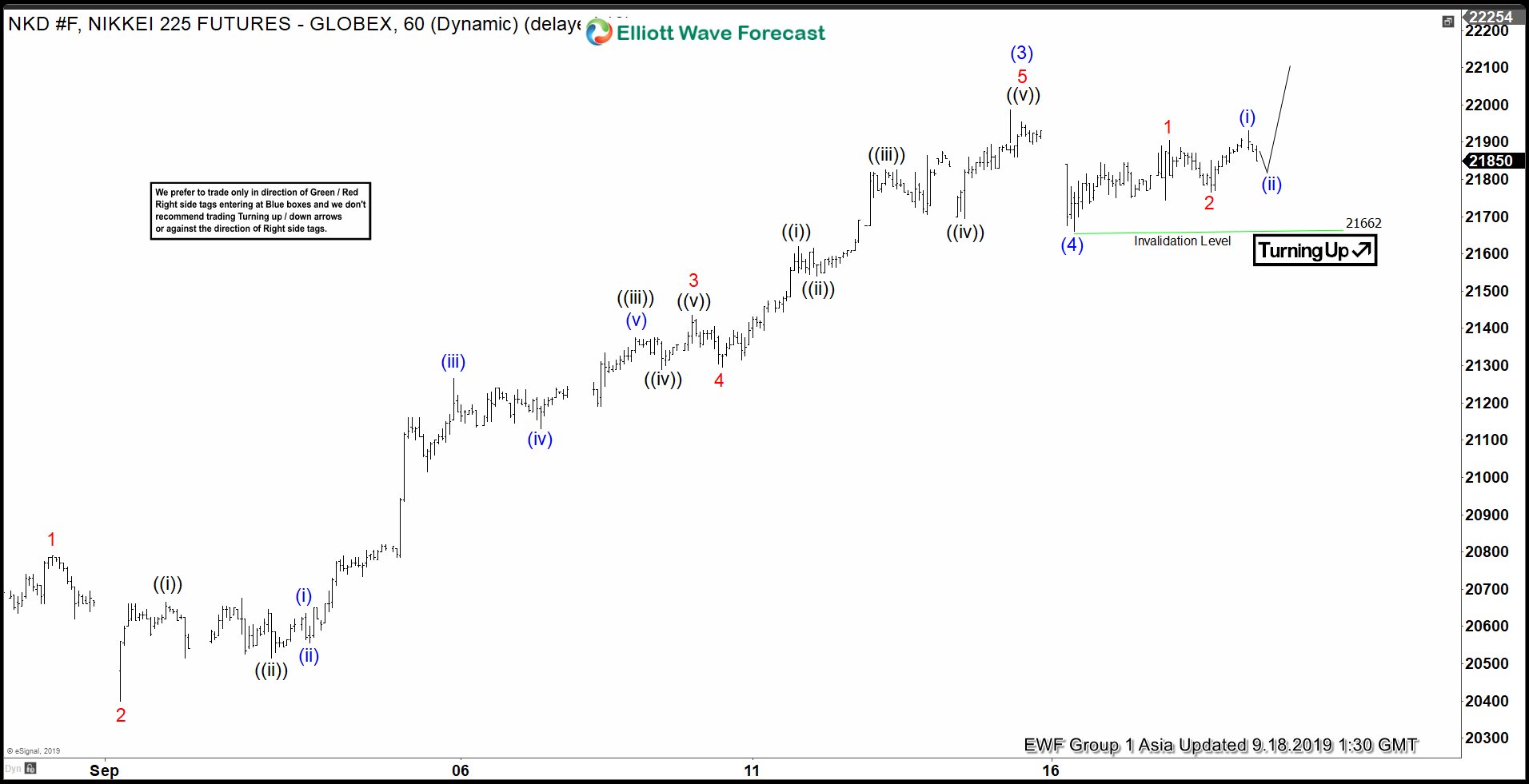

Elliott Wave view suggests the rally in Nikkei from August 26, 2019 low is unfolding as an impulse Elliott Wave structure. In the 1 hour chart below, the rally to 21890 on September 13, 2019 ended wave (3) and wave (4) pullback ended at 21662. Internal of wave (3) unfolded as an impulse in lesser degree. Wave 1 of (3) ended at 20790 and wave 2 of (3) ended at 20400. Up from there, wave 3 of (3) ended at 21435, wave 4 of (3) ended at 21295, and wave 5 of (3) ended at 21890.

Near term, the cycle is mature and thus it’s risky to chase the rally at this stage. However, while near term pullback stays above 21662, further upside can’t be ruled out within wave (5). Pair still needs to break above wave (3) at 21890 to validate this view and avoid a double correction. If Index breaks below 21662, then it still can do a double correction in wave (4) in 7 swing before the rally resumes. We do not like selling the Index. While pivot at August 26, 2019 low (19845) stays intact, Index should extend higher.