In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

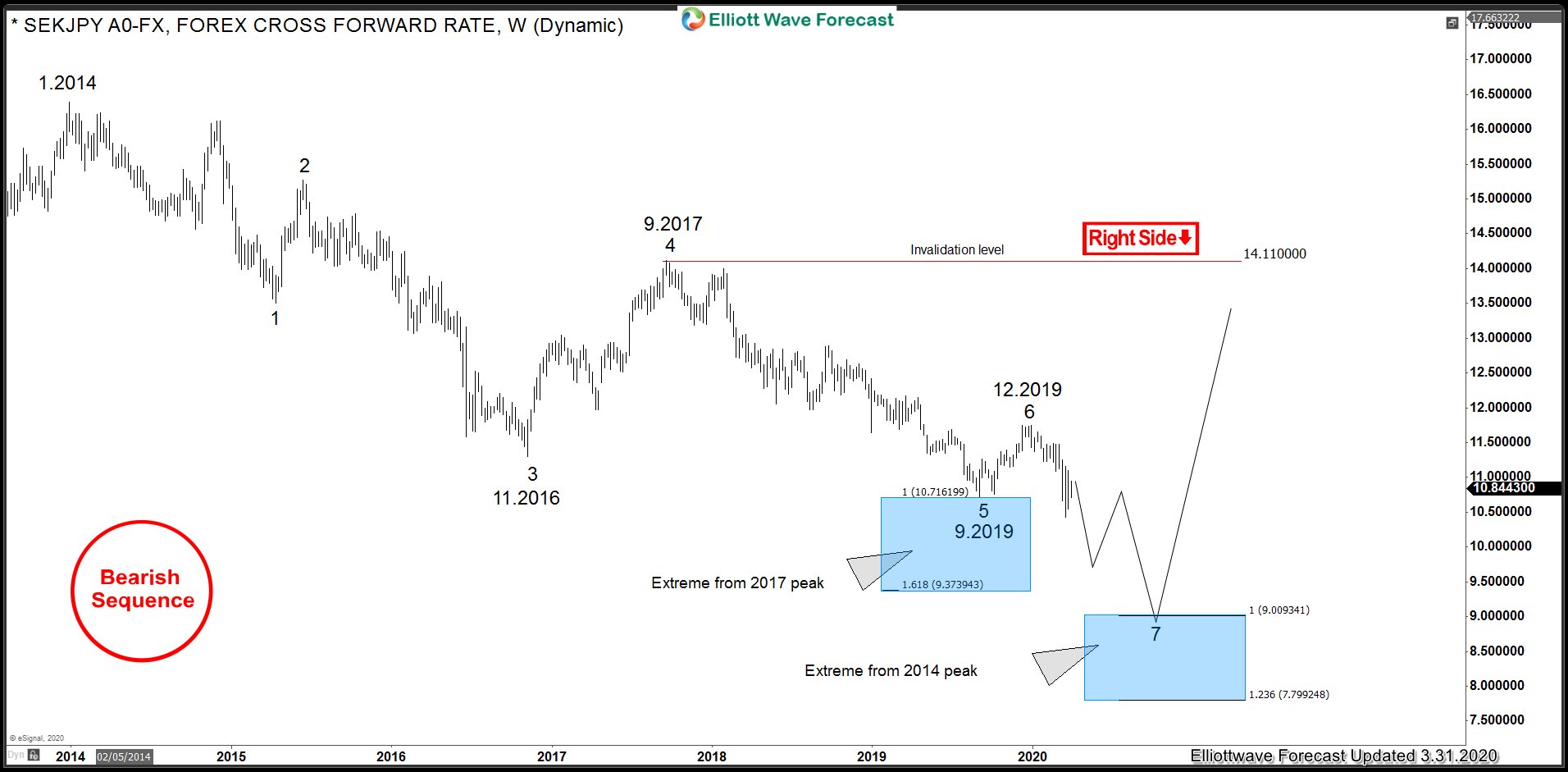

SEKJPY Breaks below September 2019 to Resume The Decline

Read MoreBack in October 2019, we mentioned that SEKJPY had reached extreme area down from September 2017 peak and should bounce soon in 3 or 7 swings which should fail for more downside. In this article, we will look at the price action which followed since then and what is expected next in the pair. First […]

-

CADJPY May See More Downside After BOC Cut Rates

Read MoreOn Friday, Bank of Canada (BOC) made another rate cut for the third time this month. The central bank lowered the interest rate by 50 basis points to 0.25%. This unscheduled rate cut is intended to provide support to the financial system and the economy during the COVID-19 pandemic. Prior to the cut, Canada has […]

-

EURGBP Elliott Wave: Pair May Find Buyers Soon

Read MoreBank of England (BOE) decided to leave interest rate unchanged at a record low of 0.1% last week. This allows EURGBP to correct from seven month highs. After reaching the high at 0.95, EURGBP pulled back to 0.89 after BOE injected liquidity into the market The BOE has already cut the interest rate by 65 […]

-

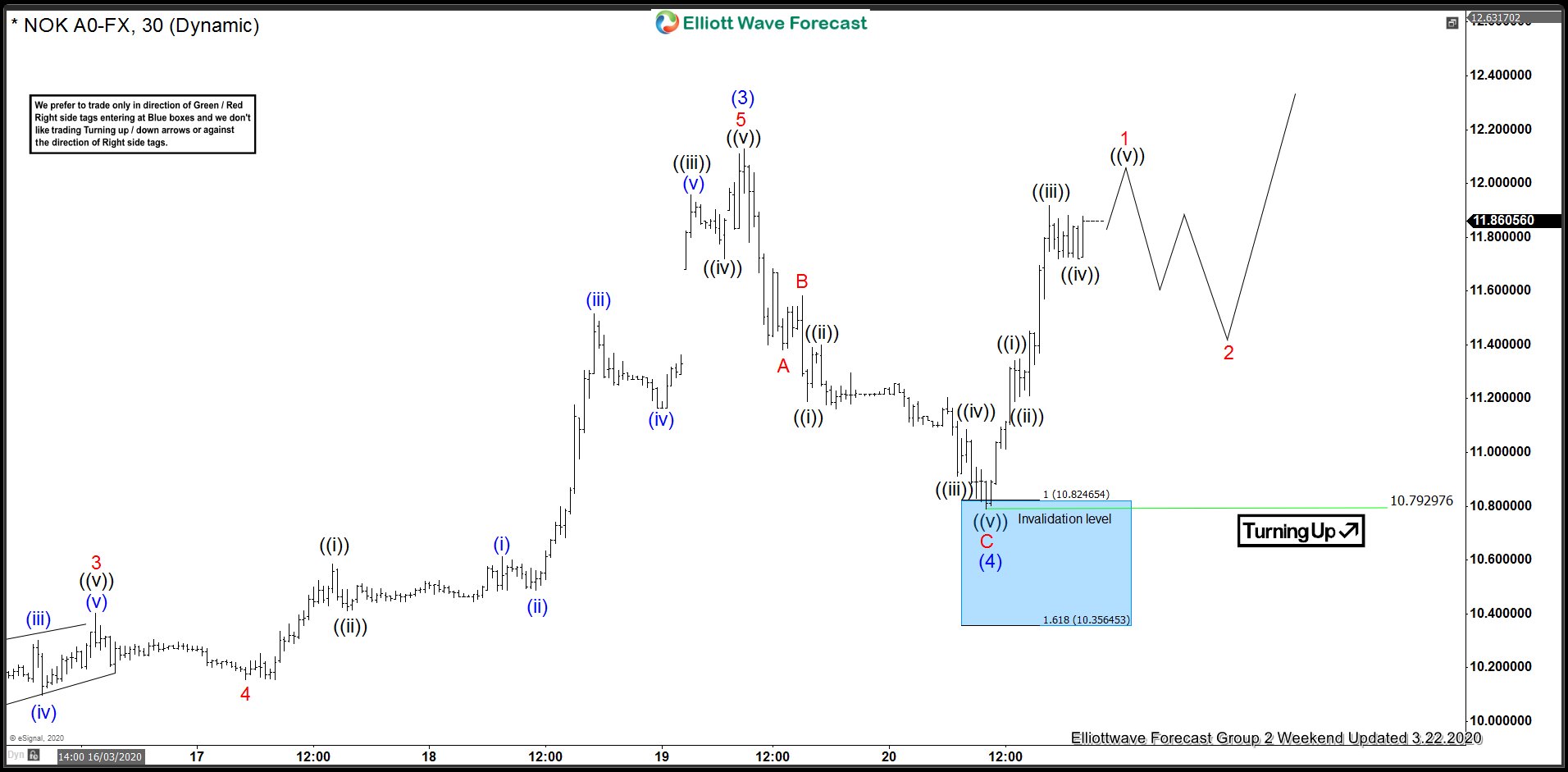

USDNOK Buyers Continue To Respect Blue Boxes

Read MoreIn this blog, we are going to take a look at the Elliottwave chart of USDNOK. The chart from March 13 London update shows that the cycle from March 9, 2020 low unfolded as 5 waves impulsive structure. The rally in wave ((iii)) ended at 10.2785 high. Based on Elliottwave theory, a 3 waves pullback […]

-

US Dollar Continues to Firm As Supply Tightens

Read MoreU.S Dollar demand is so high as a result of the corona virus pandemic that now there’s a squeeze in the credit market. The dollar soared this week as investors liquidated positions across a broad range of assets, including stocks, gold, and bonds, to meet margin calls and raise cash. . Big corporations around the […]

-

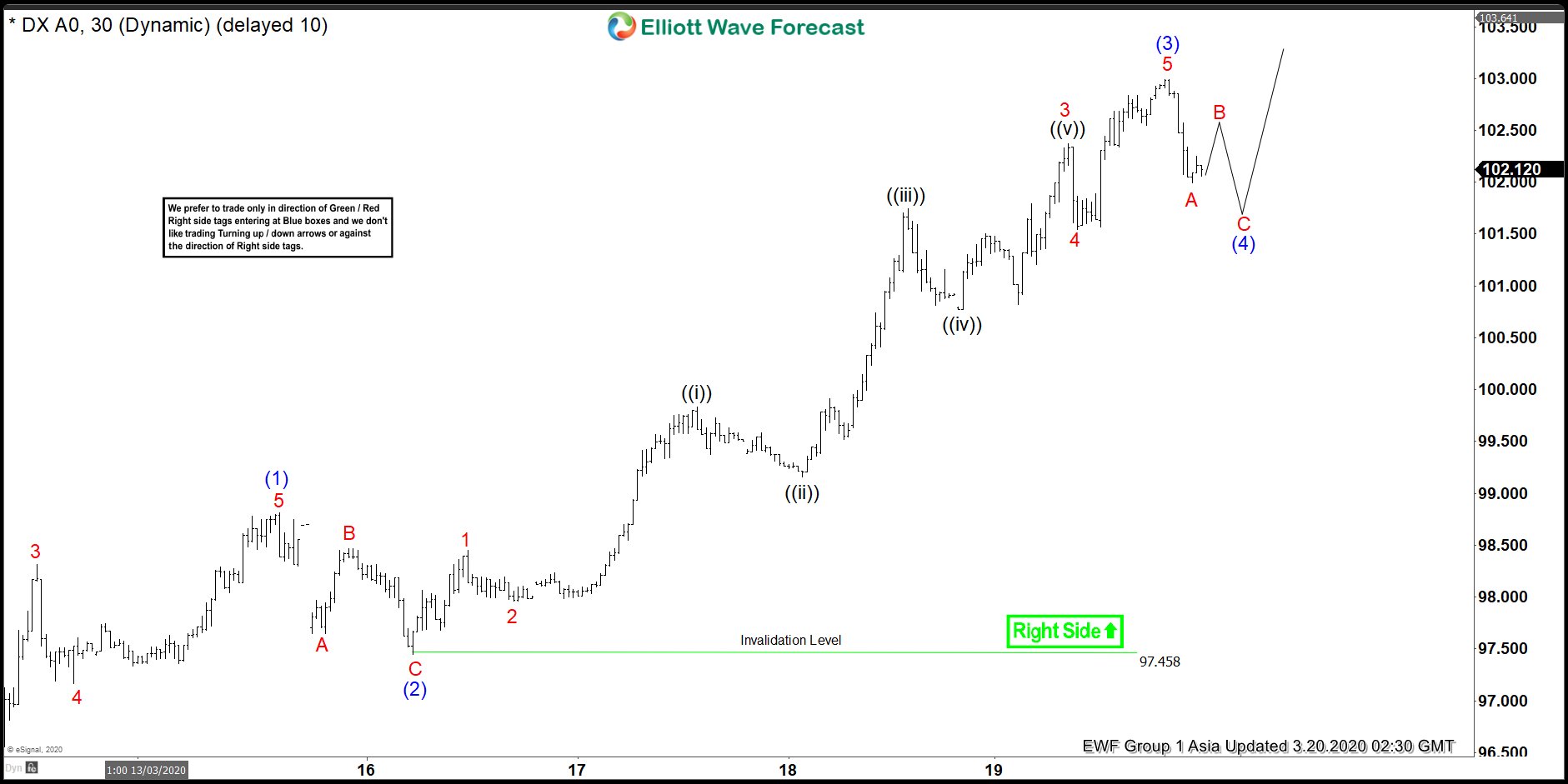

DXY Elliott Wave View: Pullback An Opportunity For Bulls

Read MoreDXY cycle from March 09, 2020 low is showing an impulse rally favoring more upside. This article & video looks at the Elliott Wave path.