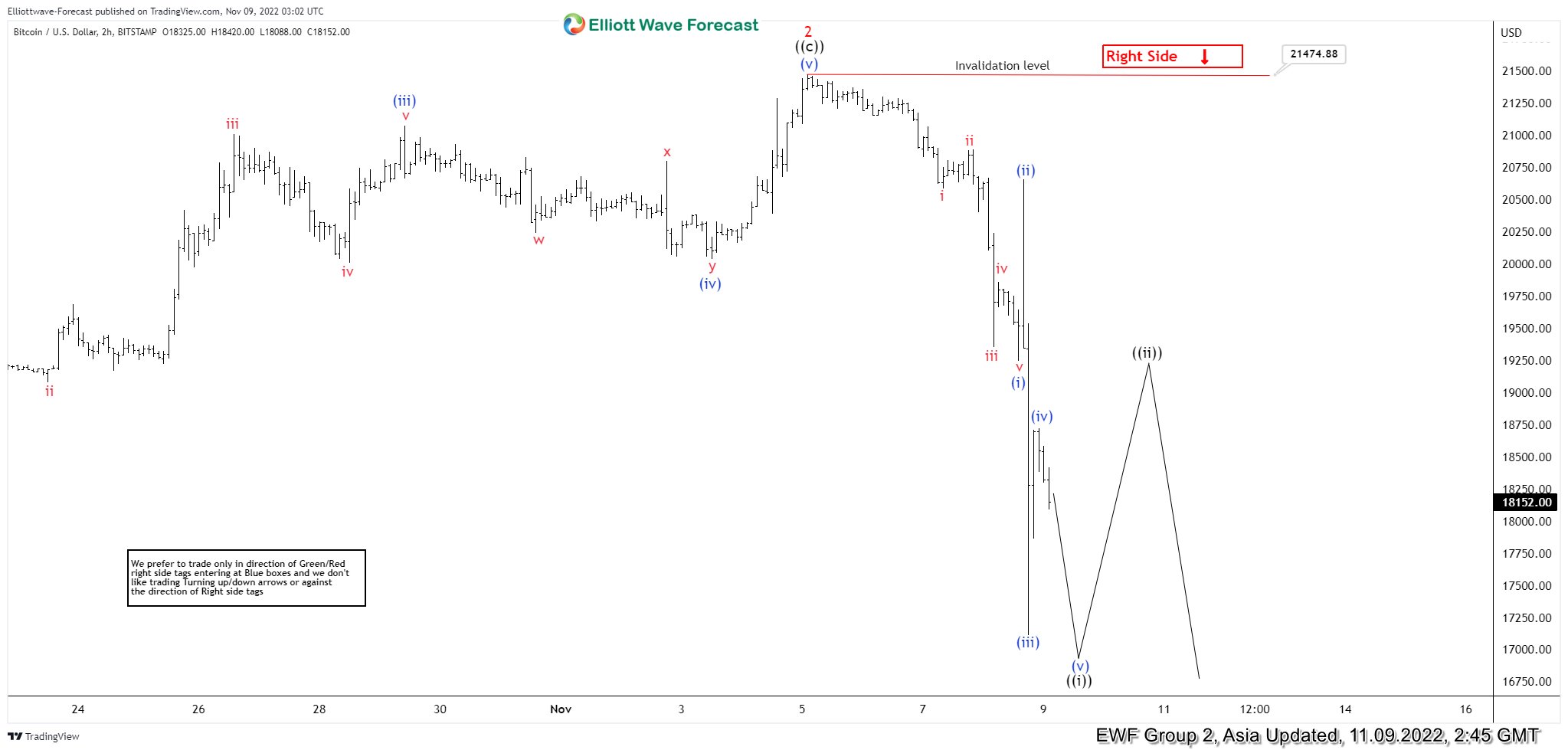

Short term Elliott Wave view in Bitcoin (BTCUSD) suggests the decline from August 15, 2022 high is unfolding as a 5 waves impulse Elliott Wave structure. Down from August 15, wave 1 ended at 18157 and rally in wave 2 ended at 21473. Internal subdivision of wave 2 unfolded as a zigzag structure where wave ((a)) ended at 20469, wave ((b)) ended at 18183, and wave ((c)) higher ended at 21474.88. This completed wave 2 in higher degree.

The crypto-currency has since resumed lower in wave 3 by breaking below wave 2 low. Structure of the move lower is in 5 waves impulse in lesser degree. Down from wave 2, wave (i) ended at 19244, and rally in wave (ii) ended at 20661. Bitcoin resumes lower in wave (iii) towards 17114 and rally in wave (iv) ended at 18721. Expect the crypto-currency to extend lower 1 more leg in wave (v) to end wave ((i)). Bitcoin should then rally in wave ((ii)) to correct cycle the cycle from Nov 5, 2022 high in 3, 7, or 11 swing before the decline resumes. Potential target lower is 100% – 123.6% Fibonacci extension from August 15, 2022 high. This comes at 12860 – 14490 area.