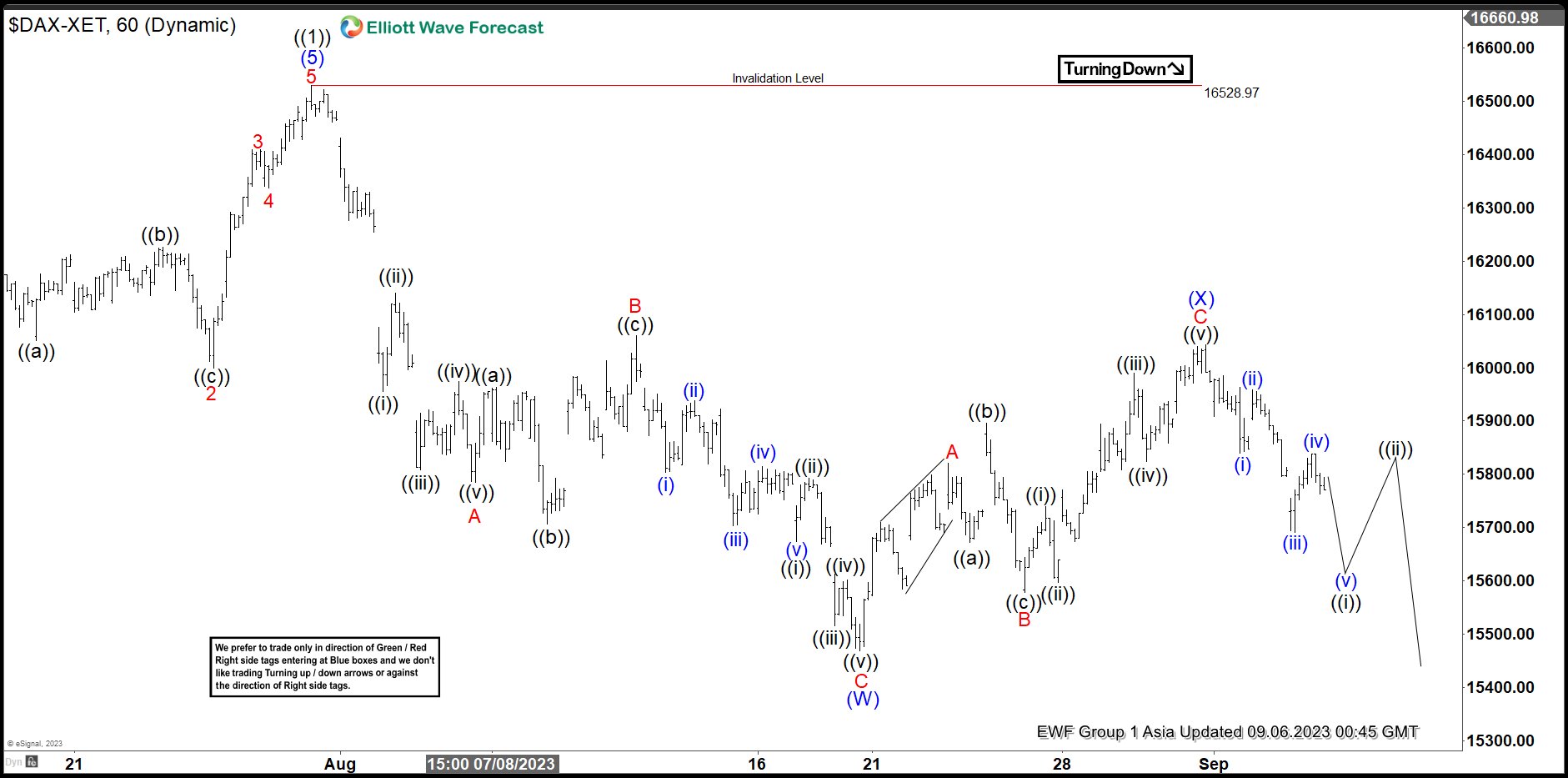

DAX ended cycle from September 28, 2022 low with wave ((1)) at 16528.97 as the 1 hour chart below shows. Index is currently in wave ((2)) pullback to correct the larger degree from September 2022 low. Internal subdivision of wave ((2)) is unfolding as a double three Elliott Wave structure. Down from wave ((1)), wave A ended at 15784.52. Wave B rally ended at 16060.27 as an expanded Flat. Index resumed lower again in wave C towards 15468.65 which completed wave (W).

Index then turned higher in wave (X) with internal subdivision as a zigzag Elliott Wave structure. Up from wave (W), wave A ended at 15820.95 and pullback in wave B ended at 15578.97. Index then extended higher in wave C towards 16042.66 which completed wave (X). DAX has turned lower in wave (Y) but still needs to break below wave (W) at 15468.65 to rule out any double correction. Down from wave (X), another leg lower is expected to end wave ((i)). Afterwards, it should rally in wave ((ii)) before turning lower again. Near term, as far as pivot at 16528.97 high stays intact, expect the Index to extend lower.