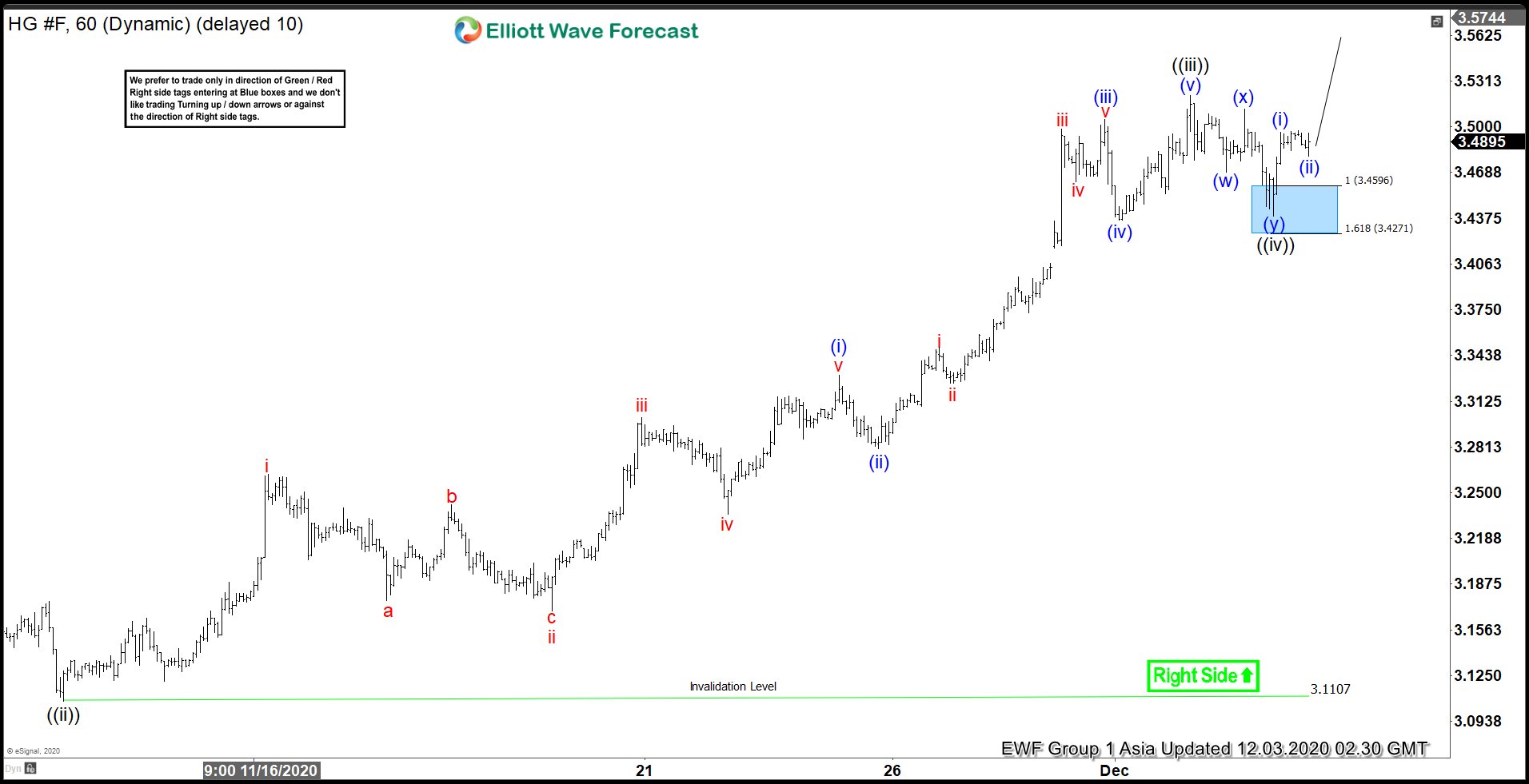

Short term Elliott Wave view in Copper (HG) suggests that the dips to 3.11 on November 11 ended wave ((ii)). The metal has resumed higher and ended wave ((iii)) at 3.52. Internal of wave ((iii)) unfolded as a 5 waves impulse Elliott Wave structure. Up from wave ((ii)) low, wave i ended at 3.26 and pullback in wave ii ended at 3.169. The metal resumed higher in wave iii towards 3.3, and pullback in wave iv ended at 3.235. Final leg higher in wave v ended at 3.33. This completed wave (i) in higher degree.

The metal then pullback in wave (ii) which ended at 3.28. Up from there, wave (iii) ended at 3.50 with internal also as a 5 waves impulse in lesser degree. From there, dips to wave (iv) ended at 3.43, and wave (v) completed at 3.52. This 5 waves move higher ended cycle from November 11 low in wave ((iii)). The metal then pullback in 3 swing (w)-(x)-(y) which found buyers at the blue box equal leg area. Wave ((iv)) is proposed complete at 3.439 and copper has turned higher from the blue box. It now needs to break above wave ((iii)) at 3.50 to avoid a double correction. As far as wave ((ii)) pivot at 3.11 stays intact, dips should continue to find support in 3, 7 or 11 swing for more upside.