In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

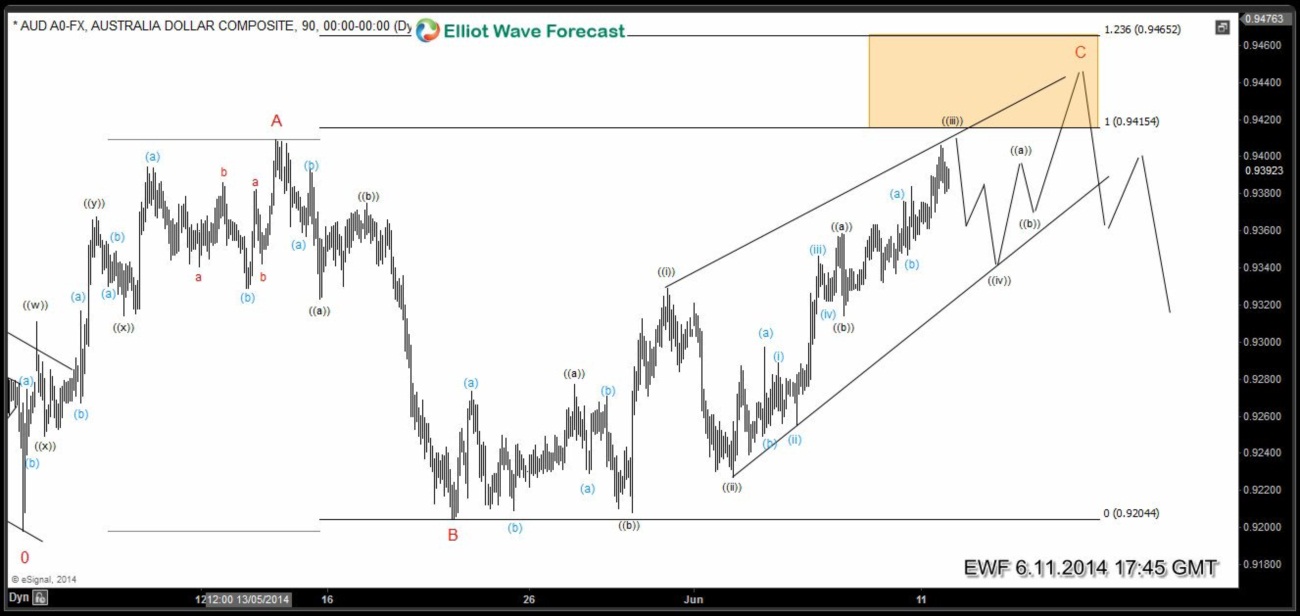

AUDUSD Elliott Wave FLAT / Ending Diagonal Structures

Read MoreAs we can see on AUDUSD 90 min chart pair has been in a sideways consolidation since 0.9198 low (5.2.2014). We believe FLAT structure is in progress which started from 0.9198. To be more precise we are currently in wave C of FLAT. Wave C has taken form of Ending Diagonal and we are nearing […]

-

$AUDJPY 1 Hour Elliott Wave Analysis 6.6.2014

Read MoreShort term view is that wave ( A ) can reach as high as 95.95 before we get a pull back in wave ( B ) and higher again. We don’t like selling the pair in proposed wave ( B ) pull back and like pair trading higher after completing wave ( B ) pull […]

-

$AUDJPY 1 Hour Elliott Wave Analysis 6.5.2014

Read MoreShort term view is that wave ( A ) can reach as high as 95.95 before we get a pull back in wave ( B ) and higher again. We don’t like selling the pair in proposed wave ( B ) pull back and like pair trading higher after completing wave ( B ) pull […]

-

$EURUSD Anticipating the move before ECB

Read MoreAt EWF, we don’t pay attention to news & fundamentals and believe market is purely technical. EURUSD formed a high @ 1.3993 on 5.8.2014 on the day of last ECB meeting. Members knew ahead of the meeting that EURUSD was expected to form an intermediate peak between 1.3970 – 1.4045. Tomorrow is the next meeting […]

-

$GBPUSD – 240m Inflection Zone Trade Setups

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones to your advantage. The Live Trading Room is held daily from 11:30 AM EST until 1:30 PM EST, join Dan there for more insight into these proven methods of […]

-

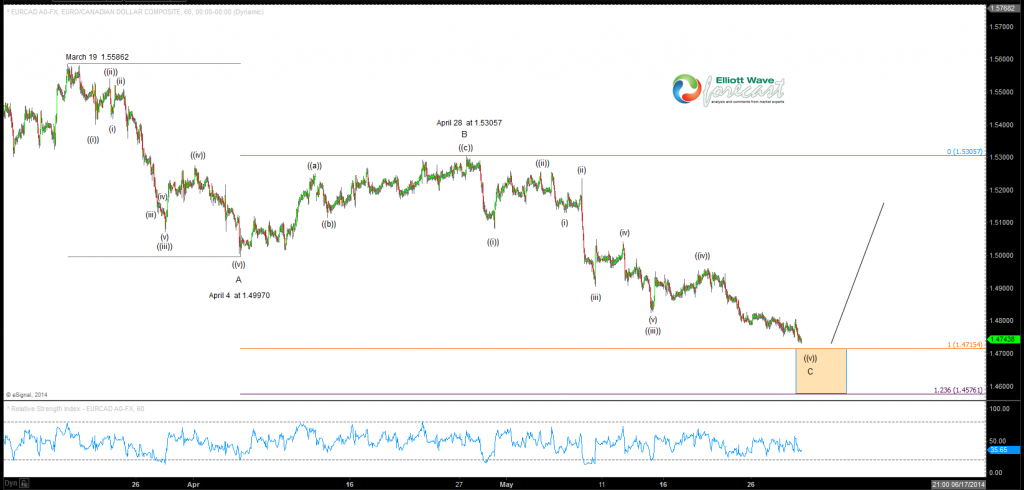

EURCAD zig-zag from March 19

Read MoreEURCAD is a currency pair we use to correlate some of the other financial instruments in the markets we cover here at elliottwave-forecast.com. Since March 19th , 2014 when price was 1.5586, the FX pair has been declining in what appears to be a typical Elliott Wave zig-zag pattern which is a larger degree three […]