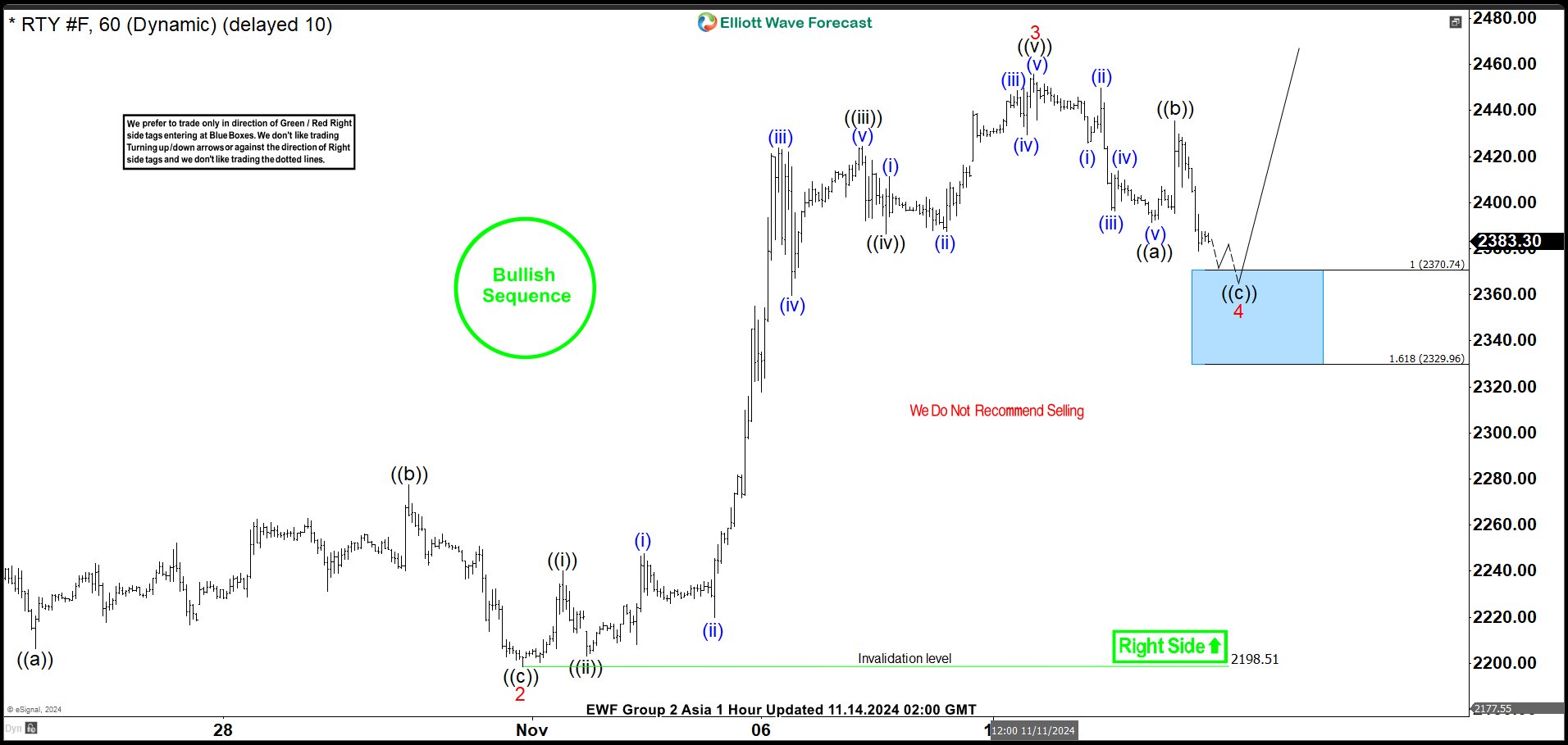

Short Term Elliott Wave view on Russell 2000 (RTY) suggests rally from 8.5.2024 low is in progress as a 5 waves impulse. Up from 8.5.2024 low, wave 1 ended at 2311.4 and pullback in wave 2 ended at 2198.51 like the 1 hour chart below shows. The Index then extends higher in wave 3 with internal subdivision as an impulse. Up from wave 2, wave ((i)) ended at 2240 and dips in wave ((ii)) ended at 2203.3. Rally in wave ((iii)) higher ended at 2424.5 and pullback in wave ((iv)) ended at 2386.5. Final leg wave ((v)) ended at 2455.6 which completed wave 3 in higher degree.

Wave 4 pullback is in progress with internal subdivision as a zigzag Elliott Wave structure. Down from wave 3, wave (i) ended at 2425.9 and wave (ii) rally ended at 2449.7. Wave (iii) lower ended at 2396.3 and wave (iv) rally ended at 2413.8. Final leg wave (v) ended at 2391.4 which completed wave ((a)) in higher degree. Rally in wave ((b)) ended at 2435.6. Expect wave ((c)) lower to end at 2330 – 2370 area to complete wave 4 in higher degree. From there, the Index can then see further upside or rally in 3 waves at least.