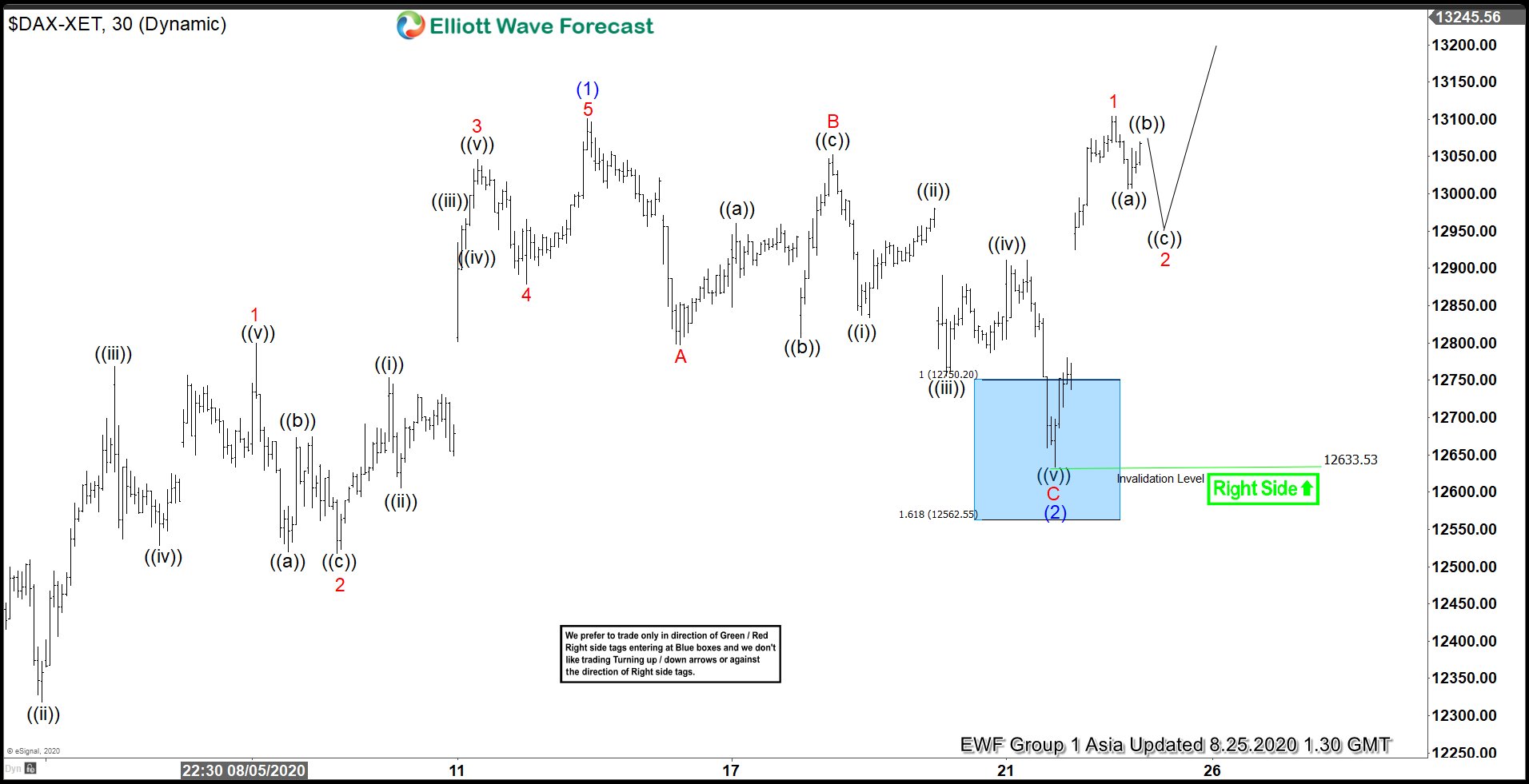

Elliott Wave View of DAX suggests the rally from July 30,2020 low has ended at 13101.12 high as wave (1). Up from July 30 low, wave 1 ended at 12799.21 high and wave 2 dip ended at 12517.44 low. Index then extended higher in wave 3 towards 13046.13 high. Afterwards, the Index did a pullback in wave 4, which ended at 12909.72 low. Finally, wave 5 higher ended at 13101.12 high. This final move completed wave (1) in higher degree and ended cycle from July 30 low.

Subsequently, Index corrected that cycle within wave (2). The correction unfolded as zigzag Elliott Wave Structure , where wave A ended at 12797.52 low. The bounce in wave B ended at 13052.84 high. Wave C then ended at 12632.46 low, which also ended wave (2) in the higher degree. The pullback reached the 100-161.8% extension blue box area. From there, Index has resumed the rally and extended higher. The rally in wave 1 has broken above previous wave (1) high, confirming that the next leg higher has started. Currently, wave 2 pullback is in progress. As long as 12632.46 low stays intact, expect the dips in 3,7 or 11 swings to find support for more upside. The minimum target of wave (3) is the 100-161.8% extension of wave (1)-(2) between 13498-14034 area.