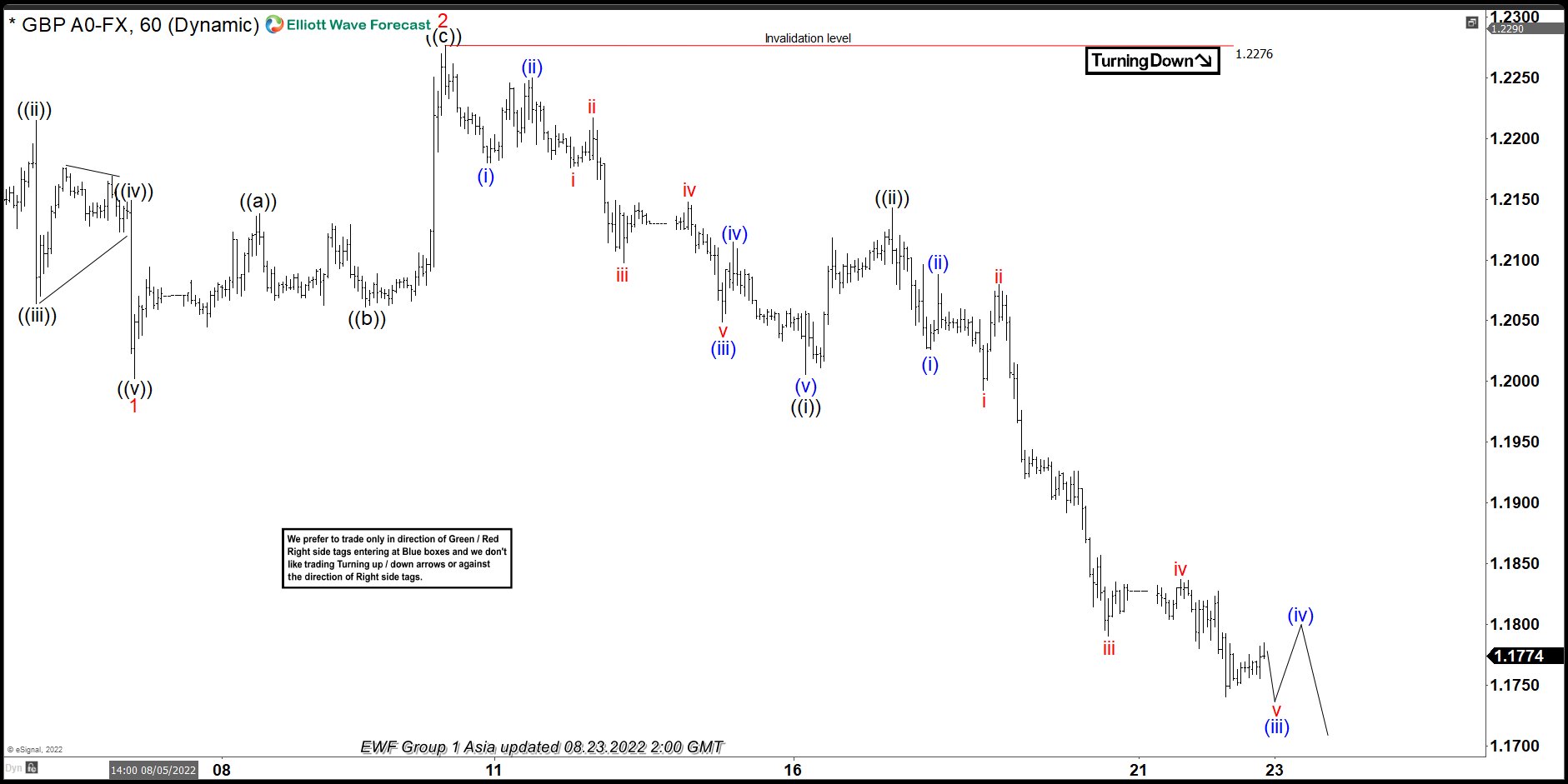

Short Term Elliott Wave View in GBPUSD suggests the rally from 7.14.2022 low ended a wave (4) hit our blue box in 4 hour chart at 1.2298. Then pair was rejected and did a leading diagonal structure as wave 1 ended at 1.2000. The market bounce doing a zig zag correction, testing the high and completed wave 2 at 1.2276. From this point, the pound has continued lower forming wave 3 Elliott wave impulse structure.

Down from wave 2, wave ((i)) ended at 1.2006, and rally in wave ((ii)) ended at 1.2142. Expect wave ((iii)) to end soon with possibly a few more marginal lows, then it should rally in wave ((iv)) in 3, 7, or 11 swing before turning lower again in wave ((v)) and finish wave 3. Wave (i) of ((iii)) finished at 1.2026 and bounce in wave (ii) of ((iii)) ended at 1.2088. Pair extend lower around 1.1739 and we are still looking for a marginal low to complete wave (iii) of ((iii)). Near term, expect any rally to fail in 3, 7, or 11 swing for further downside.