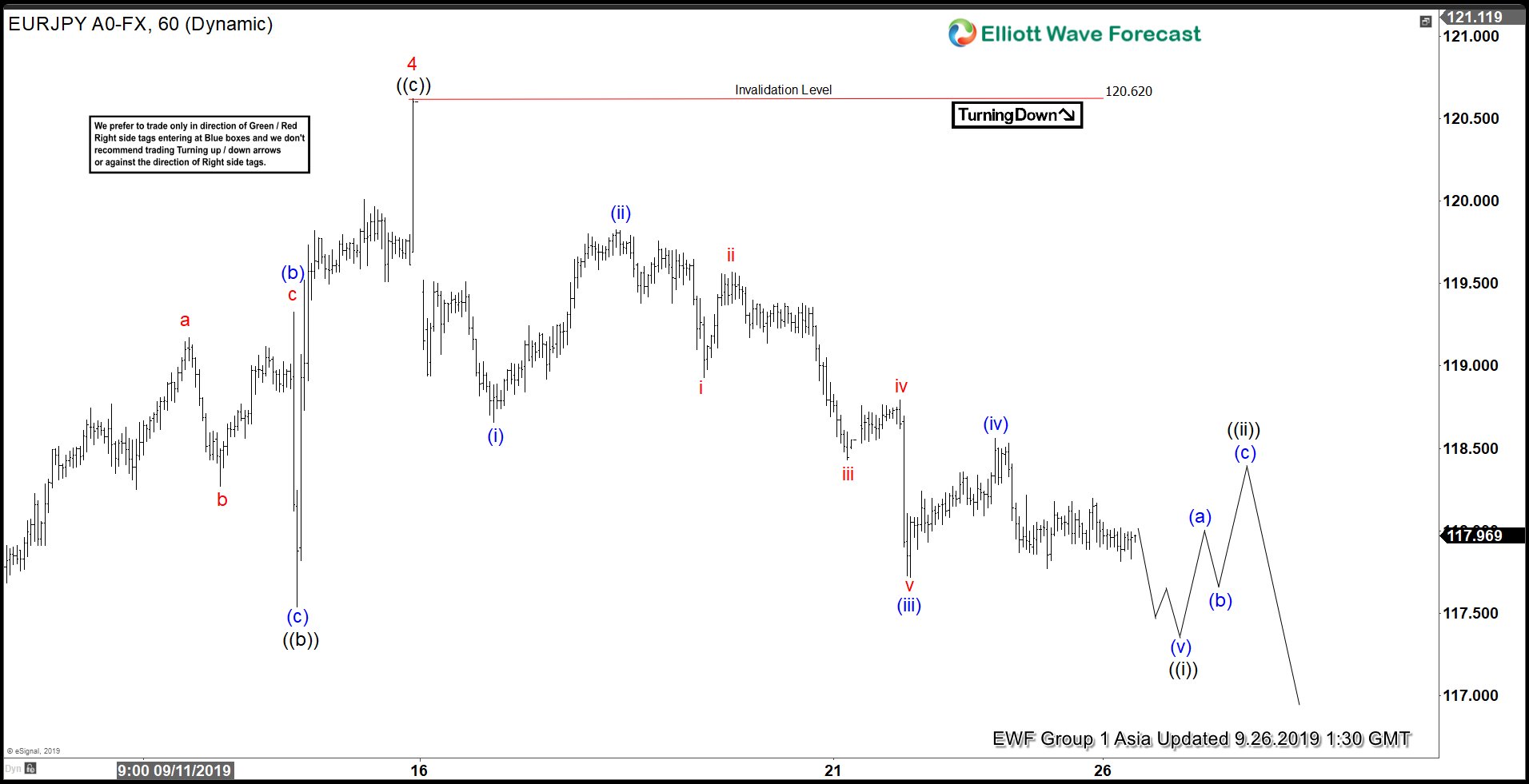

After forming a low on September 3, 2019 at 115.8, EURJPY has rallied in 3 waves. The rally ended at 120.62 and we labelled this bounce as wave 4. As the structure of the rally from September 3, 2019 low is in 3 waves, this tells us that the rally is only a correction. The pair has since turned lower again and likely has started wave 5 as the chart below shows. However, the pair still needs to break below 115.8 to confirm this view and avoid a double correction.

The internal of wave 5 is unfolding as a 5 waves impulse Elliott Wave structure. Down from 120.62, wave (i) ended at 118.66 and wave (ii) bounce ended at 119.82. Pair then resumed lower in wave (iii) towards 117.72 and wave ((iv)) bounce ended at 118.56. Expect pair to do 1 more leg lower in wave (v) before ending cycle from September 14 high (120.62). The 5 waves move lower will also end wave ((i)) in larger degree. Afterwards, wave ((ii)) bounce is expected to correct cycle from September 14 in 3, 7, or 11 swing before pair resumes lower again. As far as pivot at 120.62 high stays intact, bounce should fail and pair should resume lower.