In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

$AUD/JPY 4 Hour Elliott Wave Analysis 7.14.2015

Read MoreDecline to 89.15 completed wave (W). Pair has since bounced in wave (X) from this level, and the bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 91.79, wave X ended at 90.46, and wave Y is in progress towards 93.08 – 95.24 area to complete wave (X). We don’t like buying the proposed […]

-

$AUD/JPY Short Term Elliott Wave Analysis 7.14.2015

Read MoreDecline to 89.15 completed wave (W). Pair has since bounced in wave (X) from this level, and the bounce is unfolding in a double corrective structure W-X-Y where wave W ended at 91.79, wave X ended at 90.46, and wave Y is in progress towards 93.12 – 93.75 area to complete wave (X). The internal of wave Y is […]

-

Elliottwave Analysis Update on $EUR/CAD 7.12.2015

Read MoreThis is a video update on $EUR/CAD using Elliott Wave Principle as the tool to analyze. This pair is not part of the 42 instrument we cover. You can watch the original analysis videos on $EUR/CAD by clicking the underlined words. If you are interested to learn more about Elliott Wave or how we can help you, click to […]

-

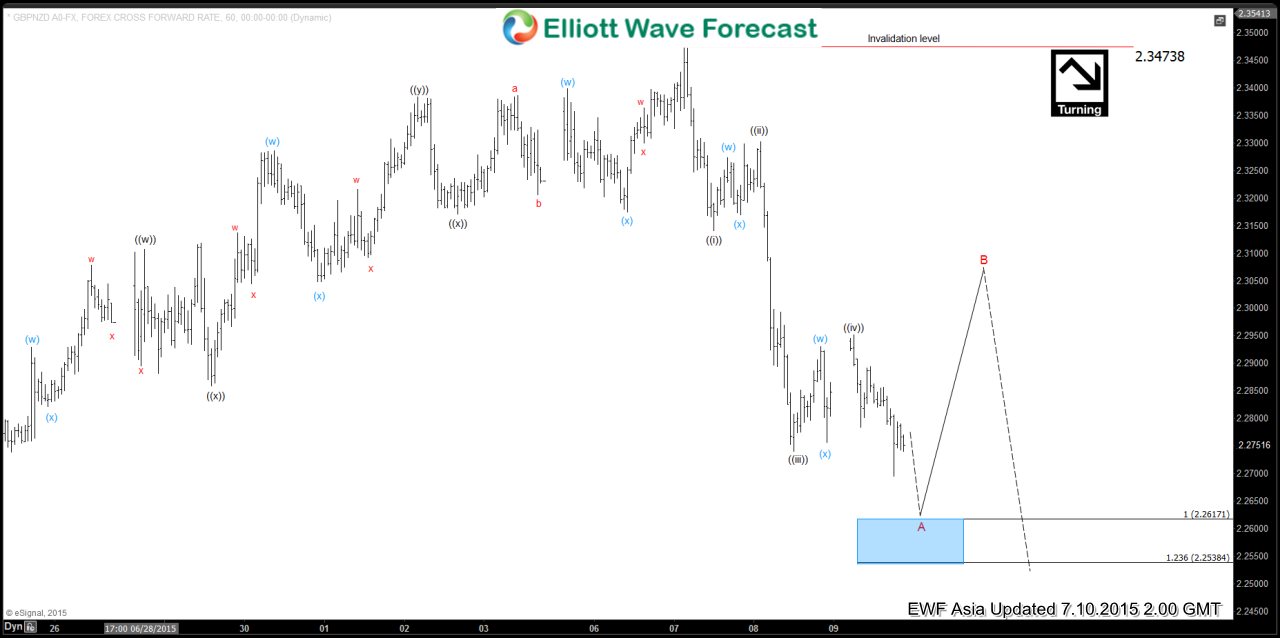

$GBP/NZD Short Term Elliott Wave Analysis 7.10.2015

Read MoreDecline from 2.347 is taking the form of impulsive 5 waves where wave ((i)) ended at 2.314, wave ((ii)) ended at 2.33, wave ((iii)) ended at 2.27, wave ((iv)) ended at 2.295, and wave ((v)) is in progress towards 2.253 – 2.26 to complete wave A. From this area, the pair is expected to bounce […]

-

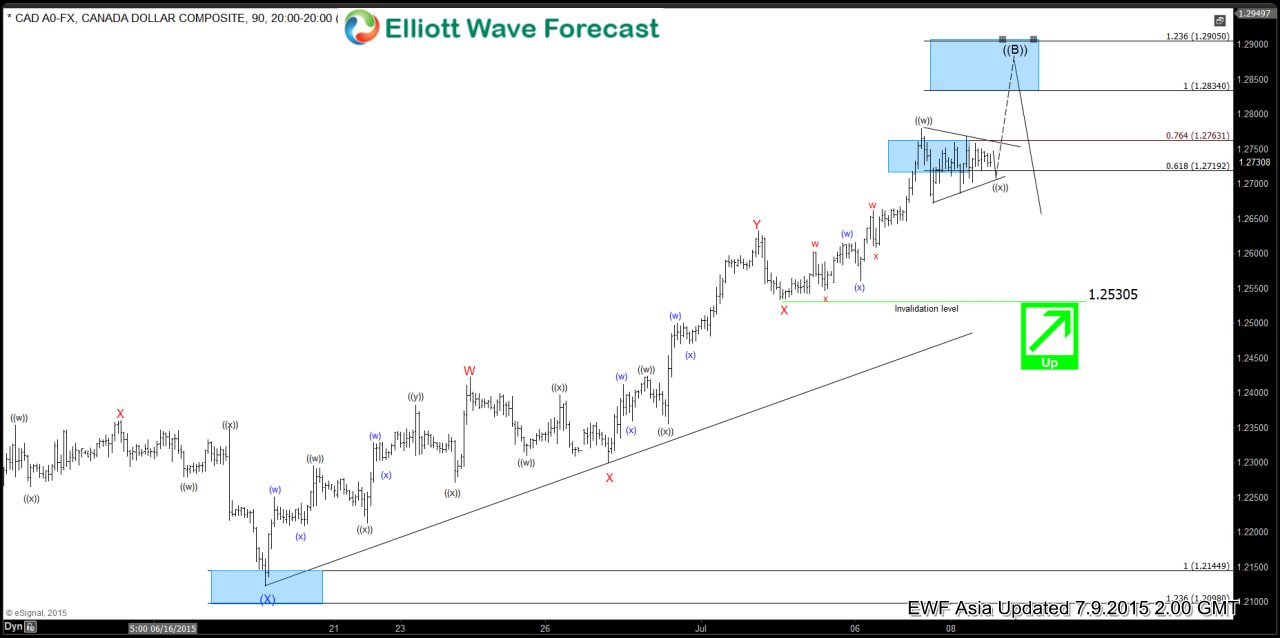

$USD/CAD Short Term Elliott Wave Update 7.9.2015

Read MoreRally from wave (X) low at 1.212 is unfolding in triple corrective structure WXYZ where wave W ended at 1.2423, wave X ended at 1.23, wave Y ended at 1.263, and second wave X ended at 1.253. Wave Z is in progress towards 1.283 – 1.29 to complete wave ((B)). The internal of wave Z is taking […]

-

$USD/CAD Short Term Elliott Wave Update 7.8.2015

Read MoreRally from wave (X) low at 1.212 is unfolding in triple corrective structure WXYZ where wave W ended at 1.2423, wave X ended at 1.23, wave Y ended at 1.263, and second wave X ended at 1.253. Wave Z is in progress towards 1.283 – 1.29 to complete wave ((B)). The internal of wave Z is taking […]