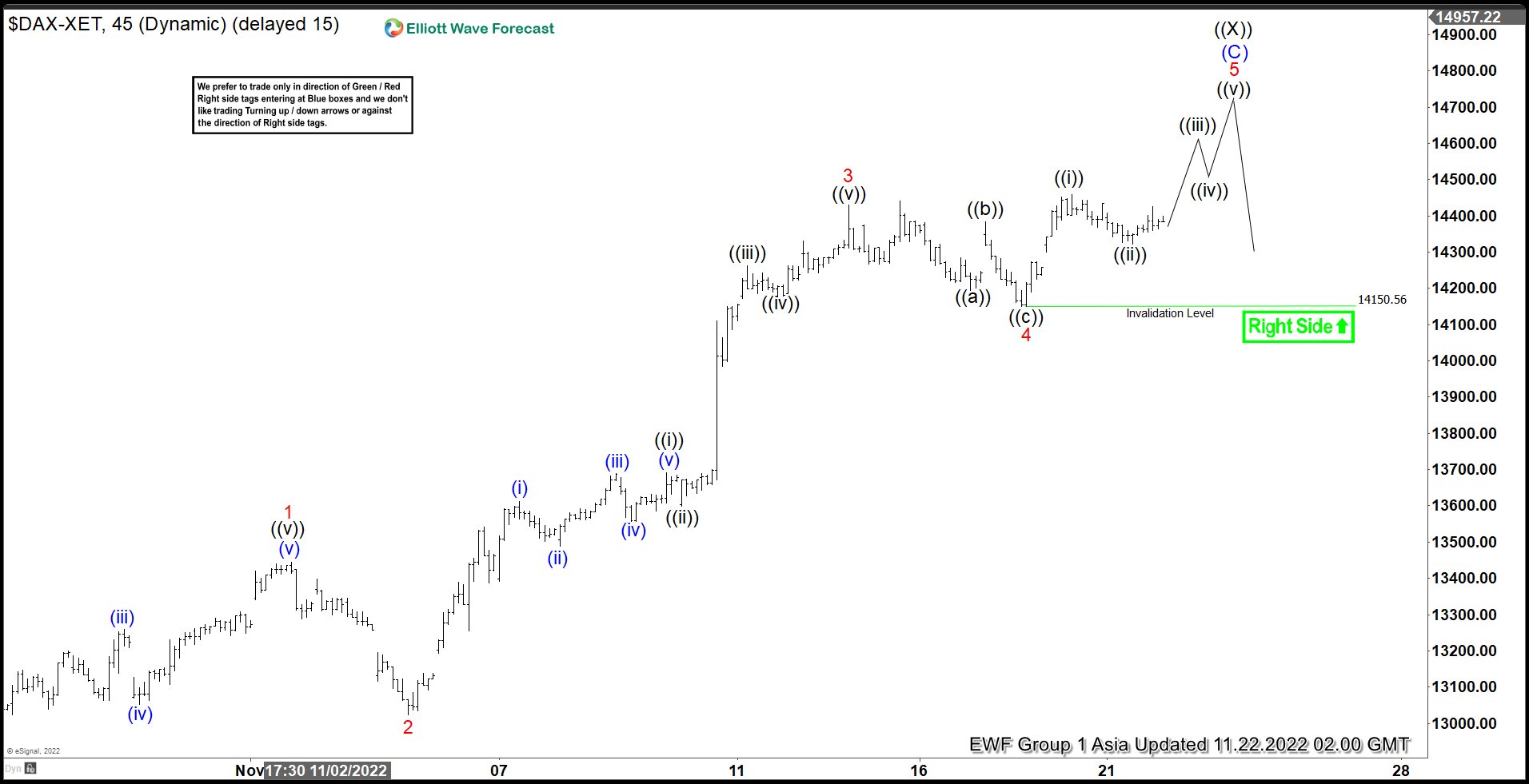

Short term Elliott Wave View in DAX suggests cycle from 9.28.2022 low is unfolding as a 5 waves impulse structure. Up from 9.28.2022 low, wave 1 ended at 13444.07 and pullback in wave 2 ended at 13022.64. Up from there, Index rallied in another 5 waves in lesser degree. Wave ((i)) ended at 13691.12 and wave ((ii)) ended at 13599.35. Index resumed higher in wave ((iii)) towards 14263.48, dips in wave ((iv)) ended at 14177.59, and final wave ((v)) ended at 14431.18 which completed wave 3.

Pullback in wave 4 ended at 14150.56 with subdivision as a zigzag. Down from wave 3, wave ((a)) ended at 14195.3, wave ((b)) ended at 14384.54, and wave ((c)) ended at 14150.56. Wave 5 is in progress as another impulse in lesser degree. Up from wave 4, wave ((i)) ended at 14457.76 and dips in wave ((ii)) ended at 14321.84. Near term, while above 14150.56, expect the Index to extend higher a bit more to complete wave 5. It will also end the higher degree cycle wave (C) of ((X)). Once the 5 waves higher from 9.28.2022 low is completed, the Index should at minimum pullback in 3 waves to correct the cycle.