In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

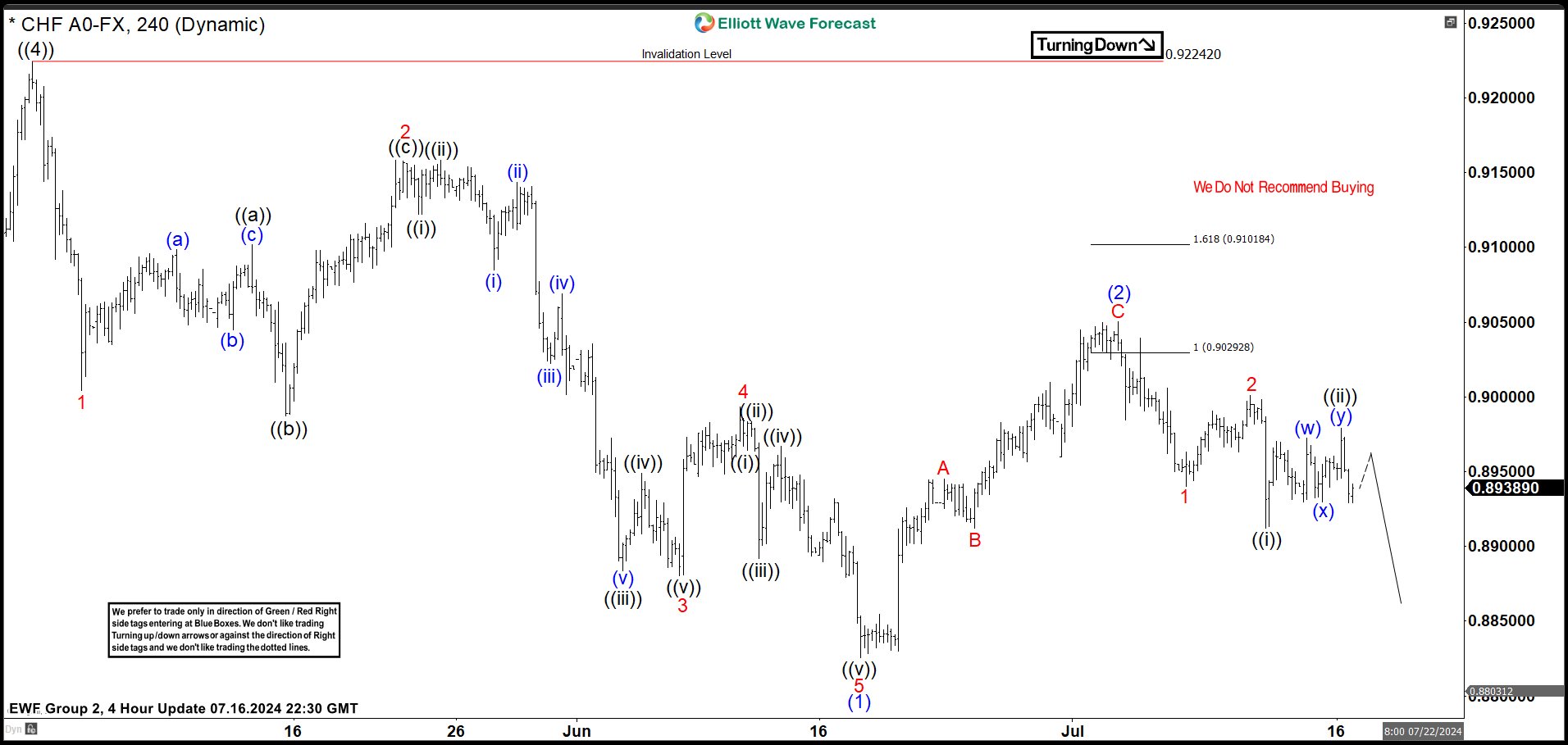

USDCHF Elliott Wave Analysis Favors Selling Bounces

Read MoreHello traders, welcome to a new blog post. Today, we will discuss the future path for the USDCHF currency pair. The recent breakout confirmed the bearish bias we shared with members of Elliottwave-Forecast. So, what is next for this pair in the coming weeks? On April 29, 2024, the pair completed the medium-term bullish corrective […]

-

Dollar Index ( DXY ) Elliott Wave Calling the Decline After 3 Waves Bounce

Read MoreIn this technical article we’re going to take a quick look at the Elliott Wave charts of Dollar Index DXY , published in members area of the website. As our members know, Dollar has given us recovery against the 105.21 peak. It found sellers after 3 waves pattern and made the decline toward new lows […]

-

Elliott Wave Favors Further Upside in GBPUSD

Read MoreGBPUSD shows bullish sequence from 4.22.2024 low favoring upside. This article and video look at the Elliott Wave path of the pair.

-

USDSGD Elliott Wave Analysis expects extensive decline

Read MoreHello traders. Welcome to a new blog post. In this one, we will discuss the future path for the USDSGD forex pair based on the Elliott wave theory. The path will include both long-term ideas and where we can find opportunities along the shorter cycles. $USDSGD is one of the 78 instruments we analyze for […]

-

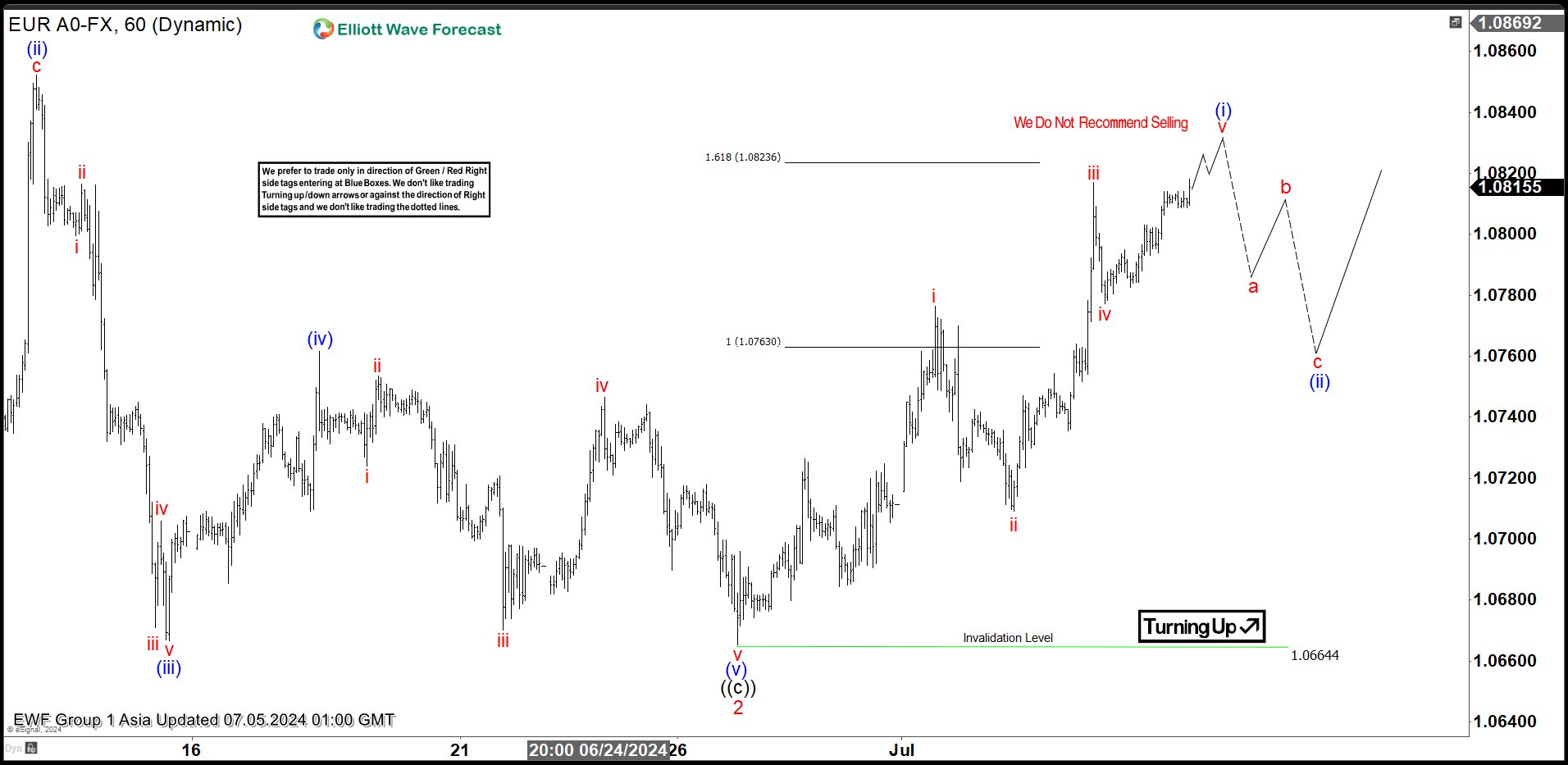

Elliott Wave Expects EURUSD to Turn Higher

Read MoreEURUSD has turned higher and expected to rally in impulsive structure. This article and video look at the Elliott Wave path for the pair.

-

Elliott Wave Intraday Analysis Looking for $USDCHF to Correct in Wave (2)

Read MoreUSDCHF is correcting cycle from 5.1.2024 high before turning lower. This article and video look at the Elliott Wave path for the pair.