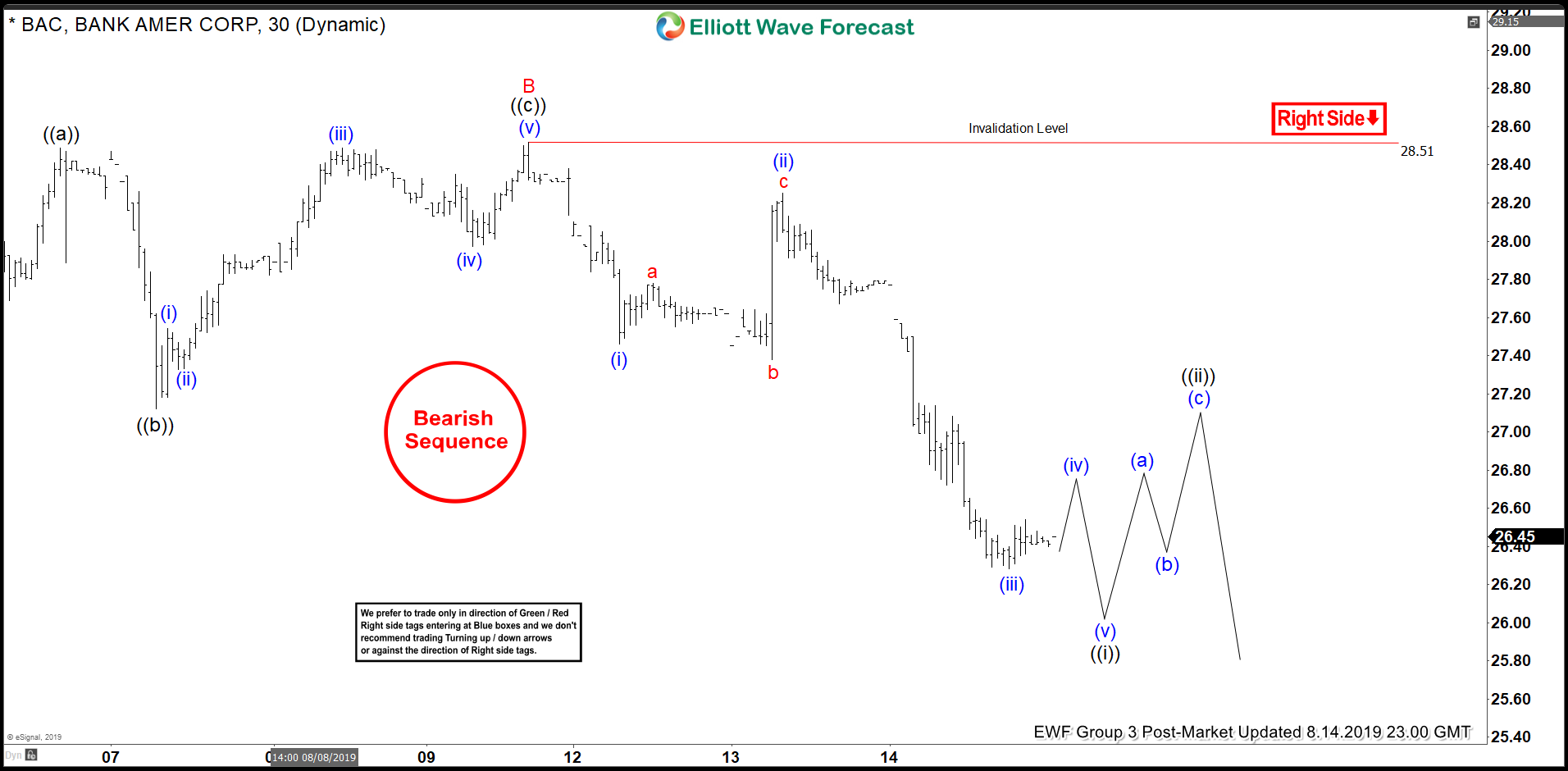

Bank of America (ticker symbol: $BAC) currently shows an incomplete sequence from August 1 high, favoring further downside. Short term Elliott Wave technical view from the chart below suggests the rally to 28.51 ended wave B. The stock has resumed lower and broken below August 7 low (27.12) confirming the next leg lower has started. Wave C is in progress and the internal subdivides as an impulse Elliott Wave structure. Down from 28.51, wave (i) ended at 27.46, wave (ii) ended at 28.25, and wave (iii) ended at 26.28.

Another leg lower is expected to end wave (v) of ((i)) before cycle from August 10 high ends. The stock should then bounce within wave ((ii)) in 3, 7, or 11 swing before the decline resumes. One possible structure of wave ((ii)) bounce can be in a zigzag before the decline resumes. We don’t like buying the stock and expect sellers to appear and rally to fail in 3, 7, or 11 swing as far as pivot at 28.51 high stays intact. Potential target to the downside in wave (C) is equal to wave (A) at 23.6 – 24.5 area.