In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

$GBP/AUD Chart of the Day Recap 6.9.2015 – 6.12.2015

Read MoreBelow is a recap of our call and forecast for $GBP/AUD from our Chart of The Day post from 6/8/2015 – 6/12/2015. The pair has been steadily moving higher as we expected throughout the week. You can click the underlined link to view the original post on that date. $GBP/AUD Chart of The Day posted at 6/9/2015 […]

-

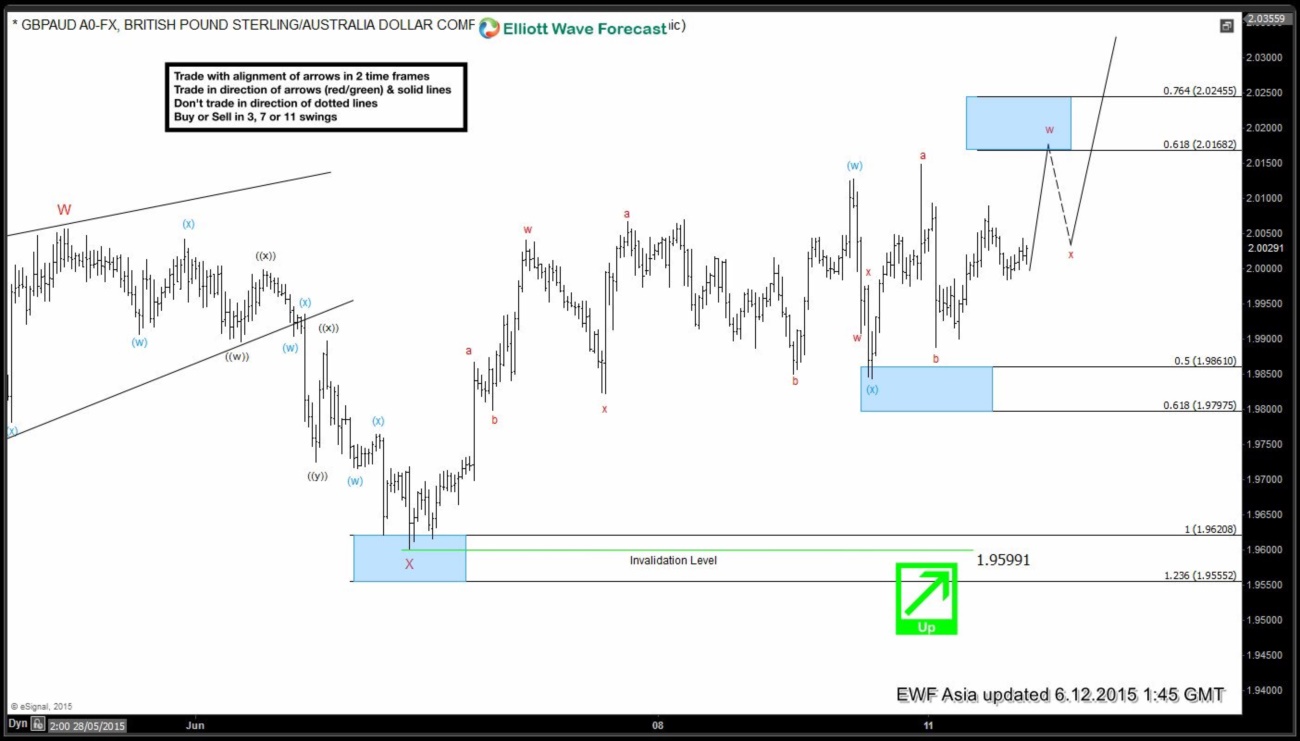

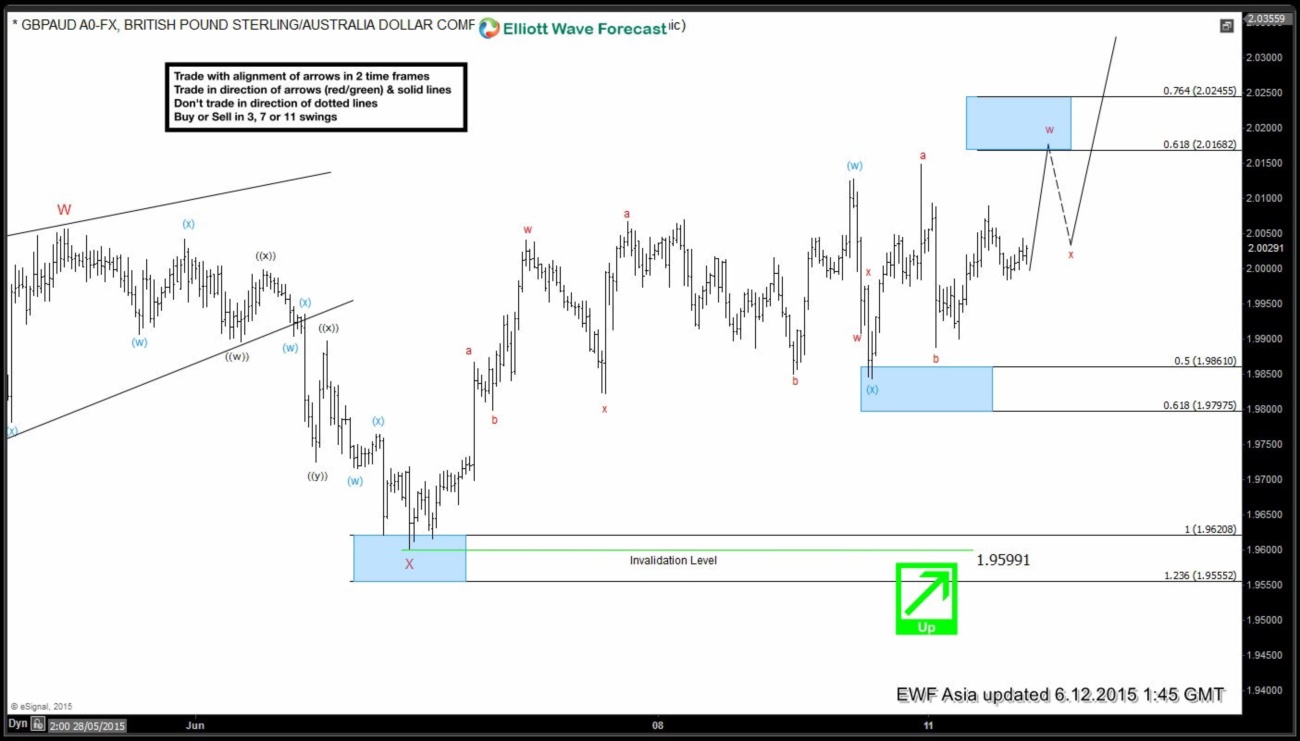

GBPAUD Short Term Elliott Wave Update 6.12.2015

Read MoreDecline to 1.95991 completed wave X. From this level, the pair rallied in wave (w) in the form of a double correction w-x-y where wave w ended at 2.004, wave x ended at 1.9822, and wave y of (w) takes the form of a FLAT and ended at 2.0128. The pair then pullback in wave […]

-

$NZD/CAD & $AUD/CAD Update 6/11/2015

Read MoreThis is a short video update on $NZD/CAD and $AUD/CAD using Elliott Wave Principle as the tool to analyze. These two pairs are not part of the 42 instrument we cover. You can watch the original analysis videos on $NZD/CAD and $AUD/CAD by clicking the underlined words. If you are interested to learn more about Elliott Wave […]

-

GBPAUD Short Term Elliott Wave Update 6.11.2015

Read MoreDecline to 1.95991 completed wave X. From this level, the pair rallied in wave (w) in the form of a double correction w-x-y where wave w ended at 2.004, wave x ended at 1.9822, and wave y of (w) takes the form of a FLAT and ended at 2.0128. The pair then pullback in wave […]

-

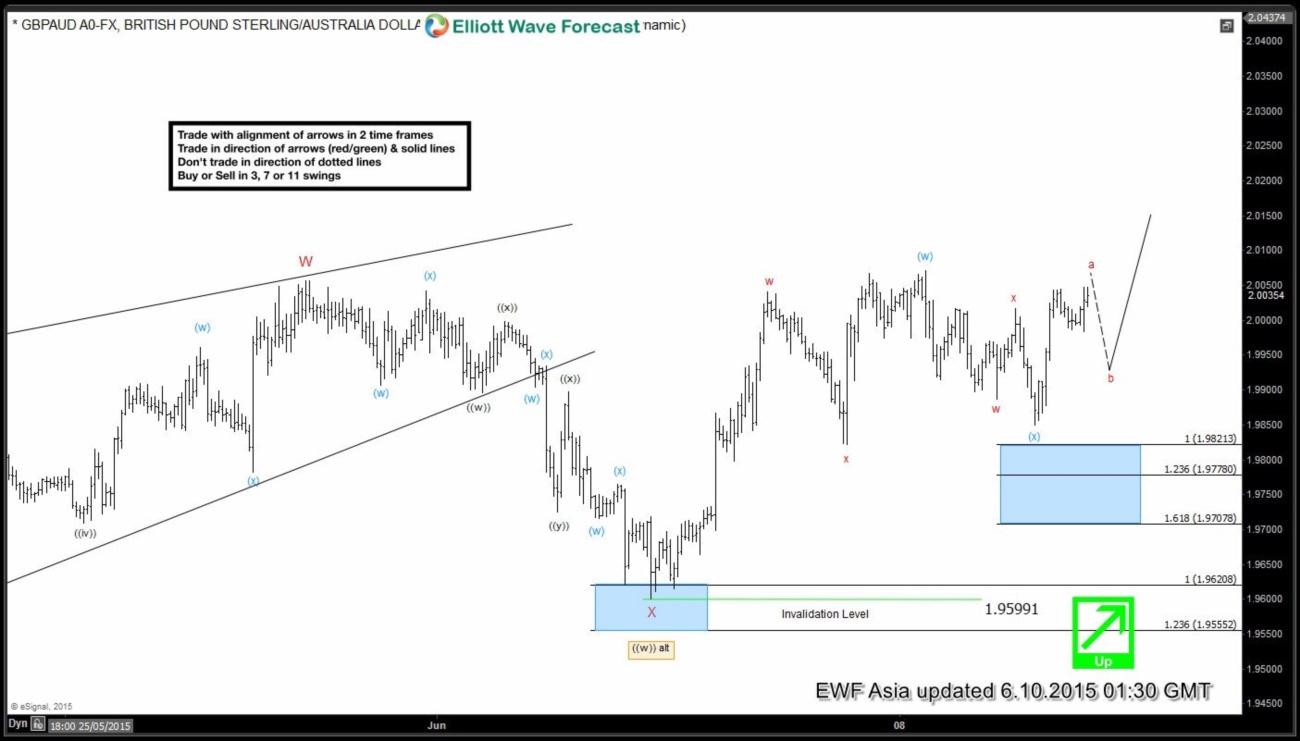

GBPAUD Short Term Elliott Wave Update 6.10.2015

Read MoreDecline to 1.95991 completed wave X. From this level, the pair rallied in wave (w) in the form of a double correction w-x-y where wave w ended at 2.004, wave x ended at 1.9822, and wave y of (w) ended at 2.00707. The pair then pullback in wave (x) also in the form of a […]

-

GBPAUD Short Term Elliott Wave Analysis 6.9.2015

Read MoreDecline to 1.95991 completed wave X. From this level, the pair rallied in wave (w) in the form of a double correction w-x-y where wave w ended at 2.004, wave x ended at 1.9822, and wave y of (w) ended at 2.00707. The pair then pullback in wave (x) also in the form of a […]