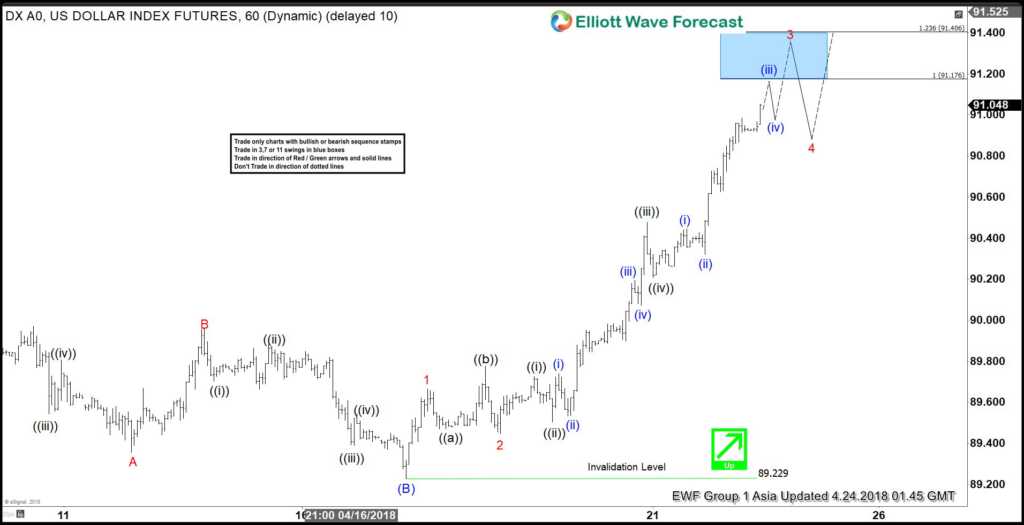

USDX Elliott Wave view in short-term cycle suggests that the decline to 89.22 ended Intermediate wave (B) as Elliott Wave Zigzag correction. Above from there, Intermediate wave (C) remains in progress as Elliott Wave Impulsive sequence with extension looking for further extension higher. The internal distribution of each leg consists of 5 waves structure with extension in the third wave thus we favor the structure to be an impulsive sequence.

Up from 89.22 low, Minor wave 1 of (C) ended in 5 waves at 89.66, Minor wave 2 ended as a Flat at 89.45 low. Then above from there Minor wave 3 remains in progress. The internal of Minor wave 3 is unfolding as an Impulse Elliott Wave sequence with extension where Minute wave ((i)) ended at 89.72, Minute wave ((ii)) ended at 89.51, Minute wave ((iii)) ended at 90.47 high, and Minute wave ((iv)) ended at 90.21 low. Above from there, Minute wave ((v)) of 3 remains in progress looking to extend higher 1 more push towards 91.17 – 91.40 area approximately to end 5 waves in Minor wave 3. Afterwards, the index should do a Minor wave 4 pullback in 3, 7 or 11 swings before further upside is seen. We don’t like selling it into a proposed pullback.