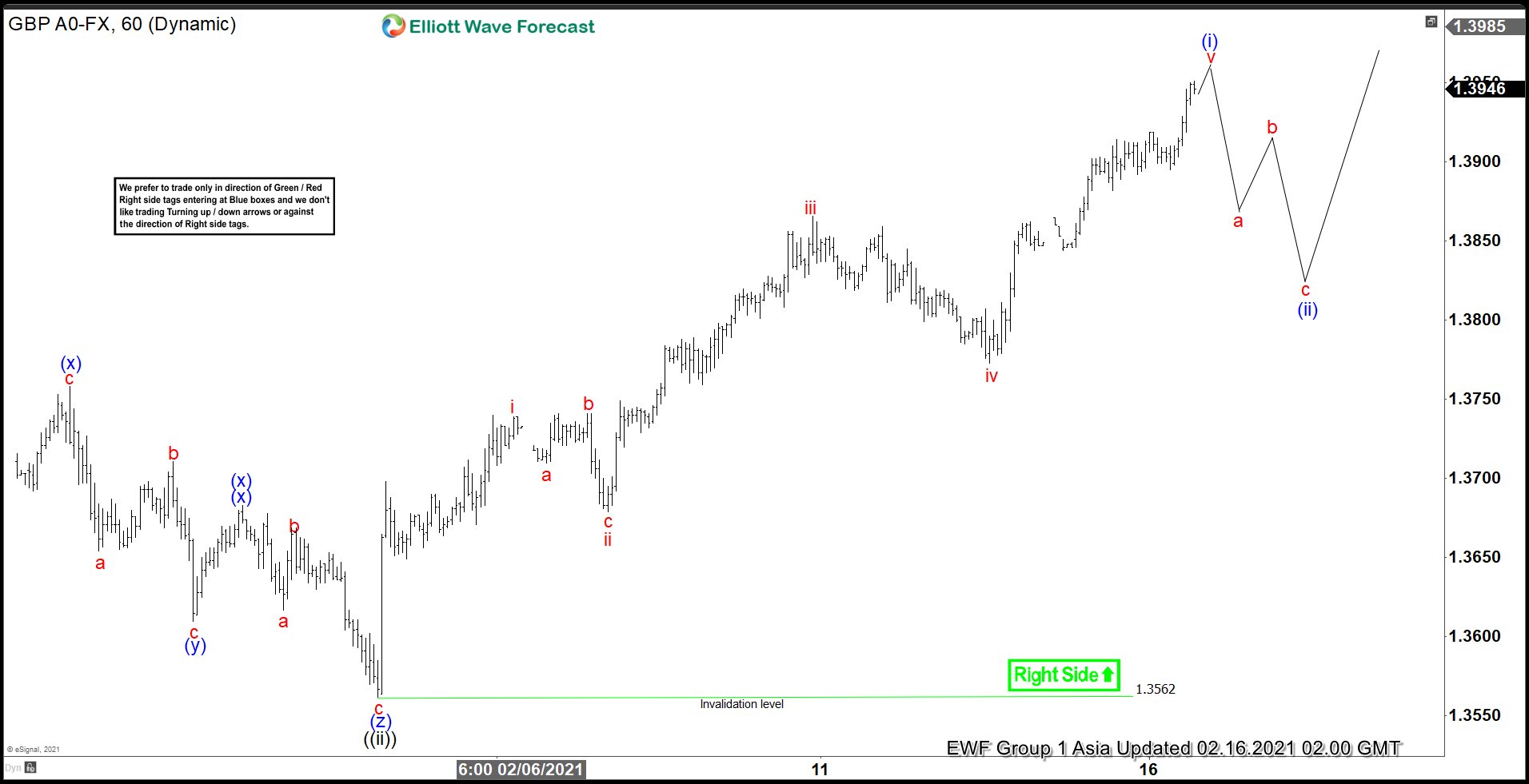

Short term Elliott wave view in GBPUSD suggests the pullback to 1.3562 ended wave ((ii)). Internal of the decline unfolded as a triple three structure. Down from wave ((i)) high on January 27 at 1.3759, wave (w) ended at 1.3628 and bounce in wave (x) ended at 1.3758. Pair has resumed lower again in wave (y) towards 1.3610, and wave ((x)) bounce ended at 1.3683. Final leg wave (z) of ((ii)) ended at 1.3562.

Pair has now resumed higher in wave ((iii)) with internal subdivision as an a 5 waves impulse Elliott Wave structure. Up from wave ((ii)) low, wave i ended at 1.3739 and pullback in wave ii ended at 1.3679. Pair then resumed higher again in wave iii towards 1.3866, and pullback in wave iv ended at 1.3773. Pair should end wave v soon and this should complete wave (i) of ((iii)). Pair should then pullback in wave (ii) of ((iii)) in 3, 7, or 11 swing to correct cycle from February 4 low (1.3562) before the rally resumes in wave (iii) of ((iii)). As far as February 4 pivot at 1.3562 stays intact, expect dips to find buyers in the sequence of 3, 7, 11 swing for further upside.