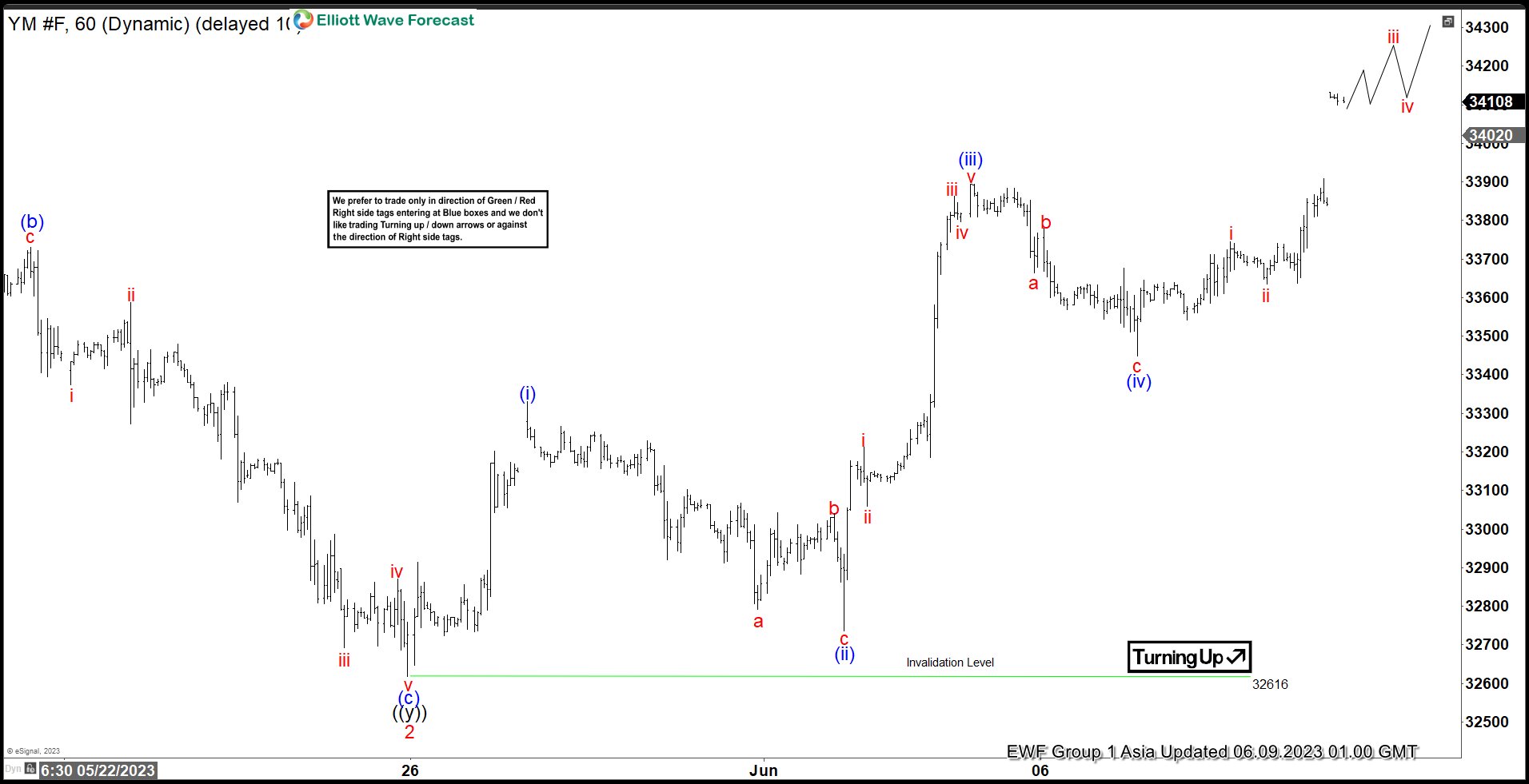

Short Term Elliott Wave in Dow Futures (YM) suggests rally from 3.15.2023 low is in progress as a 5 waves impulse Elliott Wave structure. Up from 3.15.2023 low, wave 1 ended at 34363 and pullback in wave 2 ended at 32619. The Index has turned higher in wave 3 with internal subdivision as another 5 waves in lesser degree. Up from wave 2, wave (i) ended at 3330 and dips in wave (ii) ended at 32737. Up from wave (ii), wave i ended at 33212 and pullback in wave ii ended at 33060. Wave iii ended at 33863, wave iv ended at 33797, and wave v ended at 33894 which completed wave (iii).

Pullback in wave (iv) ended at 33448 as a zigzag structure. Down from wave (iii), wave a ended at 33665, wave b ended at 33780 and wave c lower ended at 33448. This completed wave (iv). Wave (v) of ((i)) is currently in progress. Up from wave (iv), wave i ended at 33745 and pullback in wave ii ended at 33635. Expect the Index to extend higher a few more highs to end wave v of (v) of ((i)). Then it should pullback in wave ((ii)) to correct cycle from 5.25.2023 low in 3, 7, or 11 swing before the rally resumes. Near term, as far as pivot at 32616 low stays intact, expect dips to find support in 3, 7, 11 swing for further upside.