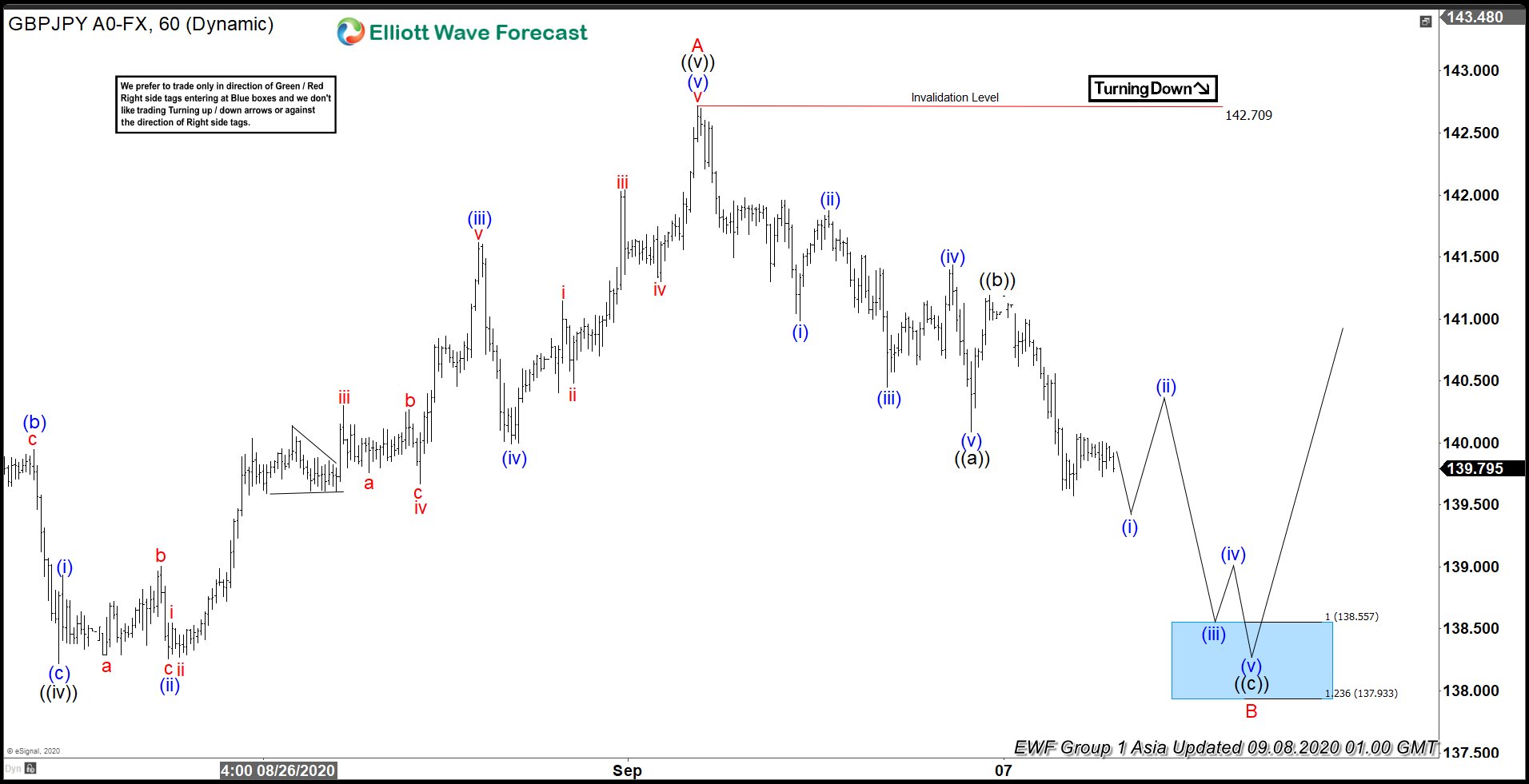

Elliott Wave View of GBPJPY shows that pair has ended the cycle from June 21 in wave A at 142.70 high. Pair is currently doing a pullback in wave B, which is unfolding as a zigzag Elliott Wave Structure. Down from wave A high, wave ((a)) ended at 140.09 low. The subdivision of wave ((a)) unfolded as 5 waves diagonal Elliott Wave Structure. Wave (i) ended at 140.98 low and wave (ii) bounce ended at 141.87 high. Pair then extended lower in wave (iii) towards 140.45 low. Wave (iv) bounce ended at 141.43 high. Finally, wave (v) resumed lower and ended at 140.09 low. This final move completed wave ((a)) in higher degree.

Afterwards, pair bounced higher within wave ((b)), which ended at 141.18 high. From there, pair continued to resume lower and broke below previous wave ((a)) low. This confirms that the next leg lower in ((c)) in already in progress. The 100 – 123.6% extension of wave ((a))-((b)) where wave ((c)) can potentially end is at 137.93-138.55 area. This area is shown with a blue box. If reached, that area should see a reaction for 3 waves bounce at least later.