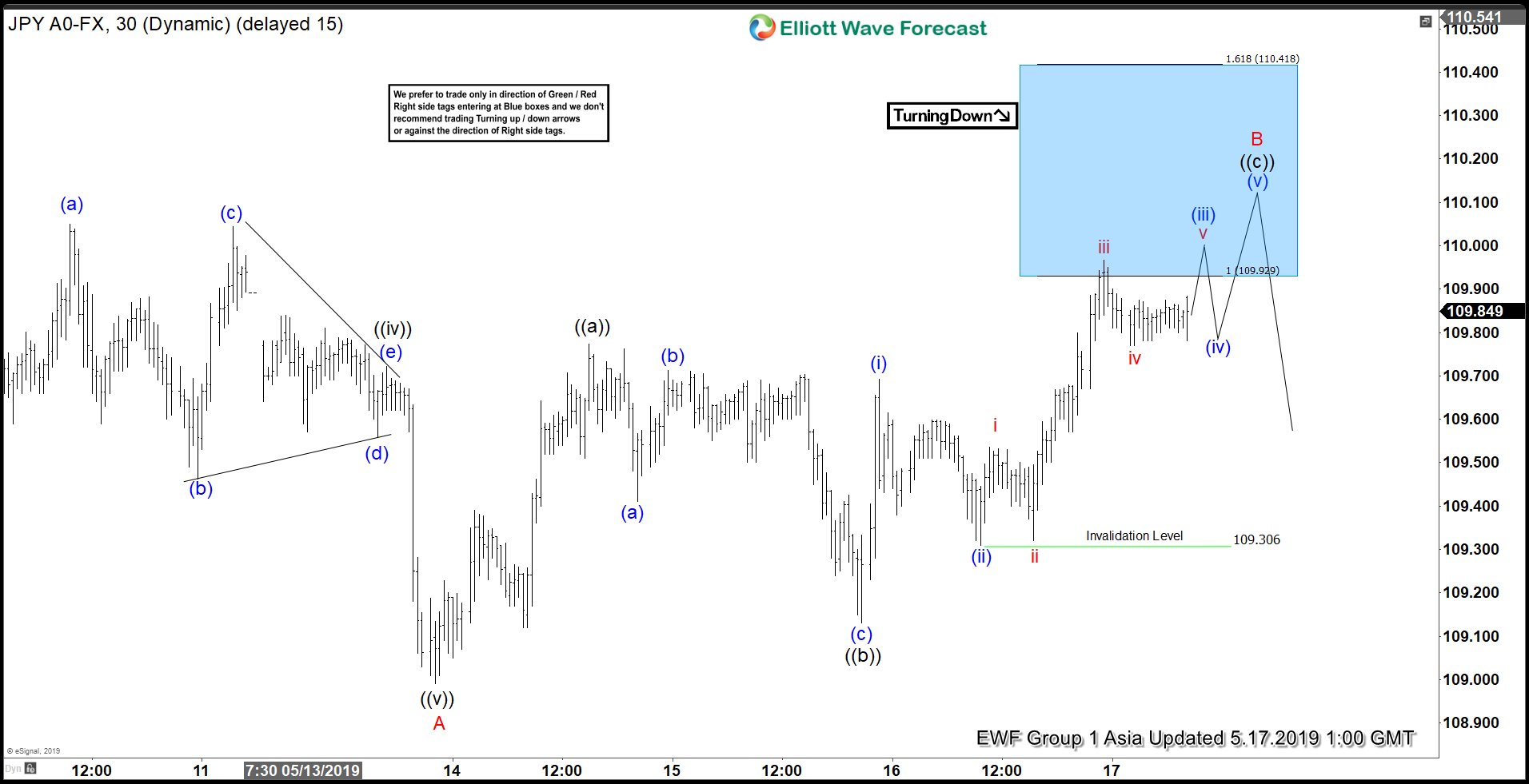

Short term Elliott Wave view in USDJPY calls the decline from April 25 peak (112.4) ended as wave ((A)) at 108.99. This suggests the decline from there is unfolding as a zigzag Elliott Wave structure. Wave B bounce is in progress to correct cycle from April 25 peak in 3, 7, or 11 swing. The internal of the bounce is unfolding as another zigzag. Up from 108.99, wave ((a)) ended at 109.77 and wave ((b)) ended at 109.13. Wave ((c)) of B is in progress as a 5 waves and expected to complete with 1 more push higher within the blue box of 109.93 – 110.4.

The pair has already reached 100% extension relative to wave ((A)), thus it has met the minimum target requirement. From the blue box area, we expect pair to either resume to new low in wave C or at least pullback in 3 waves. If the present rally continues to extend higher to 110.42 (1.618 extension), it increases the risk that the entire rally from May 13 low (108.99) is an impulse rather than zigzag. As far as pivot at April 25 peak (112.4) remains intact, rally should fail in the sequence of 3, 7, or 11 swing for further downside.