In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

$USDJPY: A look at shorter and mid-term cycles

Read MoreUSDJPY remains in a sideways consolidation with a bullish bias. This sideways consolidation can play out in a number of different ways as far as Elliott wave patterns go but strategy remains to look to buy the dips rather than selling rallies. Timing cycles are calling for a low on 10.4.2013 [jwplayer mediaid=”115138″]

-

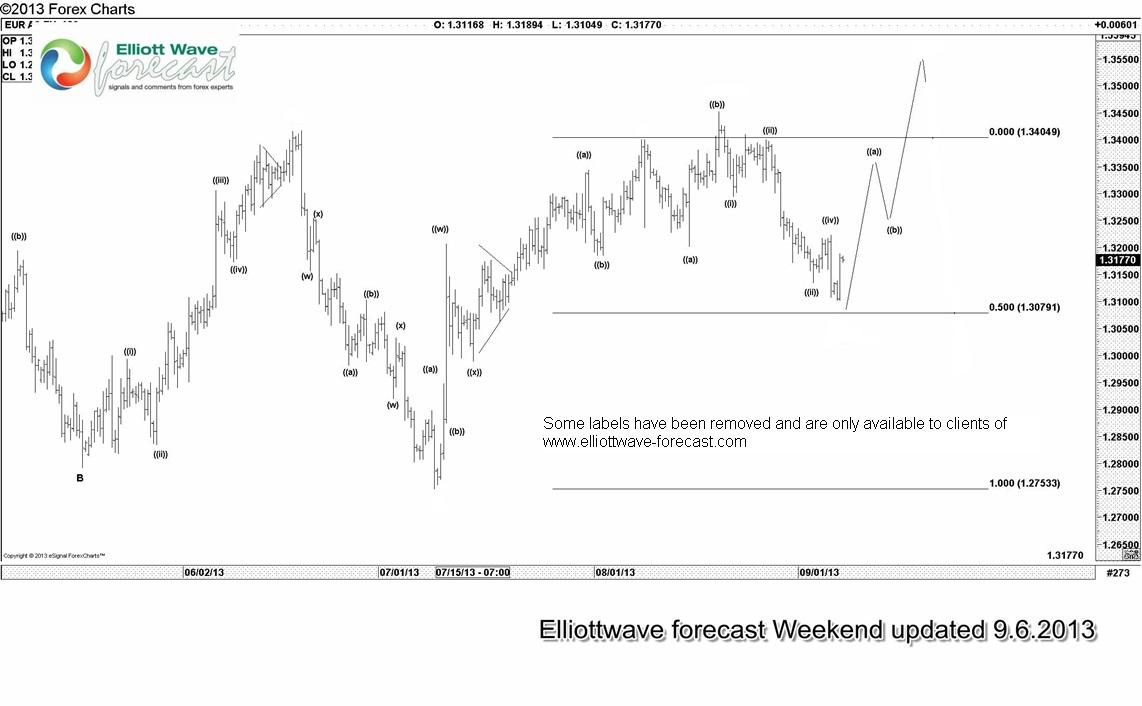

$EURUSD breaks 1.3453 peak

Read MorePair found strong support in EWF buy zone of 1.3020 – 1.3102 and has never looked back since. Most of the members were able to get good positions and some of them are still holding those longs. Against the majority, we treated 5 wave decline from 1.3453 – 1.3102 as part of a FLAT correction […]

-

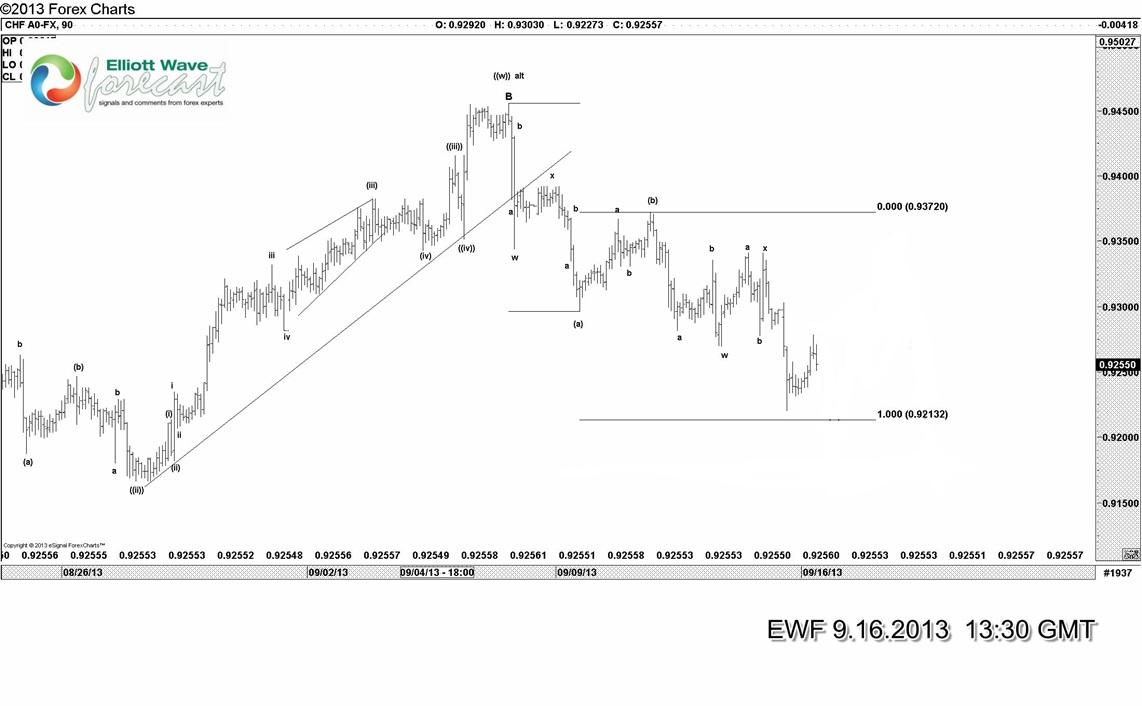

$USDCHF drops to equal legs

Read MoreElliott wave analysis of USDCHF pair from members area showing a drop to equal legs in a double corrective structure. Before: After: If you would like to frequent , timely updates, stay on top of changes in short-term wave structure and be able to trade on right side of the market. sign […]

-

$NZDUSD (9.16.2013)

Read MoreExpect a marginal new high to 0.8254 to complete wave ( 3 ) before the next wave ( 4 ) pull back which should be viewed as a buying opportunity. Hourly cycles are positive and hence we don’t like selling the pair into wave ( 4 ) pull back. If you would like to see […]

-

$EURGBP (9.13.2013)

Read MorePair failed to make new highs above 0.8454 to get into a FLAT correction and prolonged sideways consolidation is favouring the idea of wave (( b )) triangle which completed @ 0.8420 and pair is now thrusting lower. While below 0.8420, expect lower prices ahead. If you would like to see our mid-term view in […]

-

$EURAUD (9.12.2013)

Read MorePair is in a 5 wave decline from 1.5033 peak Wave (( iv )) appears to have completed as a FLAT and a swing lower is now expected to complete wave (( v )). In case of new highs above 1.4402, wave ( c ) of (( iv )) can take the form of an […]