In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

$EURUSD : wave X connector- Double Three Pattern

Read MoreWave X connector might take form of any corrective structure : Zig-Zag, Flat, Double Three, Triple Three, Triangle.. As EWF clients already know, Double three is one of the most common patterns in the Market nowadays. It’s labeled as WXY and wave subdivision is 3,3,3 which means all of these 3 waves are corrective sequences […]

-

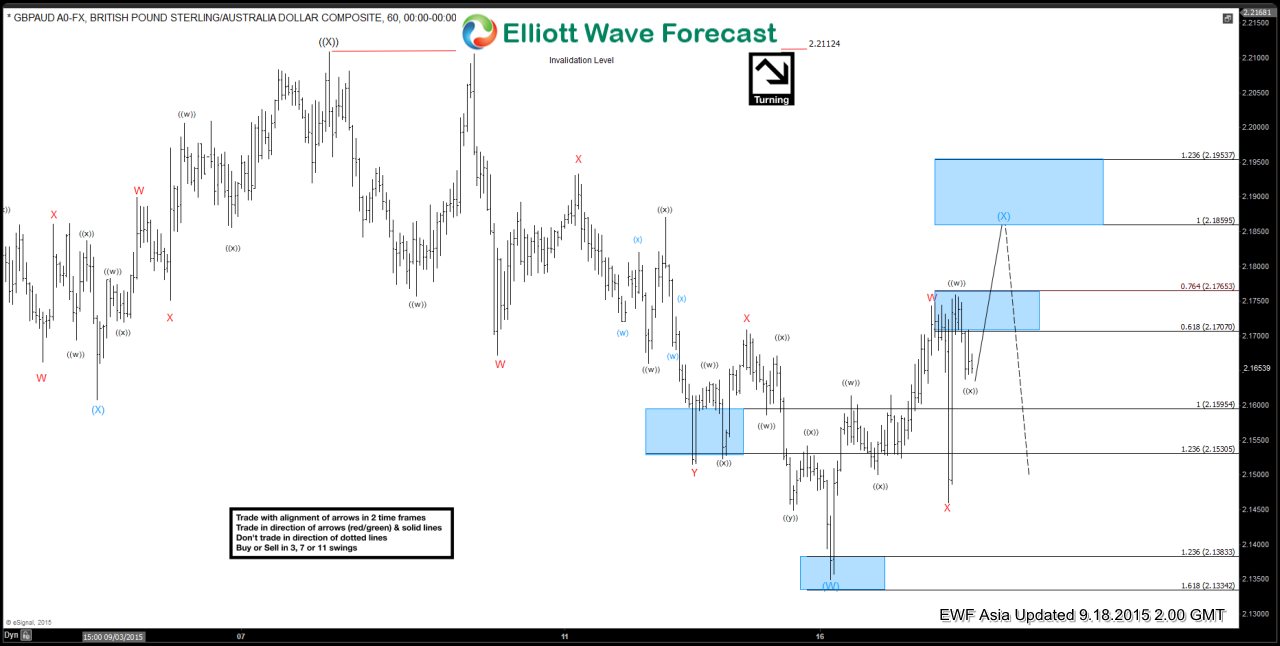

GBPAUD Short Term Elliott Wave Update 9.18.2015

Read MoreShort term Elliottwave view suggests the decline from wave ((X)) at 2.21 unfolded in a triple three structure WXYZ where wave W ended at 2.167, wave X ended at 2.193, wave Y ended at 2.151, second wave X ended at 2.17, and wave Z of (W) ended at 2.135. Wave (X) bounce is currently in progress as a double […]

-

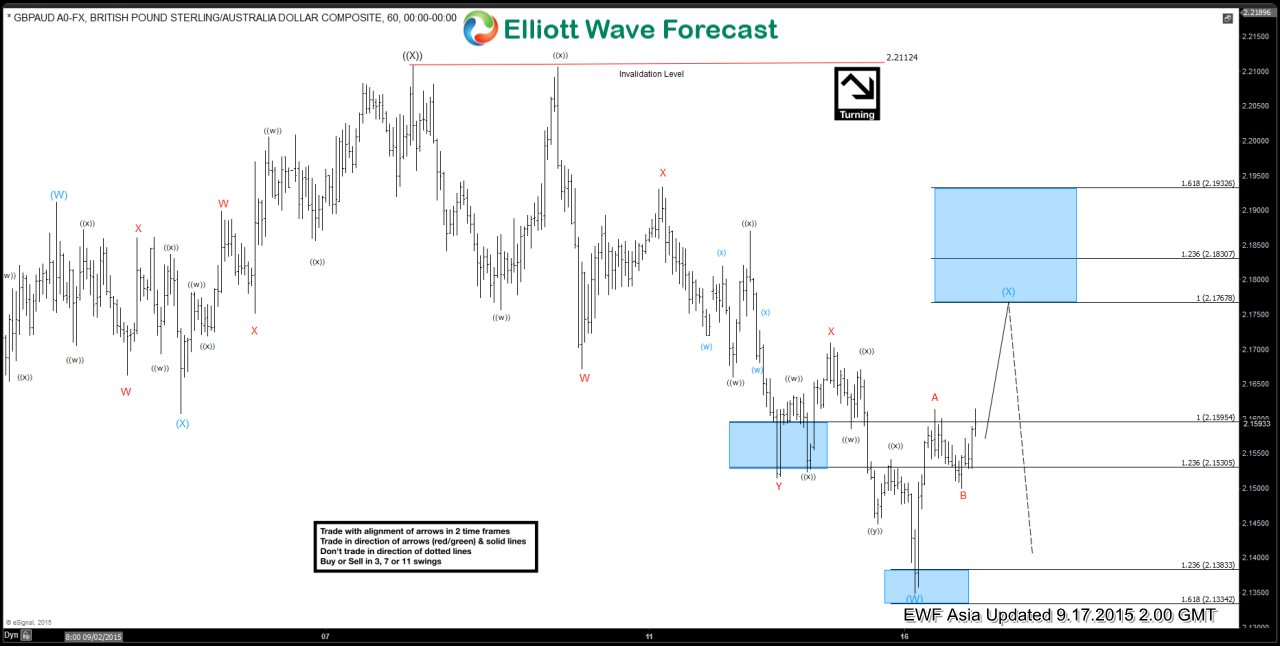

GBPAUD Short Term Elliott Wave Update 9.17.2015

Read MoreShort term Elliottwave view suggests the decline from wave ((X)) at 2.21 unfolded in a triple three structure WXYZ where wave W ended at 2.167, wave X ended at 2.193, wave Y ended at 2.151, second wave X ended at 2.17, and wave Z of (W) ended at 2.135. Wave (X) bounce is currently in progress as a zigzag […]

-

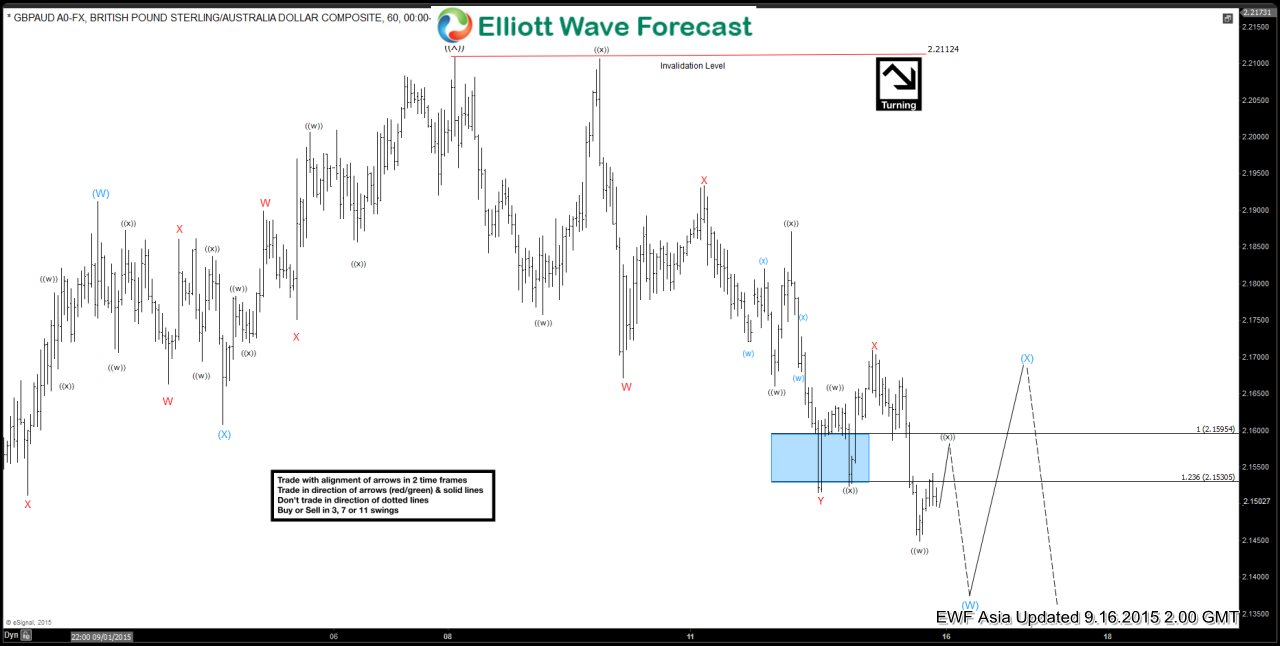

GBPAUD Short Term Elliott Wave Update 9.16.2015

Read MoreRevised short term Elliottwave suggests the decline from wave ((X)) at 2.21 is unfolding in a triple three structure WXYZ where wave W ended at 2.167, wave X ended at 2.193, wave Y ended at 2.151, second wave X ended at 2.17, and wave Z lower is in progress and can reach as low as 2.116 – […]

-

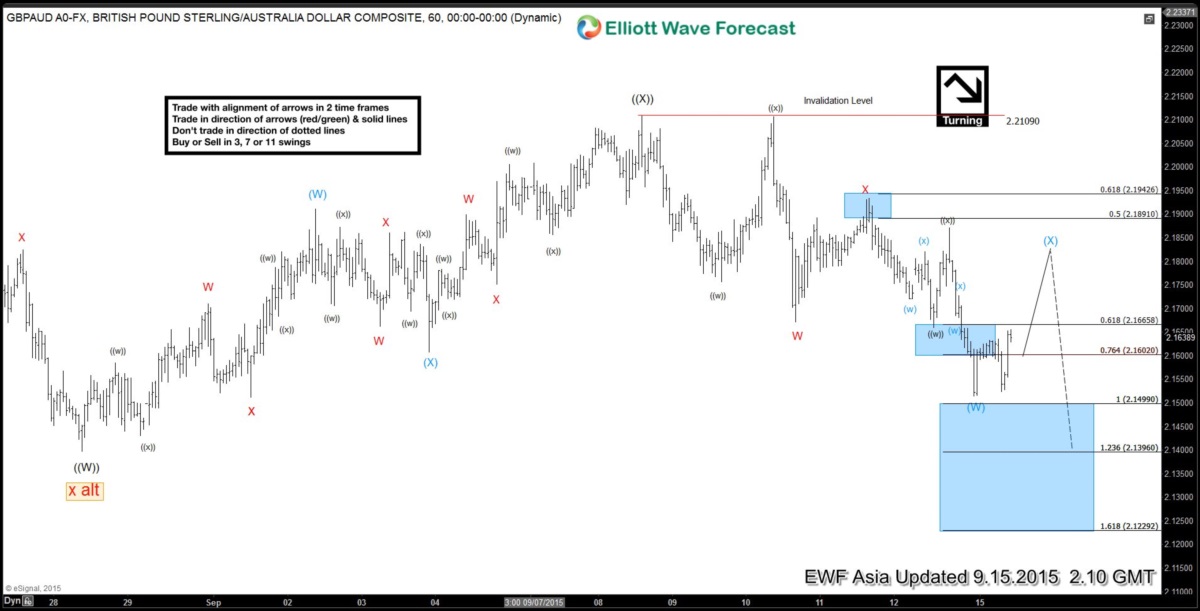

GBPAUD Short Term Elliott Wave Analysis 9.15.2015

Read MoreDecline from wave ((X)) at 2.21 unfolded in a double three structure WXY where wave W ended at 2.167, wave X ended at 2.193, and wave Y of (W) ended at 2.151. Wave (X) bounce is currently in progress and may reach as high as 2.181 – 2.194 (50 – 61.8 back from 2.21) before turning lower. We […]

-

$GBPUSD Live Trading Room – Trading Plan Recap

Read MoreHere is a quick blog from our Live Trading Room host, Dan Hussey. Take a look at how to manage your risk by using inflection zones and Elliot Wave to your advantage. The Live Trading Room is held daily at 8:00 AM EST , join Dan there for more insight into these proven methods of trading. GBP/USD Live […]