In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

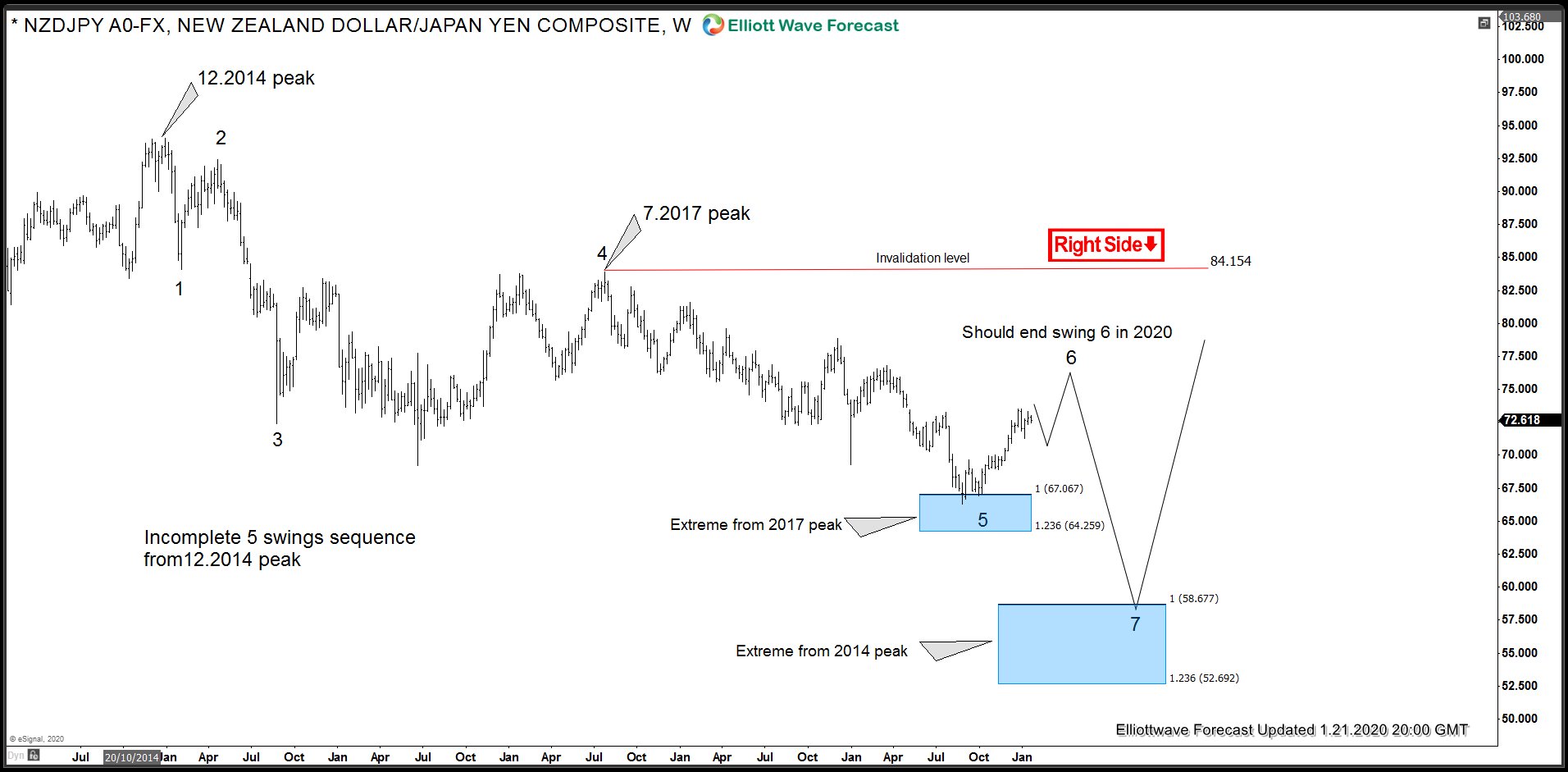

NZDJPY Incomplete Bearish Elliott Wave Sequence

Read MoreBack in October 2019 we highlighted in this article that Yen crosses like NZDJPY and SEKJPY had reached the extreme areas down from their respective 2017 peaks and a bounce was due to take place very soon. Shortly after we published the article, we saw a strong reaction higher in the Yen pairs and we believe […]

-

Elliott Wave View: Bitcoin (BTCUSD) Near The End of 5 Waves Rally

Read MoreElliott Wave view on Bitcoin (BTCUSD) suggests the rally from December 18, 2019 low is unfolding as a 5 waves impulse Elliott Wave structure. In the 1 hour chart below, we can see wave ((iii)) of the impulse ended at 8463.57. Pullback in wave ((iv)) ended at 7667 as a double zigzag Elliott Wave structure. Bitcoin […]

-

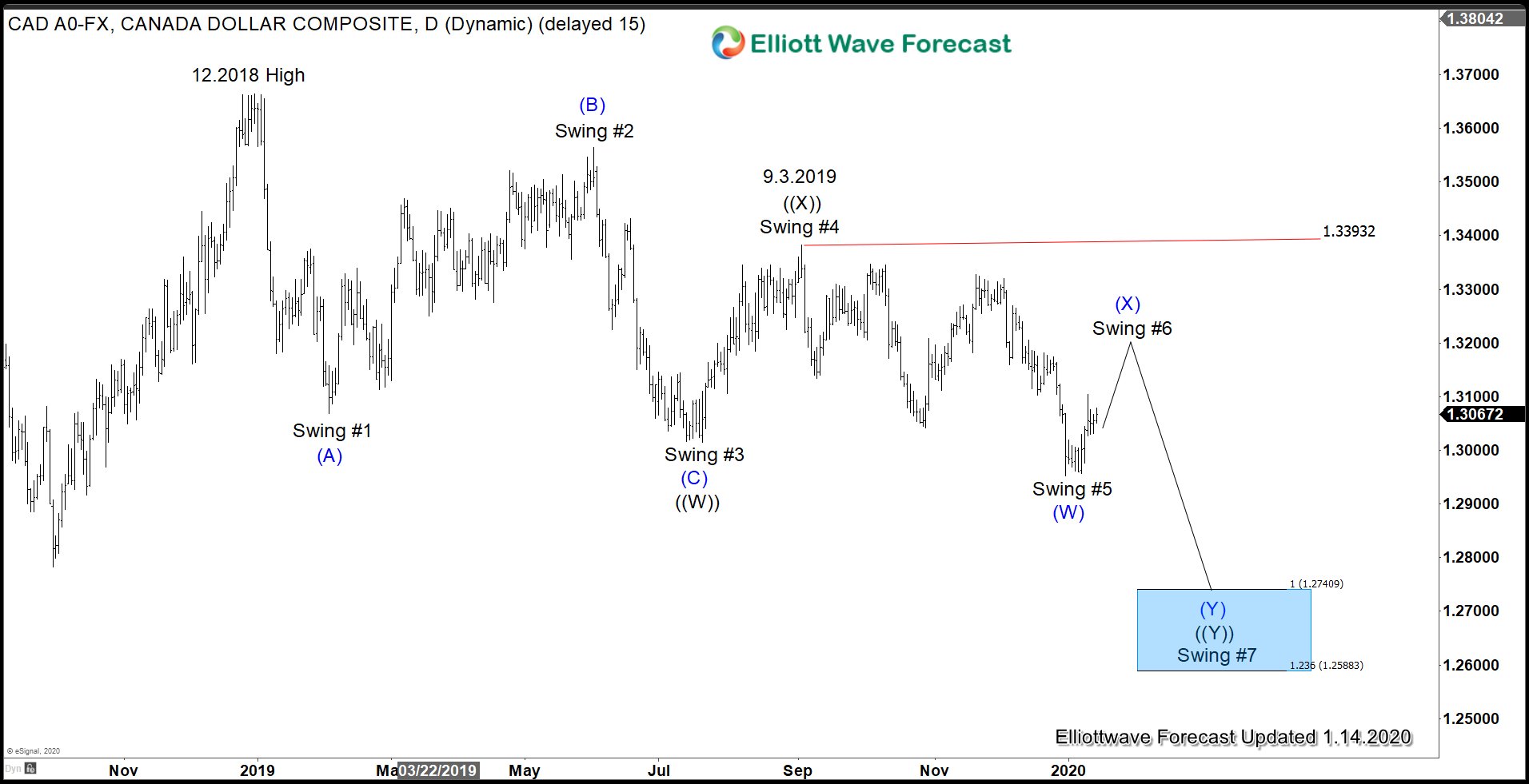

Strong Labor Market and High Inflation Supports Canadian Dollar

Read MoreCanadian Dollar has staged a rally recently on the back of a strong jobs report. Recent strong jobs data and high inflation likely allows Bank of Canada (BOC) to maintain a steady rate this year. BOC will have its first rate meeting this year on January 22. Canadian employment report in December shows a strong […]

-

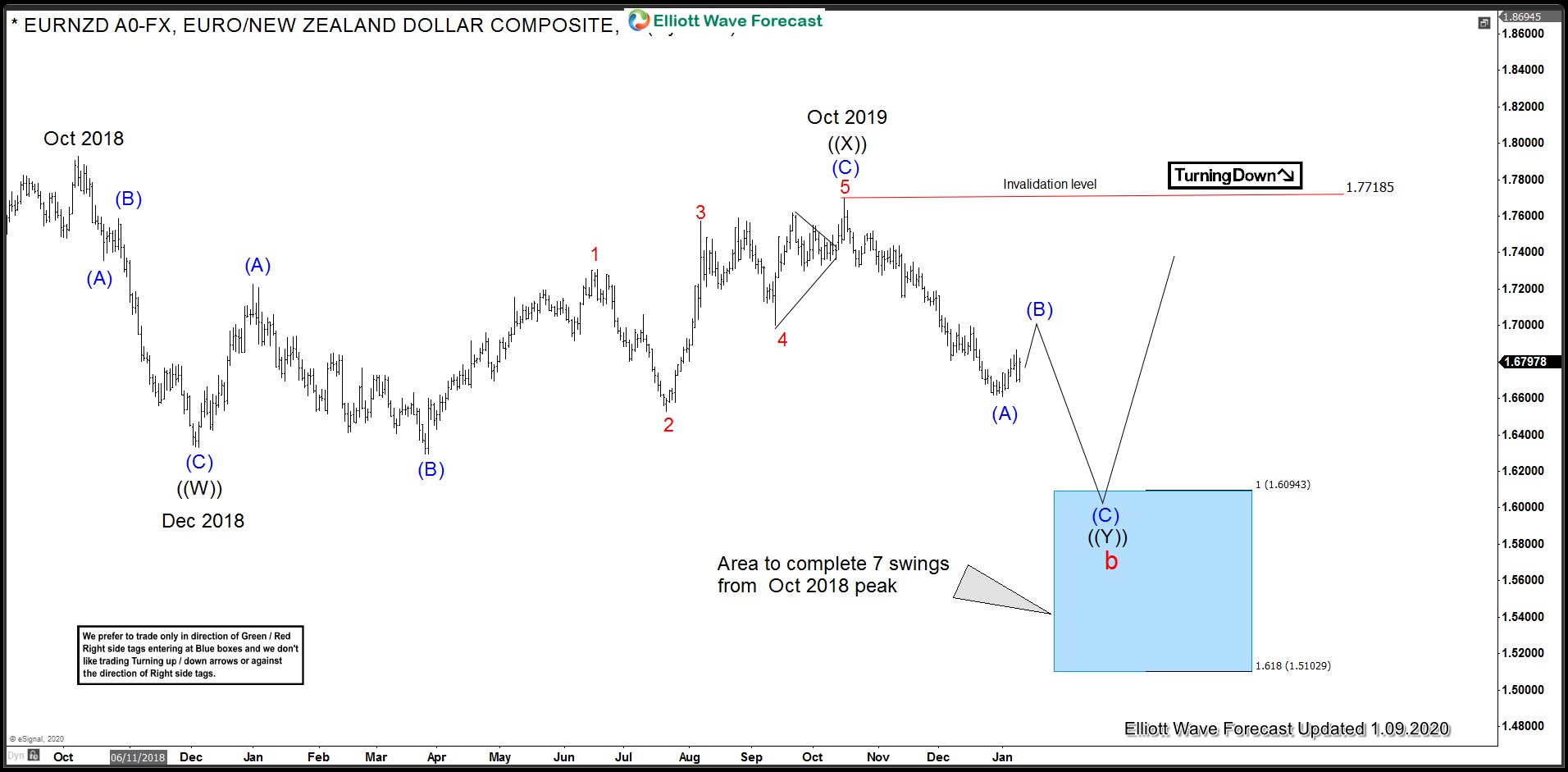

Using Market Correlation to Time The Entries

Read MoreLast year turned out to be great for GBP crosses as they managed to put in strong rallies in favor of GBP since December 2018 lows or highs. In this article, we would concentrate on two of the GBP crosses namely GBPAUD and GBPNZD because the rallies last year in these two instruments managed to […]

-

10 Year T-Note Futures: $ZN_F Forecasting Elliott Wave Path

Read MoreIn this blog, we take a look at the 1 hour Elliott Wave chart performance of $ZN_F 10 Year T-Note Futures, which our members took advantage at the blue box.

-

Elliott Wave View: $EURUSD Further Strength Expected

Read MoreShort Term Elliott Wave view in $EURUSD suggests that the cycle from October 1, 2019 low remains incomplete and pair can see further upside. Near term, pullback to 1.1064 on December 21, 2019 low ended wave X. Pair has resumed higher in wave Y with subdivision unfolding as a zigzag Elliott Wave structure. Wave ((a)) […]