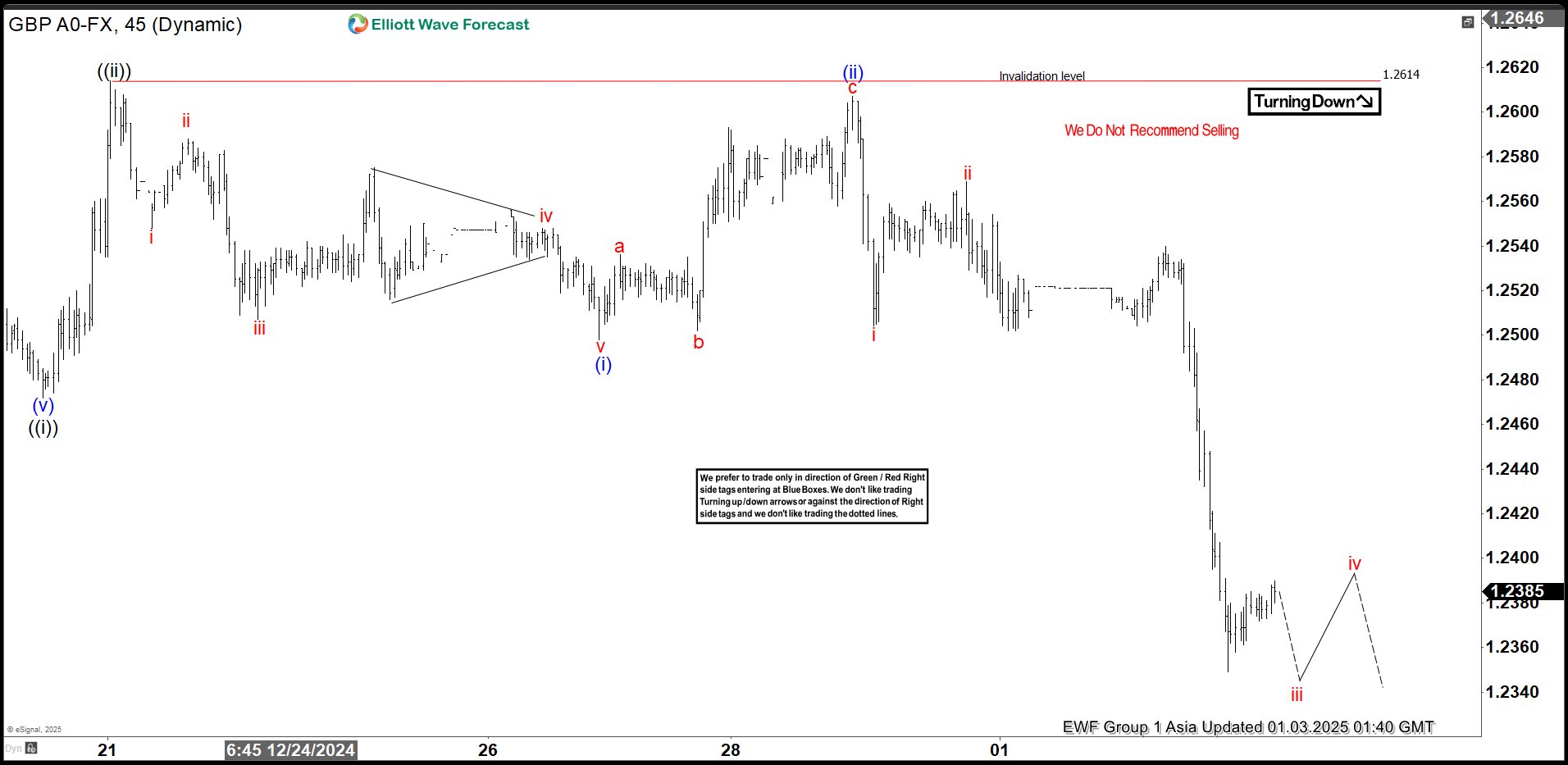

Short Term Elliott Wave view in GBPUSD suggests decline from 12.6.2024 high is in progress as a 5 waves impulse. Down from 12.6.2024 high, wave ((i)) ended at 1.247 and wave ((ii)) rally ended at 1.261 as the 45 minutes chart below shows. Pair has turned lower in wave ((iii)) with internal subdivision as another impulse. Down from wave ((ii)), wave i ended at 1.2548 and rally in wave ii ended at 1.2588. Pair resumed lower in wave iii towards 1.2507. Wave iv rally ended at 1.2548 and wave v lower ended at 1.2498 which completed wave (i) in higher degree. Rally in wave (ii) ended at 1.2607 with internal subdivision as a zigzag.

Up from wave (i), wave a ended at 1.2536 and wave b ended at 1.2502. Wave c higher ended at 1.2607 which completed wave (ii). Pair has turned lower in wave (iii). Down from wave (ii), wave i ended at 1.2504 and wave ii ended at 1.2569. Expect pair to extend lower to end wave iii, then it should rally in wave iv before turning lower again. Near term, as far as pivot at 1.2614 high stays intact, expect rally to fail in 3, 7, or 11 swing for further downside.