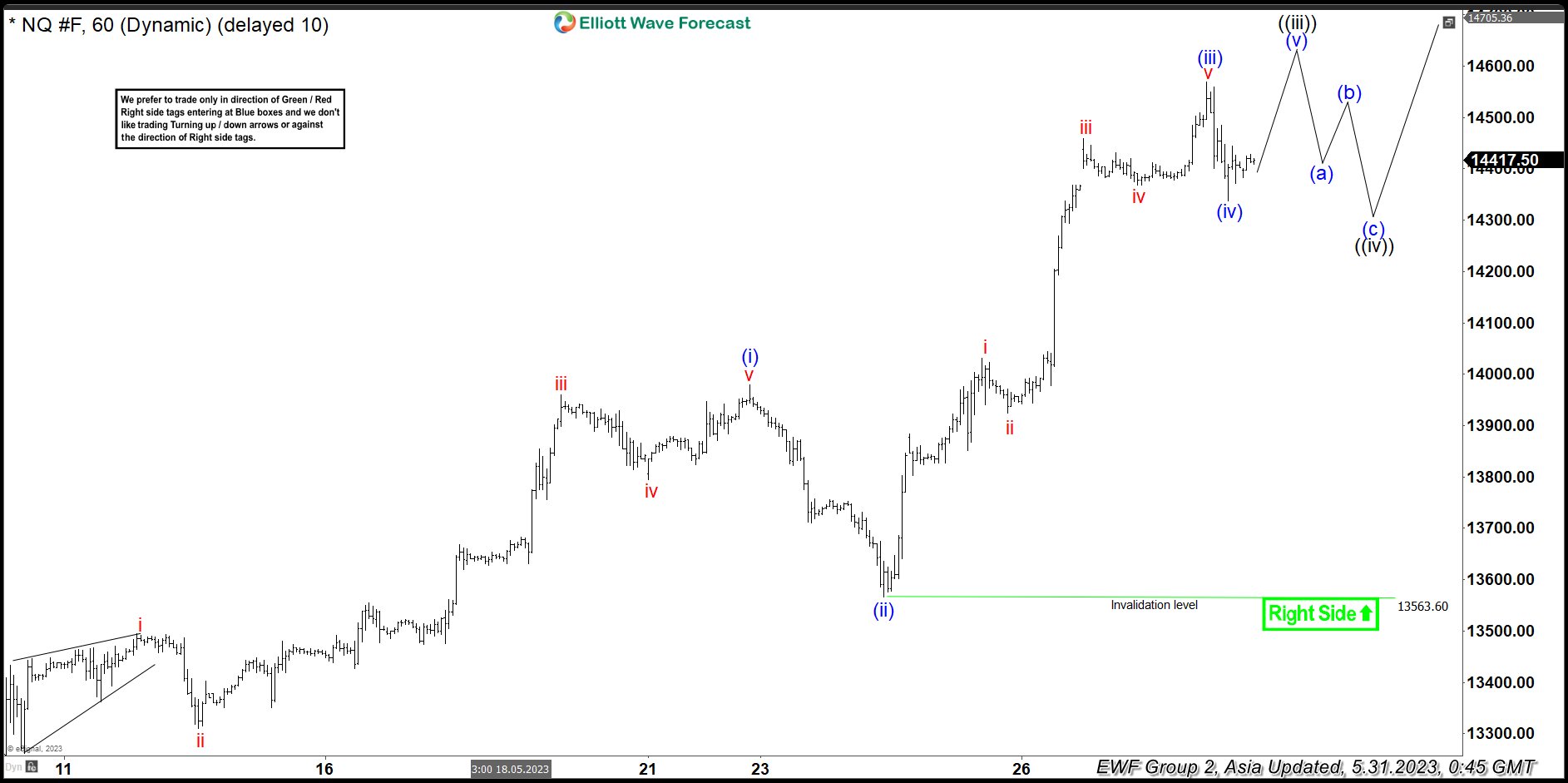

Short term Elliott Wave View in Nasdaq (NQ) suggests the rally from 4.26.2023 low is in progress as a 5 waves impulse with extension (nest). Up from 4.26.2023 low, wave ((i)) ended at 13370.25 and pullback in wave ((ii)) ended at 13001.75. Wave ((iii)) is currently in progress with internal subdivision as another 5 waves in lesser degree. The 1 hour chart below shows the rally within wave ((iii)). Up from wave ((ii)), wave i ended at 13494.25 and dips in wave ii ended at 13310.50. Wave iii ended at 13960.25, wave iv ended at 13794.25, and final wave v ended at 13979.25 which completed wave (i). Index then pullback in wave (ii) which ended at 13563.60.

The Index extended higher again in wave (iii) towards 14570 and pullback in wave (iv) ended at 14336.75. Expect Index to extend higher in wave (v) to complete wave ((iii)). Afterwards, it should pullback in wave ((iv)) to correct cycle from 5.4.2023 low before the Index resumes higher again. Wave ((iv)) typically ends at 23.6 – 38.2% Fibonacci retracement of wave ((iii)). The target can be measured after wave ((iii)) is confirmed complete. Near term, as far as pivot at 13563.6 low stays intact, expect pullback to find support in 3, 7, or 11 swing for further upside.