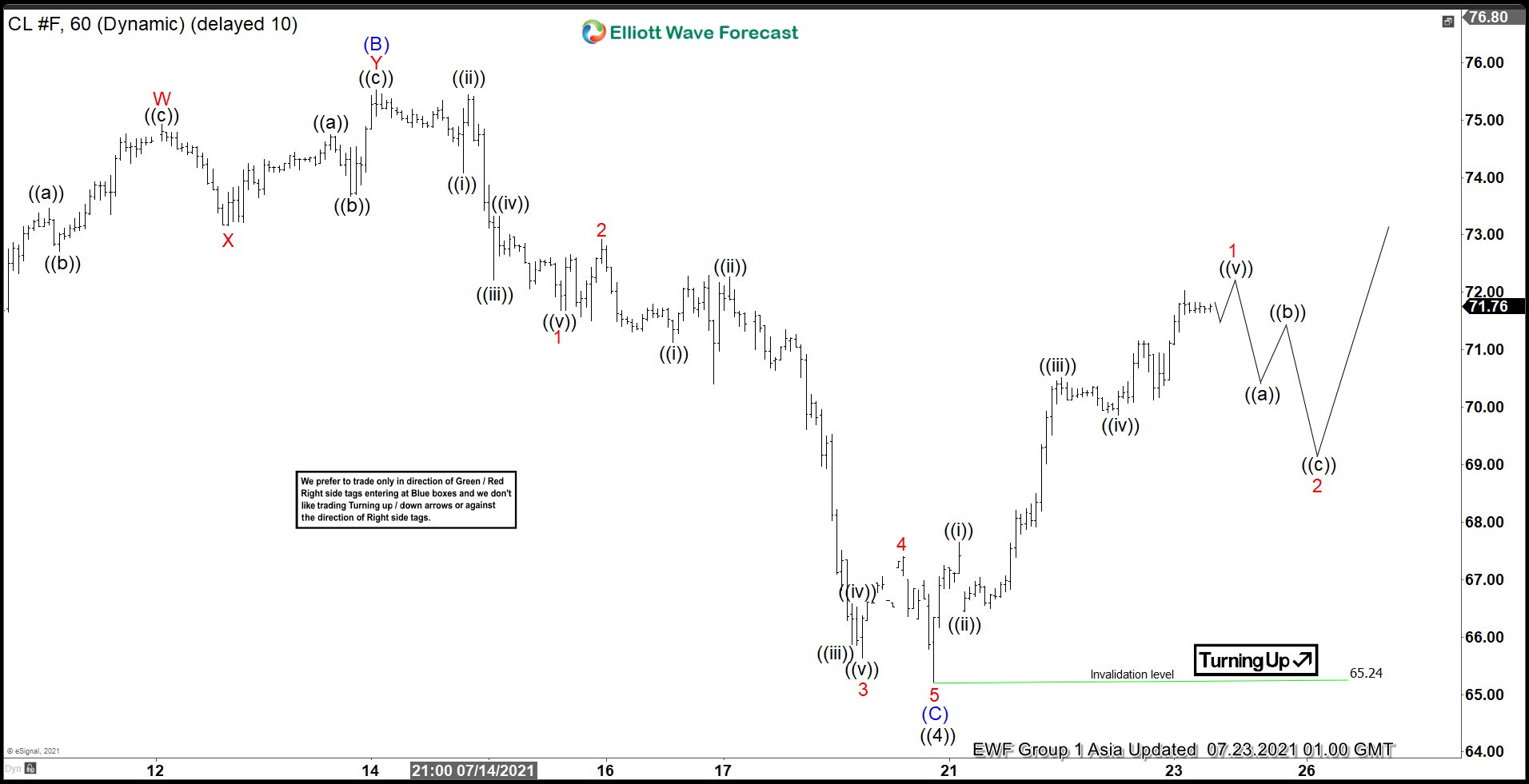

Oil (CL) has ended wave ((4)) pullback on June 7 at 65.24. Since then, it has rallied and surpassed 50% of the drop that began on June 6. We saw the highest point at the price of 76.98 and it had a strong bearish reaction in clear 3 waves (A), (B) and (C) forming a zigzag Elliott Wave structure. Wave (A) was an impulse that fell to 70.76. The rally from there was corrective in 7 swings reaching 76.4% Fibonacci retracement to terminate wave (B) at 75.52. Afterwards, Oil continues dropping forming another impulse that concluded wave (C) of ((4)) at 65.24. Down from wave (B), wave 1 ended at 71.68 and rally in wave 2 ended at 72.93. Oil then resumes lower in wave 3 towards 65.63, rally in wave 4 ended at 67.40, and final leg wave 5 ended at 65.24.

Oil has started to rally in wave ((5)). The bounce from wave ((4)) low at 65.24 looks impulsive. Wave ((i)) ended at 67.65 and the correction as wave ((ii)) ended 66.45. The rally continues and wave ((iii)) completed at 70.51. Wave ((iv)) pullback dropped toward 69.87 and from there, oil extends higher again. Near term, we expect a marginal high to complete wave ((v)). This should complete wave 1 in larger degree and see a pullback in 3 swings at least before the rally resumes. As far as July 20 pivot low at 65.24 remains intact, expect dips to find support in 3, 7, or 11 swing for more upside.