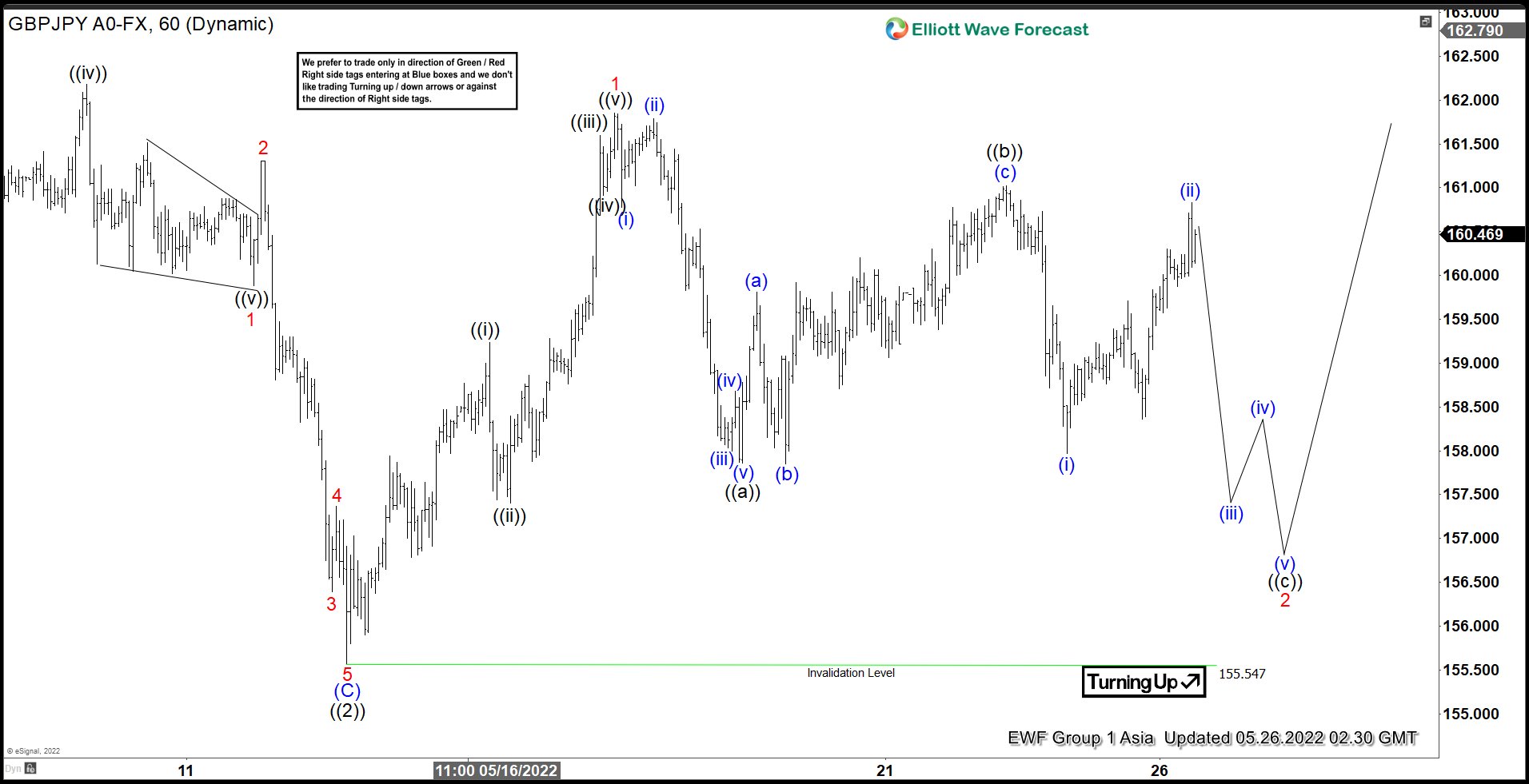

Short Term Elliott Wave View in GBPJPY suggests cycle from April 20, 2022 high has ended with wave ((2)) at 155.55. Pair rallies from that level building an impulsive structure as wave 1. Up from the wave ((2)), wave ((i)) ended at 159.24, pullback in wave ((ii)) ended at 157.40. Then pair rally in wave ((iii)) ended at 161.59, small pullback as wave ((iv)) finished at 160.91 and the last push to complete wave ((v)) of 1 ended at 161.86.

Pullback in wave 2 is currently in progress to correct wave 1. Internal subdivision of wave 2 is unfolding as a zigzag Elliott Wave structure. Down from wave 1, wave ((a)) ended at 157.86 and corrective rally in 3 swings completed wave ((b)) at 161.02. Pair resumes lower and we are looking for an impulsive structure to complete wave ((c)). Down from wave ((b)), wave (i) ended at 157.97 and wave (ii) ended at 160.83. Wave (iii) is in progress lower as long as it stays below 161.02 wave ((b)). We should see 3 swings lower as waves (iii), (iv) and (v) to complete the impulse as wave ((c)) and the correction as wave 2. As we stay above 155.55 the pair should continue with the rally again.