In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

EURJPY Forecasting The Rally From The Blue Box Area

Read MoreIn this blog, we’re going to take a quick look at the Elliott Wave charts of EURJPY pair. EURJPY ended short term cycle in wave ((iii)) as 5 waves rally from 11.14.2019 low at 117.05 to 12.13.2019 high at 122.66. Then, the pair pulled back to correct the cycle up from 11.14.2019 low in 3 […]

-

Pound Sterling After the Tories’ Landslide Victory in UK Election

Read MoreThe UK election result pushed GBP higher after the Conservatives, led by Prime Minister Boris Johnson, won the majority in parliament with a landslide victory. This is the Tories’ biggest victory since Margaret Thatcher days. Johnson can finally get his Withdrawal Agreement Bill passed now that the Parliamentary blockage out of the way. However, getting […]

-

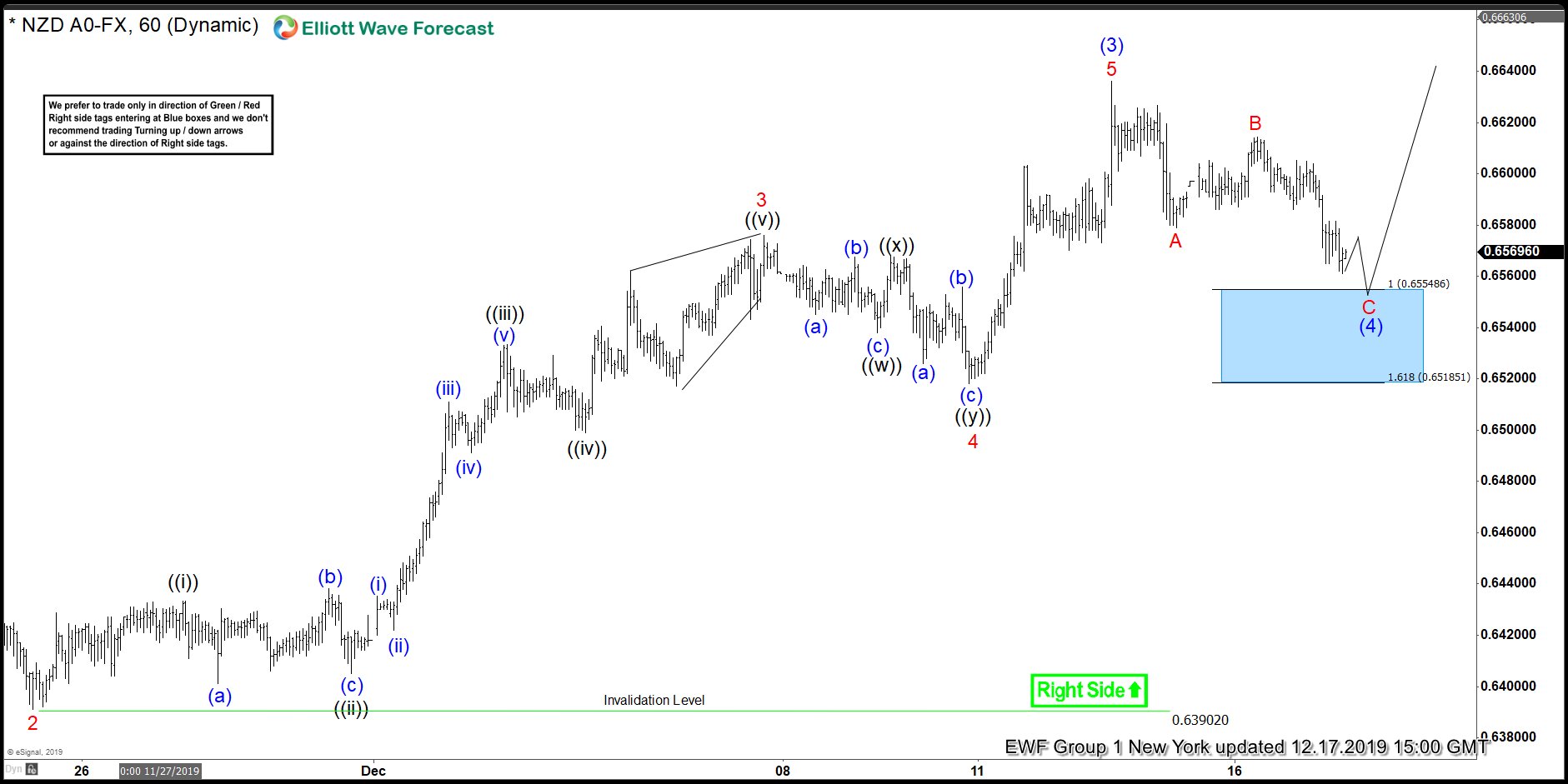

NZDUSD Elliott Wave Forecasting The Rally From The Blue Box

Read MoreIn this technical blog we’re going to take a quick look at the Elliott Wave charts of NZDUSD pair published in members area of the Elliottwave-Forecast . As our members know, cycle from the 10/01 low is unfolding as 5 waves structure. Recently we got 3 waves pull back against the 0.6316 low. The pair […]

-

EURUSD Elliott Wave View: Reaction Higher Is Expected

Read MoreEURUSD rally from October 01, 2019 low is showing an incomplete structure, favoring more upside. This article looks at the Elliottwave path.

-

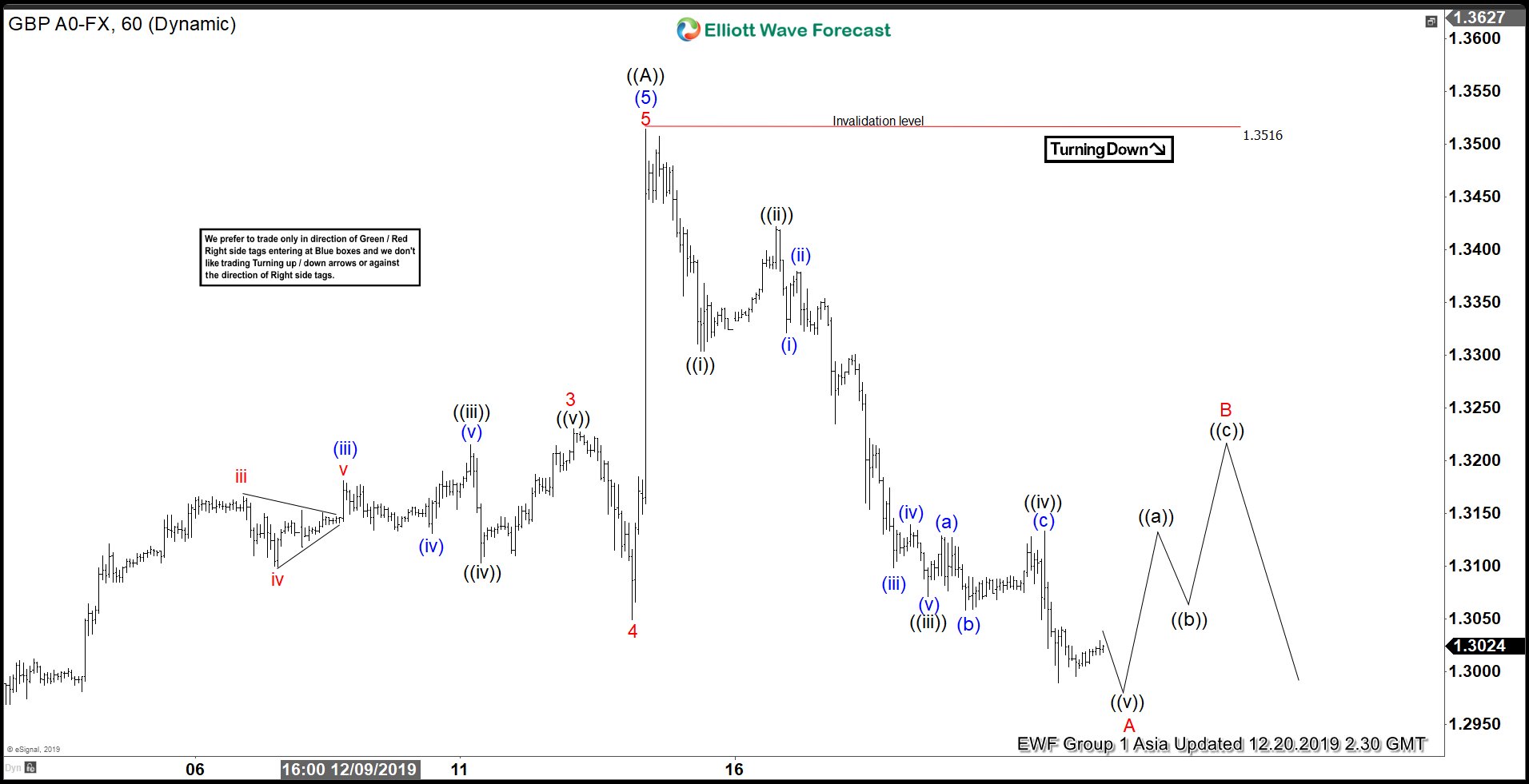

Elliott Wave View: GBPUSD Impulsive Decline Suggests More Downside

Read MoreGBPUSD decline from Dec 13, 2019 high is unfolding as Elliott Wave impulse structure and while bounce stays below there, pair can see more downside.

-

USDSEK Forecasting The Decline using Elliott Wave

Read MoreIn this blog, we will take a look at the recent price action of USDSEK since we published the short-term view for this pair in Chart of the day on 12.6.2019 Pair was showing an incomplete sequence down from 10.9.2019 (9.964) peak against 11.13.2019 (9.765) and was calling for more downside toward 9.3527 – 9.2549 […]