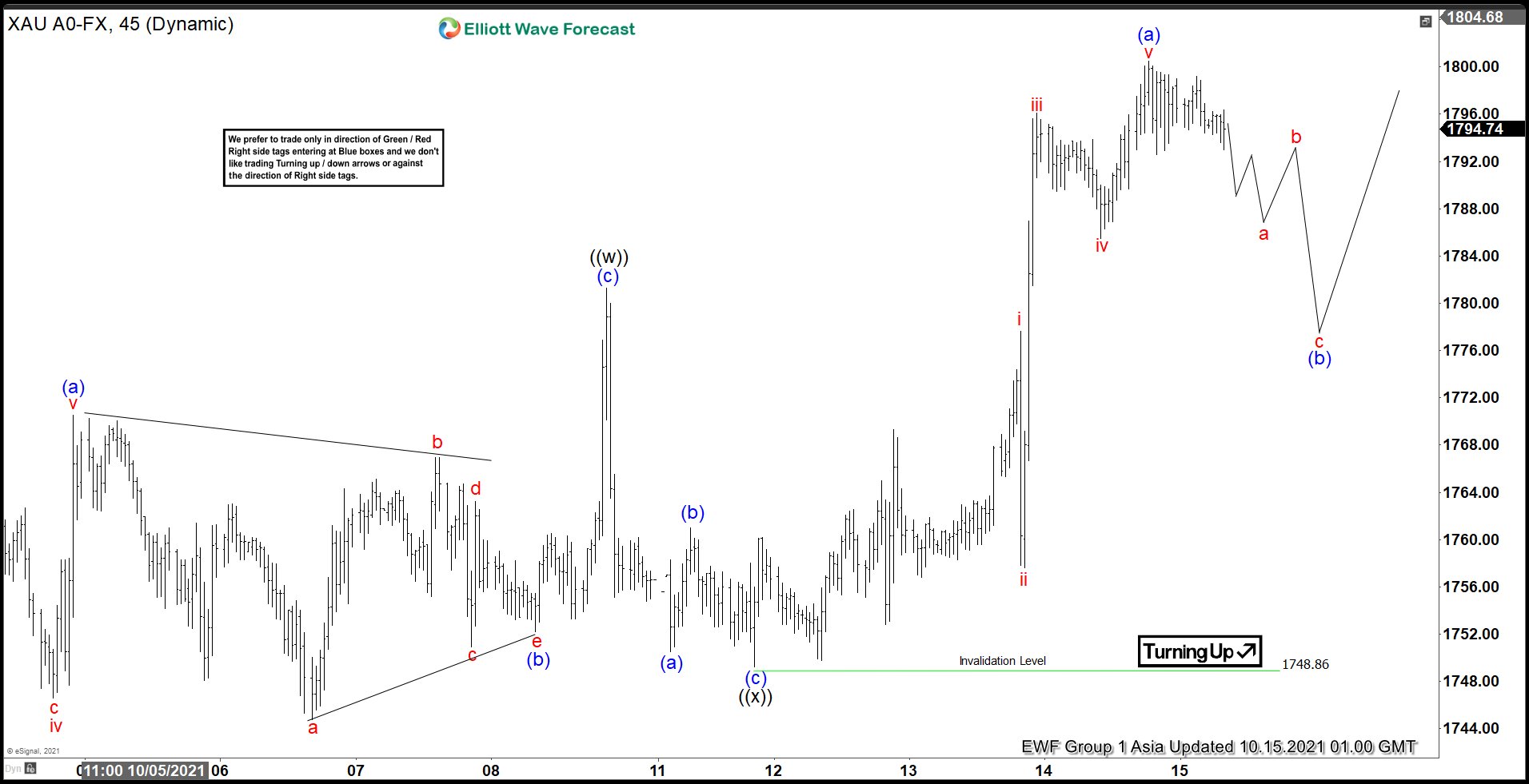

Short Term view in Gold (XAUUSD) suggests the rally from September 30, 2021 low is unfolding as a double three Elliott Wave structure. Up from September 30 low, wave (a) ended at 1770.55 and pullback in wave (b) ended at 1752.20. Final leg higher wave (c) ended at 1781.30 which completed wave ((w)) in higher degree. Wave ((x)) pullback has also ended at 1748.86 with internal subdivision as a zigzag. Down from wave ((w)), wave (a) ended at 1750.55, wave (b) ended at 1760.97 and wave (c) ended at 1748.86. This completed wave ((x)).

The precious metal has resumed higher in wave ((y)) higher. Up from wave ((x)), wave i ended at 1777.64 and wave ii ended at 1757.60. Wave iii ended at 1796.12, wave iv ended at 1785.50, and final leg wave v ended at 1800.50. This completed wave (a) of ((y)). Expect the metal to pullback in wave (b) to correct cycle from October 11, 2021 low before the rally resumes. Potential target higher is 100% – 161.8% fibonacci extension from September 30 low towards 1809.24 – 1846.65. Near term, as far as pivot at 1748.86 low stays intact, expect dips to find support in 3, 7, 11 swing for further upside.