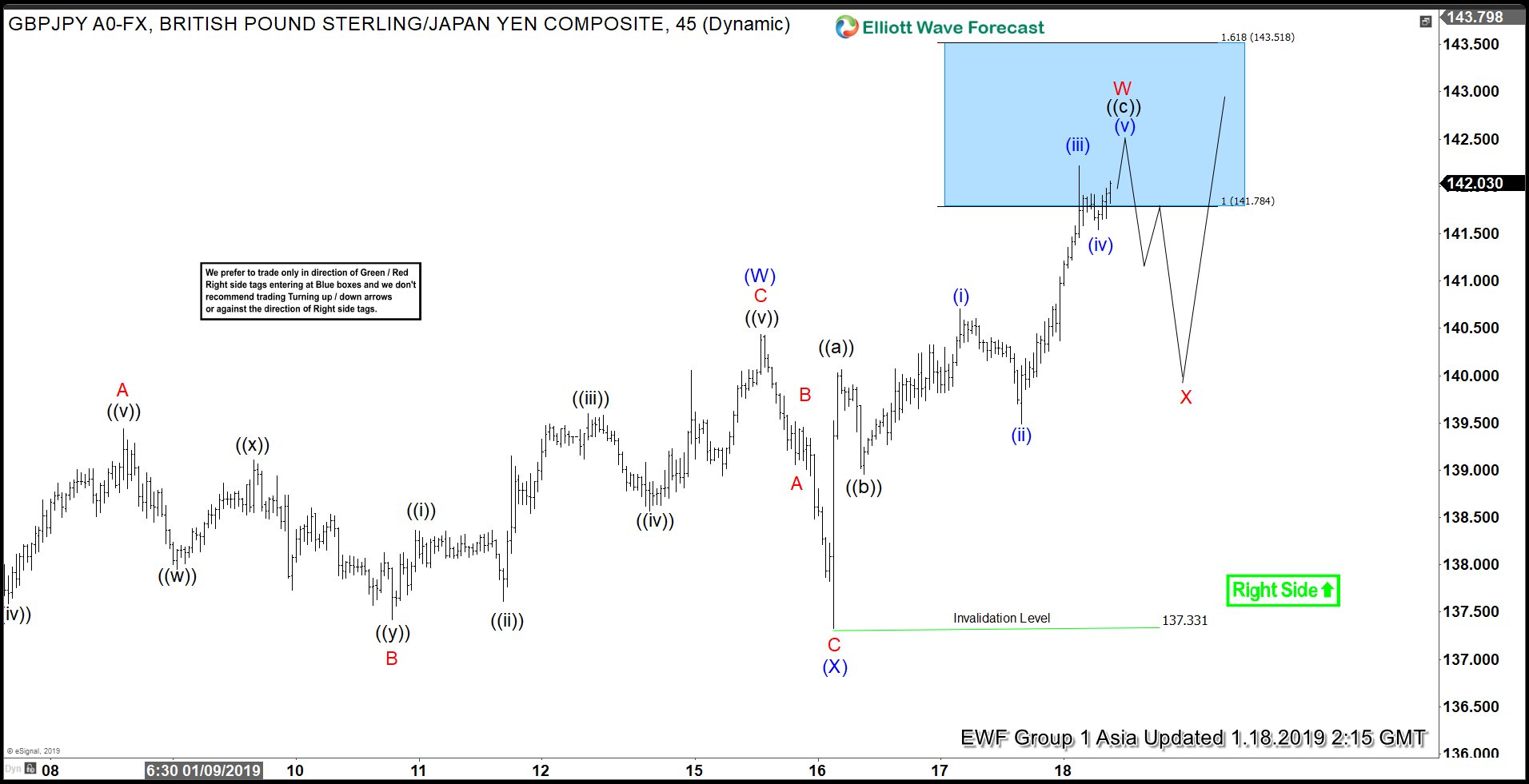

Short term Elliott Wave view on GBPJPY suggests the rally to 140.43 ended wave (W). From there, pair did a pullback to 137.33 which ended wave (X). Since then, pair has made a new high above wave (W) at 140.43, suggesting that the next leg higher in wave (Y) has started. Internal of wave (W) unfolded as a zigzag Elliott Wave structure where wave A ended at 139.44, wave B ended at 137.42, and wave C of (W) ended at 140.43.

Rally from wave (X) low at 137.33 can take various structures. One possible structure we present is a zigzag Elliott Wave structure. In this scenario, wave ((a)) ended at 140.06, wave ((b)) ended at 138.96, and wave ((c)) of W should complete soon. Pair has reached 141.78 – 143.5 area where wave W can end any moment. Once wave W is complete, it should pullback in wave X to correct cycle from 1/16/2019 low.

Wave X pullback should unfold in 3, 7, or 11 swing. As far as pivot at 137.33 low stays intact in the pullback, expect pair to extend higher again. Near-term target to the upside is 142.7 – 144, and the full 100% target is 146.08 – 148.16.