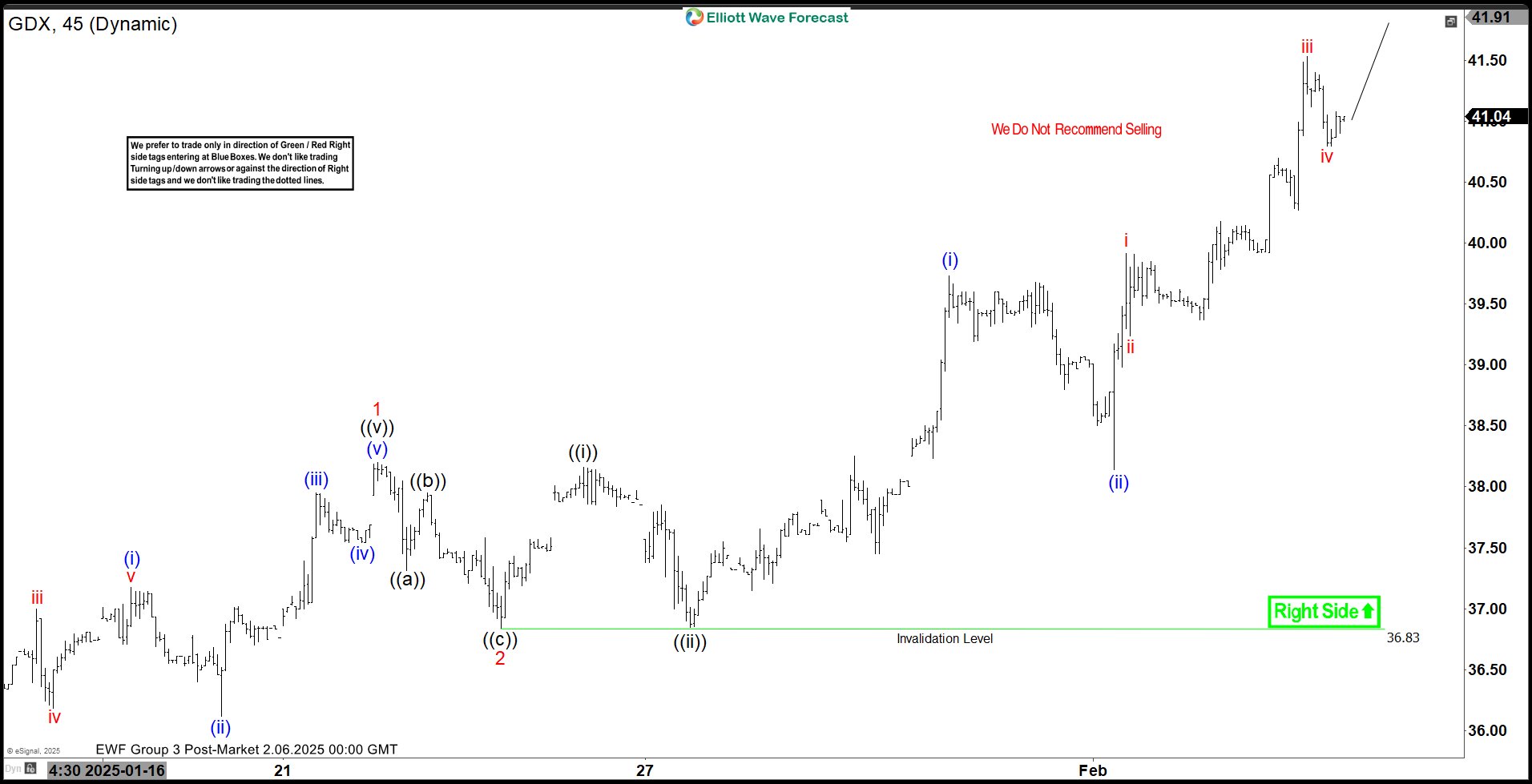

GDX Bullish Impulse Wave Developing Since December 2024 Low

Short Term Elliott Wave View in Gold Miners ETF (GDX) suggests rally from 12.30.2024 low is in progress as an impulse. Up from 12.30.2024 low, wave 1 ended at 38.2 and dips in wave 2 ended at 36.84. Internal subdivision of wave 2 unfolded as a zigzag Elliott Wave structure. Down from wave 1, wave ((a)) ended at 37.31 and wave ((b)) ended at 37.95. Wave ((c)) lower ended at 36.83 which completed wave 2 in higher degree.

Detailed Wave Structure with Extension Pattern

The ETF has extended higher in wave 3 with subdivision as a 5 waves with extension (a nesting impulse). Up from wave 2, wave ((i)) ended at 38.16 and pullback in wave ((ii)) ended at 36.84. The ETF extended higher in wave (i) towards 39.73 and pullback in wave (ii) ended at 38.14. Up from there, wave i ended at 39.92 and wave ii ended at 39.24. Wave iii higher ended at 41.53 and pullback in wave iv ended at 40.80. Expect the ETF to end wave v of (iii), then it should pullback in wave (iv) before higher again. Near term, pullback should find support in 3, 7, or 11 swing against 36.83 low for further upside.

GDX 45-Minute Elliott Wave Technical Chart

Gold Miners ETF (GDX) 45-minute chart showing current impulse wave structure with projected targets

Video Update: GDX Elliott Wave Technical Breakdown

Detailed video explanation of GDX’s impulse wave pattern and trading opportunities

Back