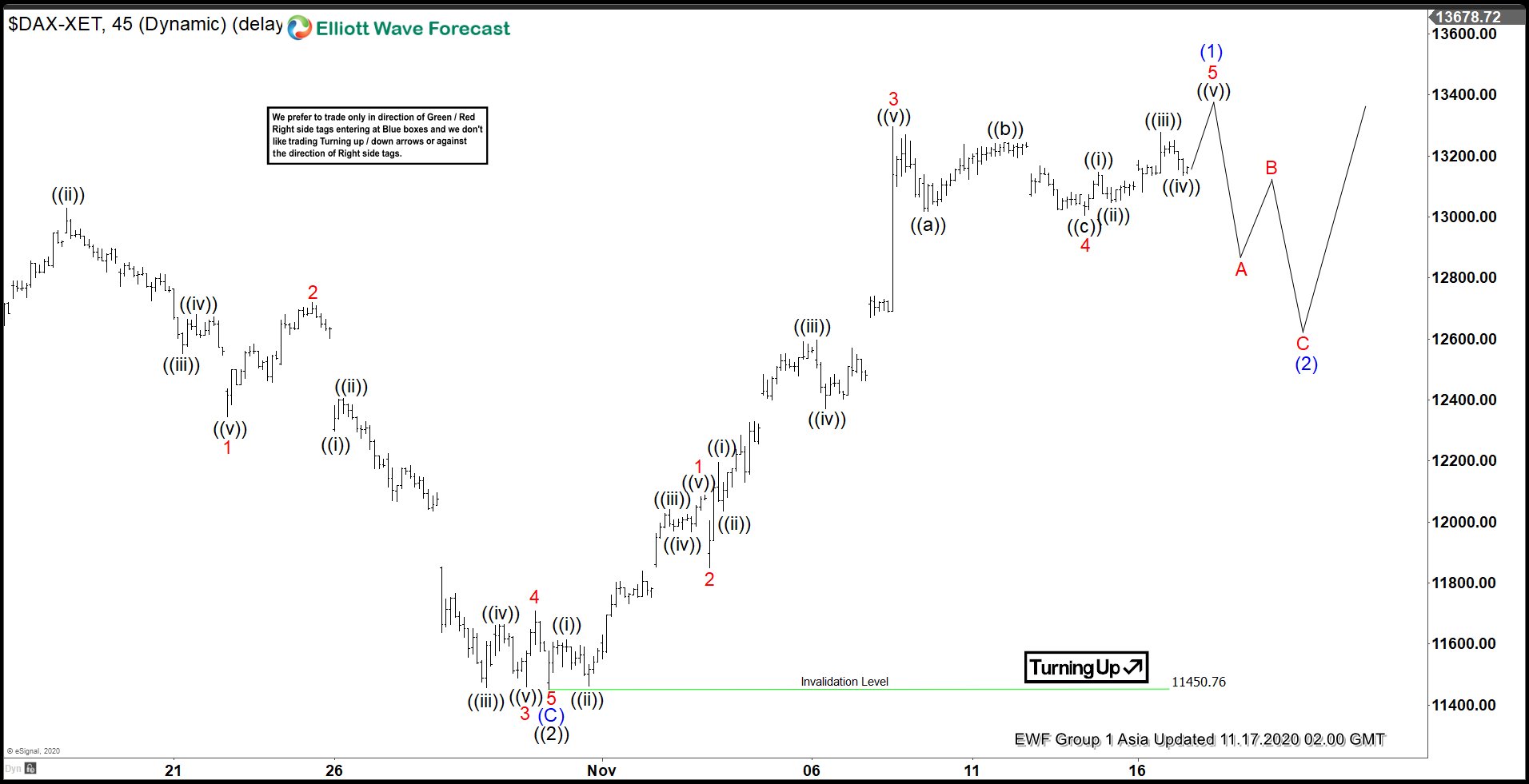

Short term Elliott Wave view in DAX suggests the decline to 11450.76 ended wave ((2)). This pullback ended the correction to the cycle from March 16, 2020 low. Index is proposed to have turned higher in wave ((3)), but it should still break above the previous peak on September 3 at 13460.46. A break above this level will confirm the next leg higher has started and rule out a double correction in wave ((2)).

Internal of wave ((3)) is unfolding as an impulsive Elliott Wave structure. Up from wave ((2)) low at 11450.76, wave 1 ended at 12087.64 and pullback in wave 2 ended at 11848.21. Index resumes higher in wave 3 towards 13297.05, and pullback in wave 4 ended at 13004.82. The final leg wave 5 should end soon with 1 more leg higher. This should complete wave (1) of ((3)) in higher degree. Afterwards, expect Index to pullback in wave (2) to correct cycle from October 30 low before the rally resumes. As far as pivot at 11450.76 low stays intact, expect dips to find support in the sequence of 3 , 7, or 11 swing for further upside.