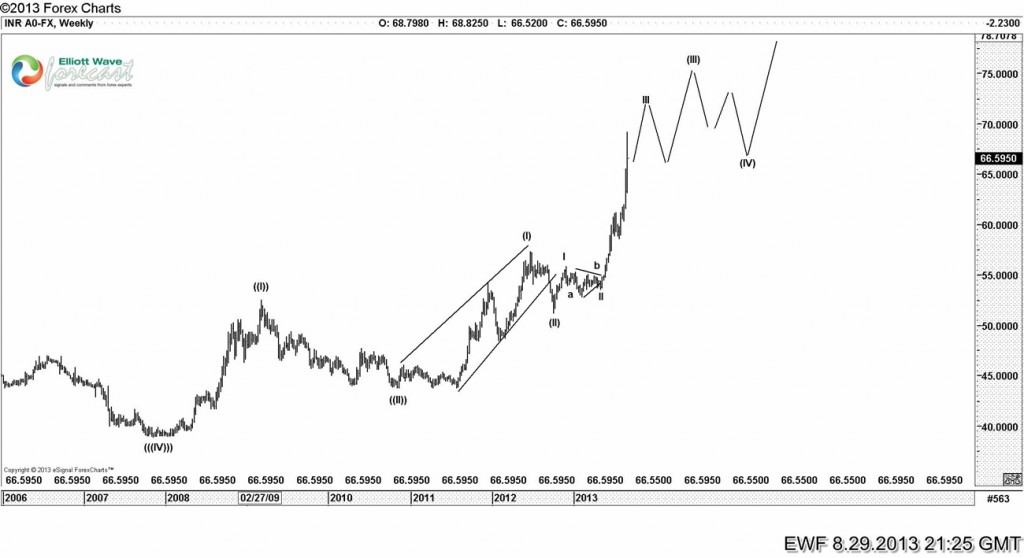

The pair has hit our target of 67.94 (1.236 ext) from our previous blog published on 7.22.2013. Now that the target has been hit, it’s time to take another look at the pair. We expected the pair to hit 67.94 target in wave ( c ) of a 7 swing structure from 2011 lows but speed , angle and RSI strength is not really supporting this idea. Moreover, attached daily chart shows a convincing break of the base channel which is indicative of impulsive price action.

Impulsive view on the daily chart shows pair has completed wave (( 3 )) of III of ( III ) of (( III )) of ((( V ))) and there is more upside seen ahead. Wave (( 4 )) has 38.2 fib support @ 65.23 and should hold for new highs above 69.32 and much higher. Wave (( 1 )) overlap point is 61.20 and price needs to stay above this level for the impulsive view to remain valid. However, ideally price should not drop below 63.20 wave ( 4 ) 0f lesser degree. Decline so far from the recent highs is in 5 swings so far but H1 RSI divergence has been erased which means we could see 7th swing lower to 65.08 – 65.65 to complete a cycle from 69.22 peak before attempts to resume the rally. This is just one possible way to complete wave (( 4 )) but we know 4th waves can get complex so further consolidation in the form of a triangle or FLAT can’t be ruled out before further strength is seen.

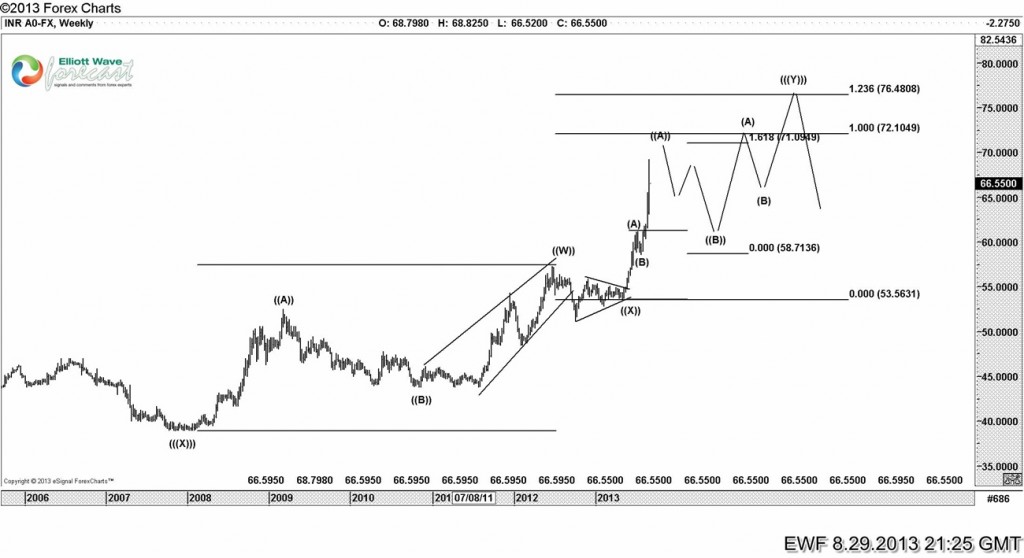

There is a less aggressive view which suggests pair is in a double corrective structure on the weekly time frame when it is complete wave (( A )) of (( Y )) which could still reach as high as 71.09 – 72.10 before we see a pull back in wave (( B )) before the final leg higher toward 1.236 ext (76.48) to form a significant high which should hold for a while at least. Both the views are calling for more strength and hence selling is not recommended.

Thank you for viewing this analysis on $USDINR. If you liked it, why not Sign up for 14 Day FREE Trial We cover 25 instruments in 4 different time frames working round the clock to provide you with frequent & timely updates and to keep you on right side of the market.

If you are interested in learning more about Elliott wave structures and sequence of waves / swings, why not check our and register for up coming webinar on this topic. See the details here

Back