In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

8 Best Forex Signal Providers for 2025

Read MoreWhat are Forex Signal Providers? Forex signals are trading opportunities identified by a signal provider. Signal providers analyze the market, often using software, and send alerts of potentially profitable trades to subscribers. No matter your level of trading skill and experience, forex signals can help you enhance your trading activities. In addition, experienced traders have […]

-

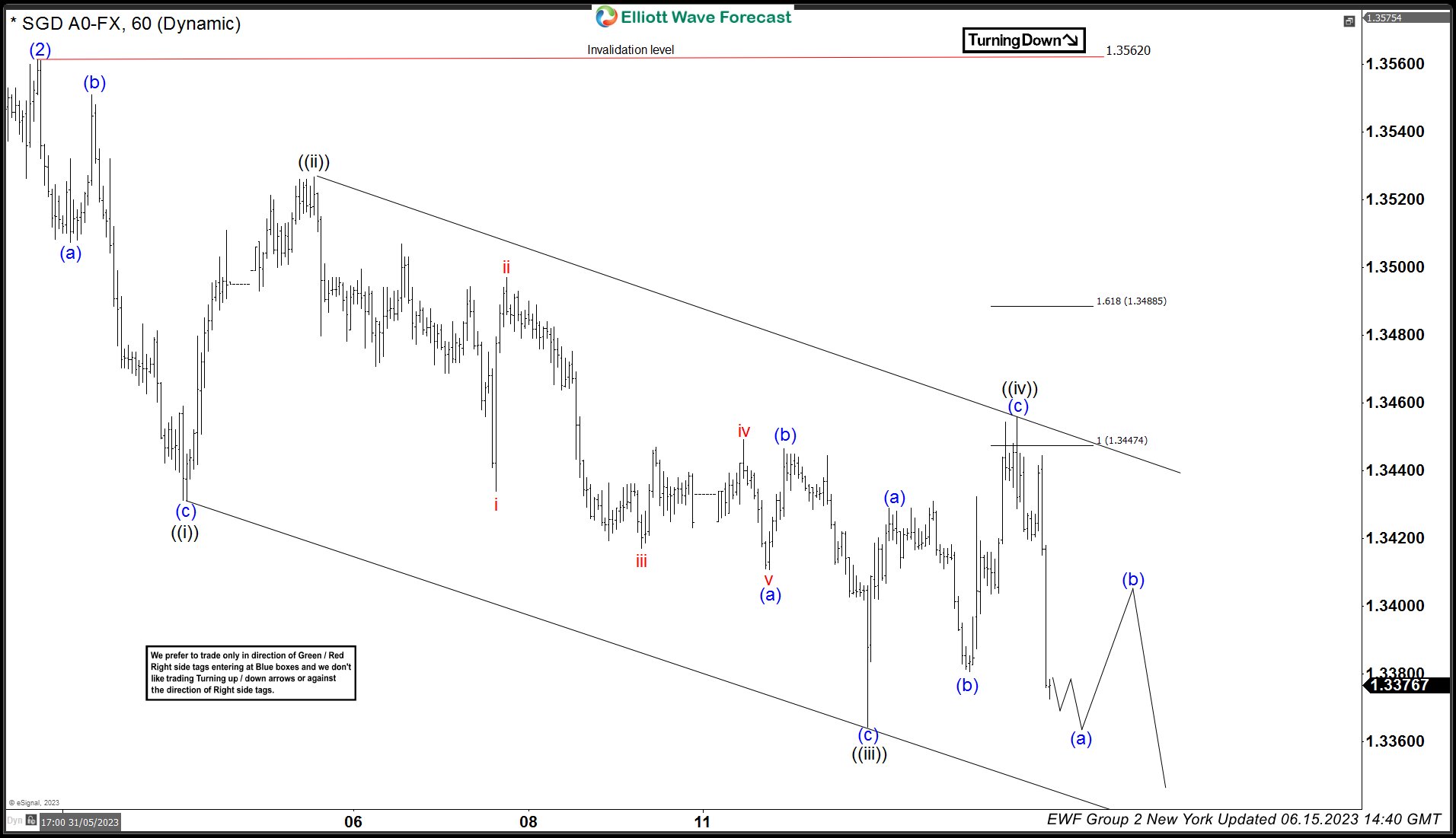

USDSGD: Wave ((iv)) Found Sellers At Equal Legs Area

Read MoreHello Traders, in this article we will go through how USDSGD reacted lower after reaching an equal legs area. Here at Elliott Wave Forecast we have in place a system that allows us to measure an area in which we can expect a react to take place. We call it equal legs area or blue […]

-

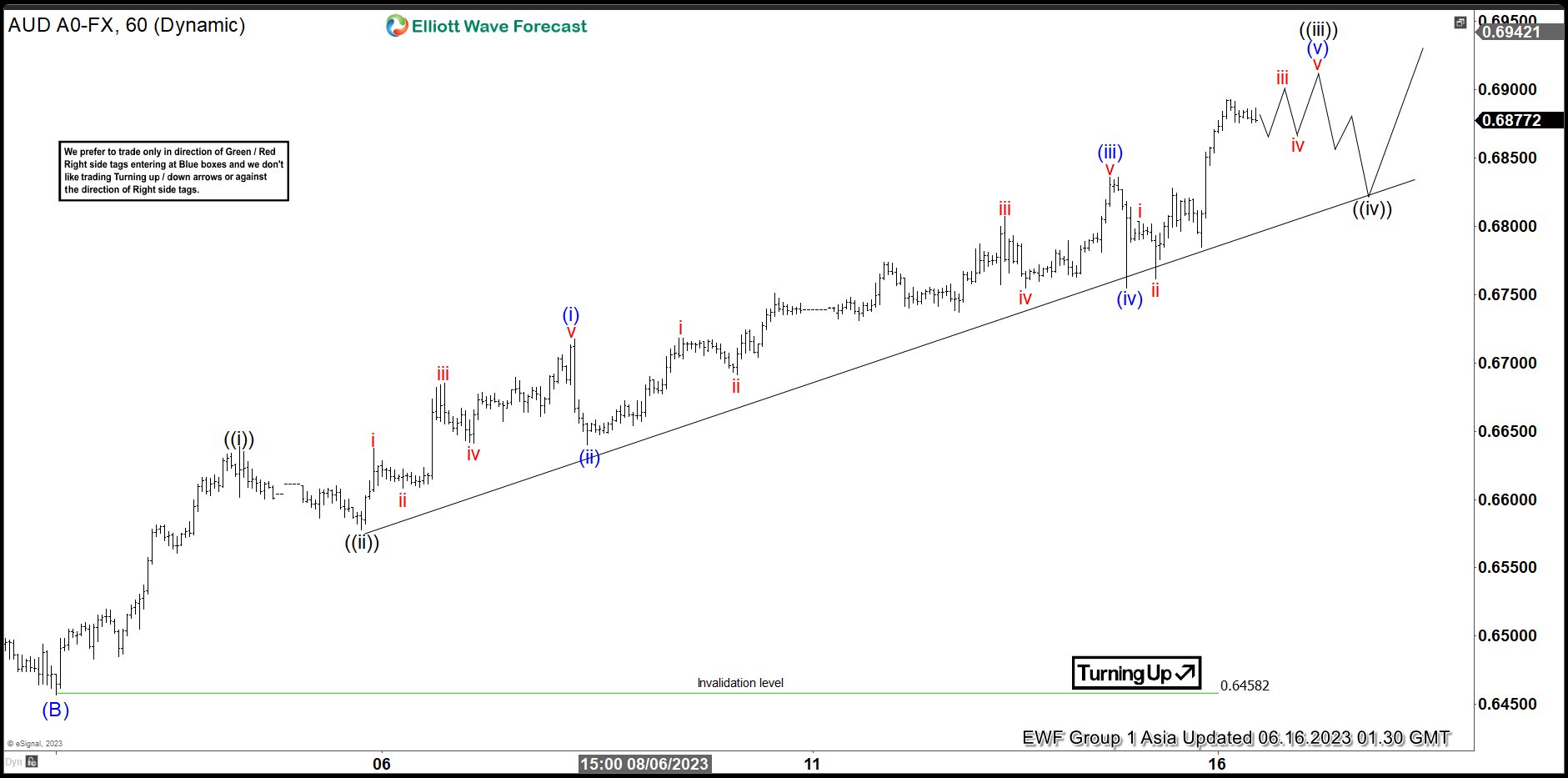

AUDUSD Starts New Elliott Wave Impulse Higher

Read MoreAUDUSD shows impulsive structure from 6.1.2023 low favoring higher. This article and video look at the Elliott Wave path of the pair.

-

Elliott Wave View: USDJPY Approaching Turning Area

Read MoreUSDJPY rally from 5.4.2023 low takes the form of an impulsive structure. This article and video look at the Elliott Wave path.

-

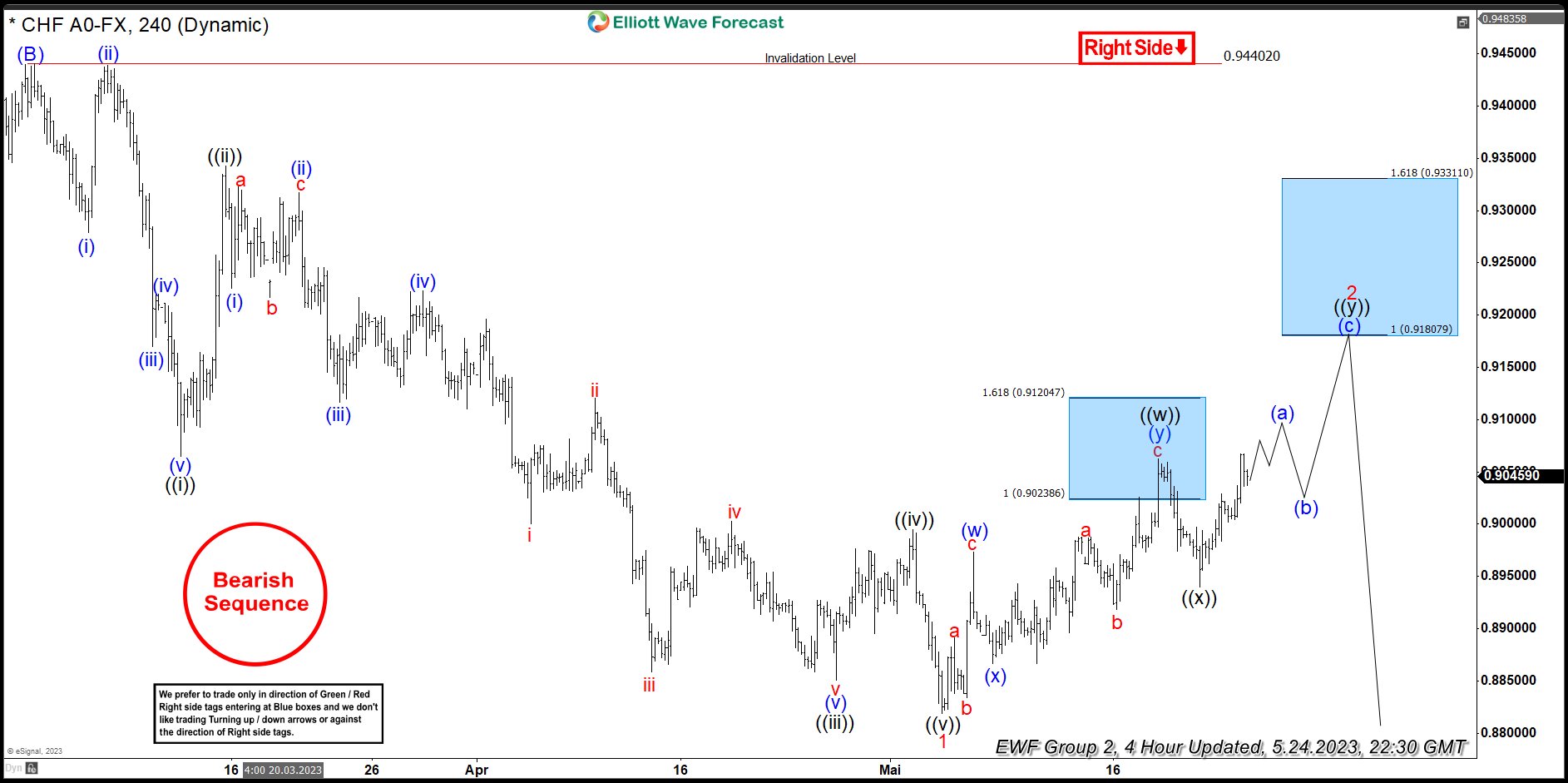

USDCHF Double Three Elliott Wave Advance and Next Blue Box Area

Read MoreIn our recent article about USDCHF, we explained incomplete bearish sequence in USDCHF since October 2022 and December 2016 highs and explained that bounces should fail in 3, 7 or 11 swings for extension lower. Pair found sellers after three waves in the first blue box area and reacted lower to allow any sellers to […]

-

AMZN Starting To React From The Blue Box Area

Read MoreIn this technical blog, we will look at the past performance of the 1-hour Elliott Wave Charts of Amazon ticker symbol: AMZN. In which, the rally from 01 May 2023 low unfolded as an impulse structure. And showed a higher high sequence favored more upside extension to take place. Therefore, we advised members not to sell the stock […]