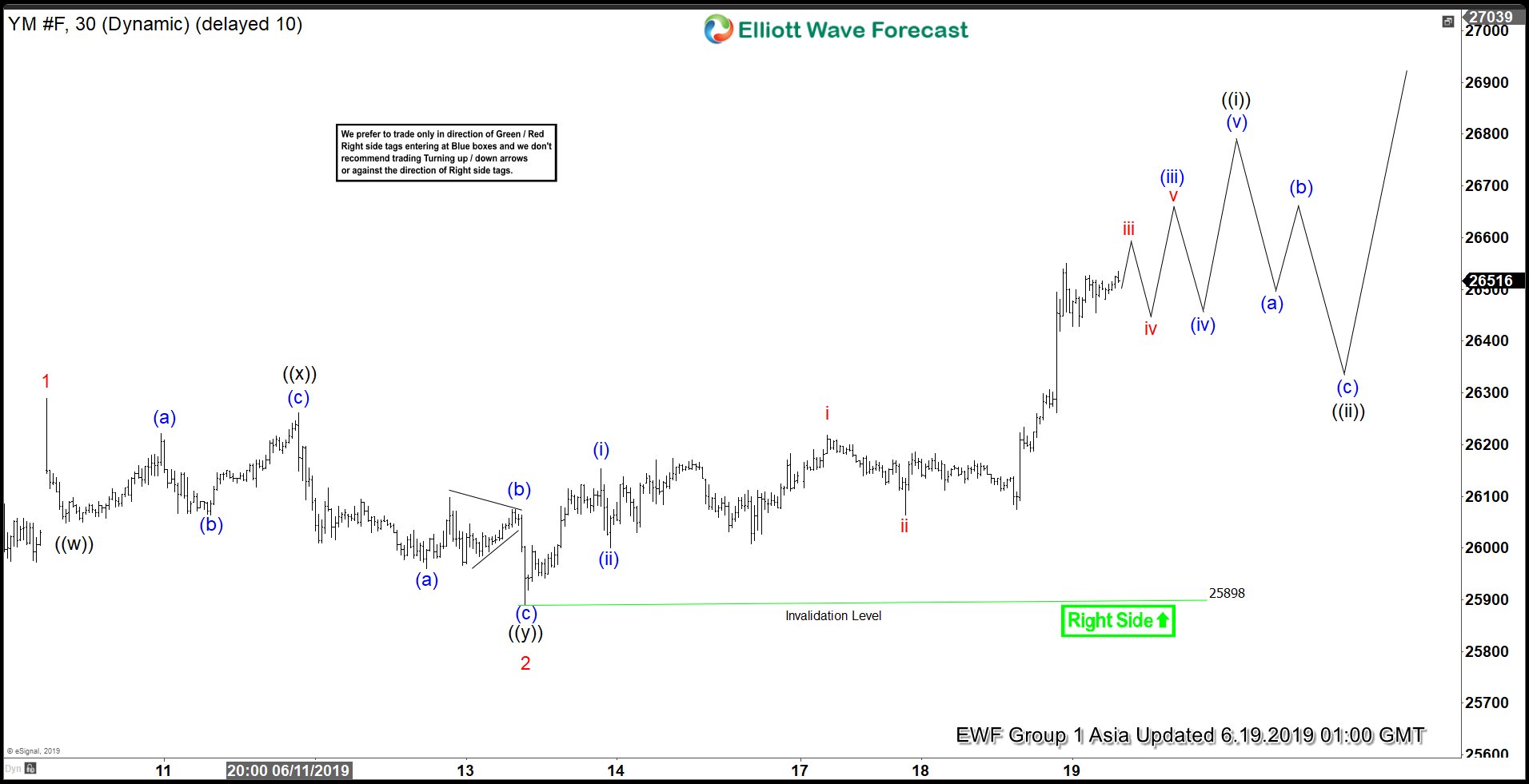

Dow Jones Futures (YM_F) broke above June 10 high (26289) suggesting that the next leg higher has started. The Index is now showing an incomplete sequence from June 3 low (24610), favoring further upside. Short term Elliott Wave view calls the rally to 26289 on June 10 as wave 1 and pullback to 25898 as wave 2. This indicates that the entire rally from June 3 low is unfolding as an impulse Elliott Wave structure. Wave 2 unfolded as a double zigzag where wave ((w)) ended at 26050, wave ((x)) ended at 26261, and wave ((y)) of 2 ended at 25898.

Wave 3 is currently in progress and subdivides as an impulse in lesser degree. Up from wave 2 low at 25898, wave (i) ended at 26153 and wave (ii) ended at 26001. Expect the Index to see a few more highs to end 5 waves up from 25898 low. This 5 waves up will end wave ((i)) of 3. Index should then pullback in wave ((ii)) to correct cycle from June 13 low before the rally resumes. We do not like selling the Index and expect buyers to appear as dips continue to hold above 25898 in 3, 7, or 11 swing.