In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

$USDCAD Short Term Elliott Wave Analysis 01.12.2016

Read MoreShort term Elliott Wave cycle suggests rally from wave (X) low at 1.38 is unfolding in a double three structure where wave W ended at 1.417, wave X FLAT ended at 1.406, and pair has resumed higher in wave Y towards 1.44 area. Near term, rally to 1.423 ended wave (a), and pair is in wave […]

-

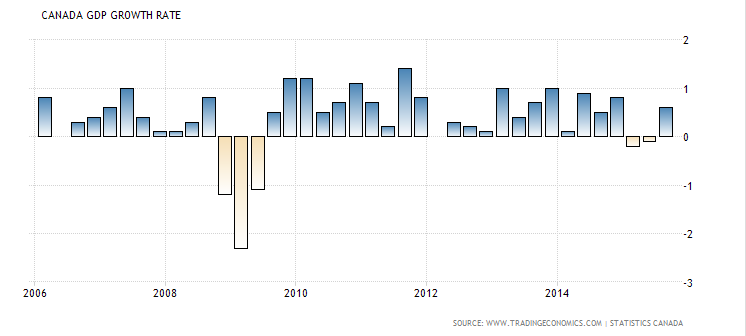

How Bearish is Canadian Dollar?

Read MoreCanada’s Economy In the first half of 2015, Canada slipped into technical recession, as defined by two consecutive quarters of negative GDP. Depressed oil prices in 2015 has caused significant pain to Canadian economy which is a net exporter of energy, and it has also caused the weakening of Canadian dollar, which is down 10% […]

-

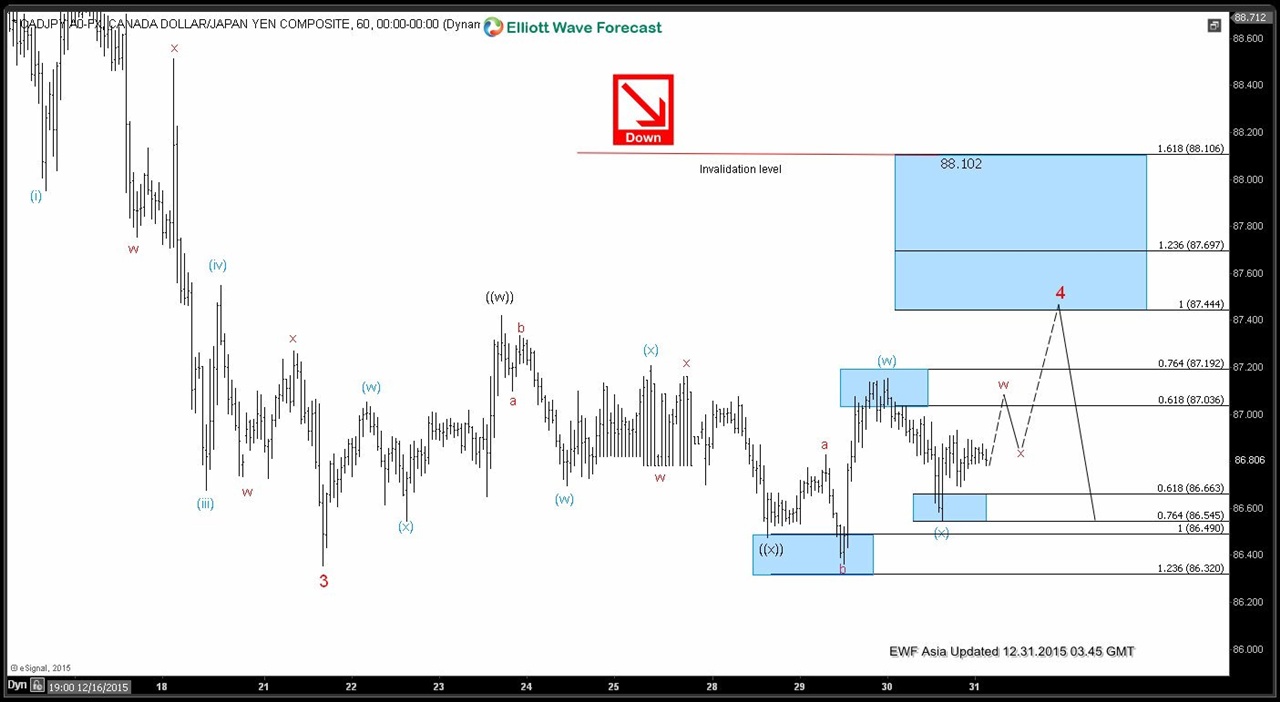

CADJPY Short Term Elliott Wave Analysis 12.31.2015

Read MoreShort term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, wave 4 bounce is unfolding as a double three where wave ((w)) ended at 87.4, wave ((x)) ended at 86.36, and wave ((y)) of 4 is in progress towards 87.43 – 87.7 area before lower again. We don’t like buying the pair […]

-

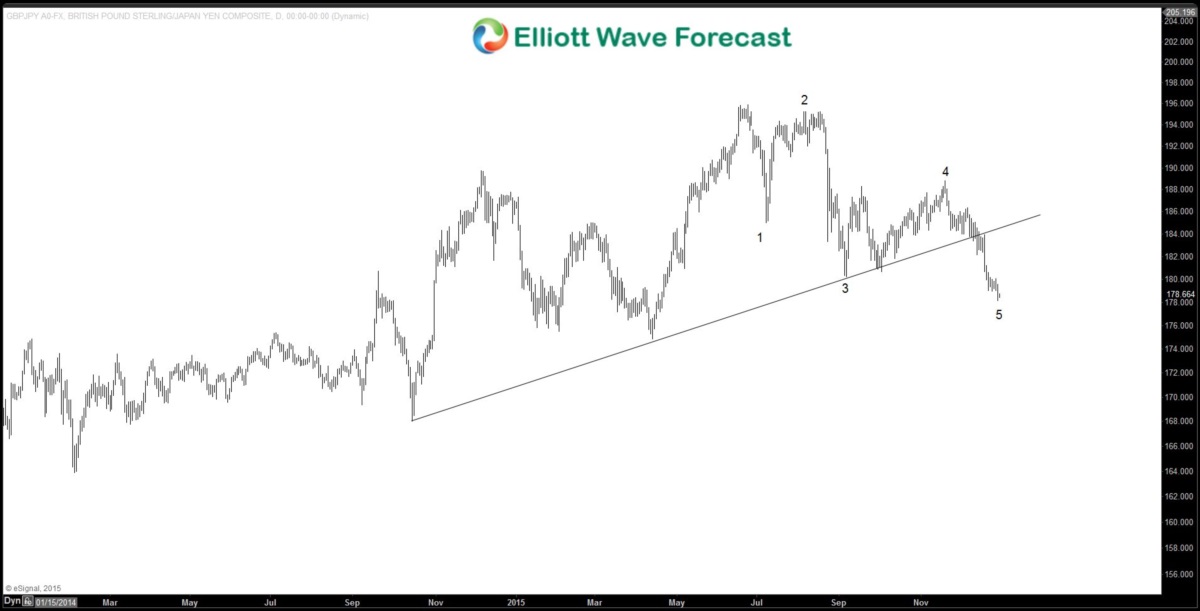

Will Euro Referendum and Brexit affect GBP?

Read MoreBackground of the Referendum When the Conservatives party under David Cameron won the general election in 2015, one of the party’s election pledges is to hold a nationwide vote over the UK membership in the European Union. The referendum will happen by the end of 2017, likely sometimes in September 2016. In this referendum, U.K seeks to renegotiate the terms […]

-

CADJPY Short Term Elliott Wave Analysis 12.30.2015

Read MoreRevised short term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, wave 4 bounce is unfolding as a double three where wave ((w)) ended at 87.4, wave ((x)) ended at 86.36, and wave ((y)) of 4 is in progress towards 87.43 – 87.7 area before lower again. We don’t like buying the […]

-

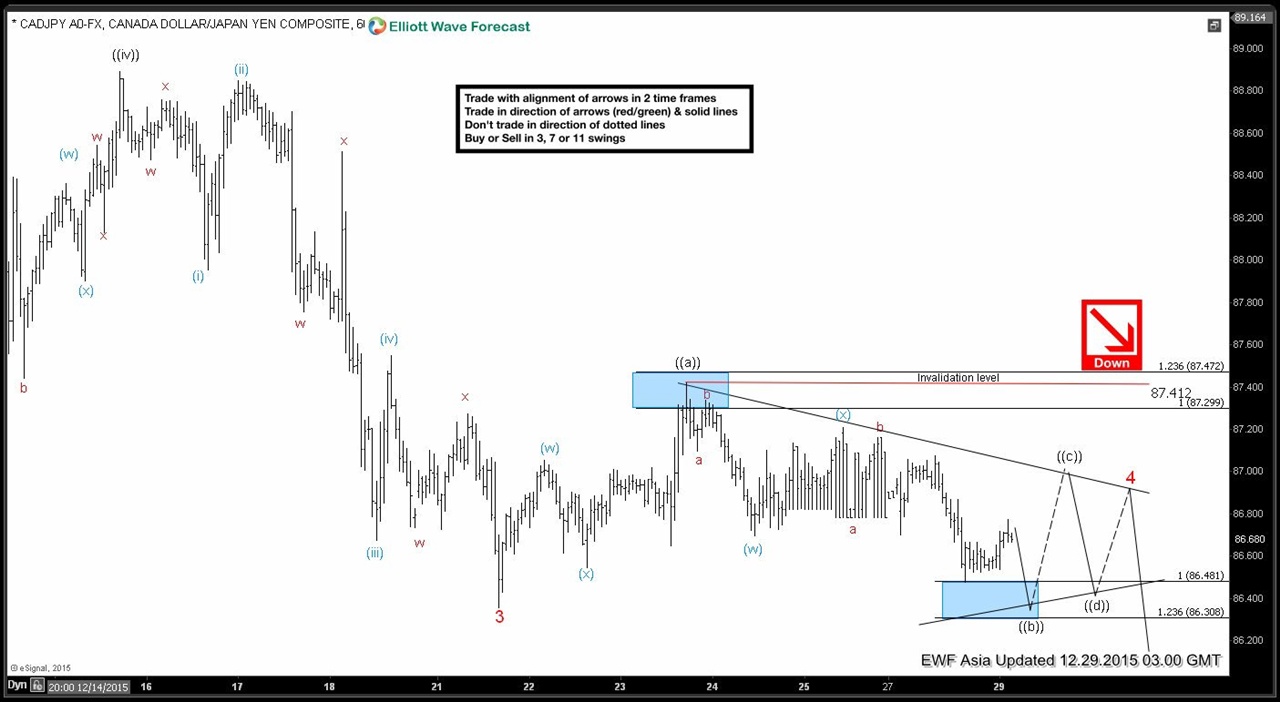

CADJPY Short Term Elliott Wave Analysis 12.29.2015

Read MoreShort term Elliott Wave cycle suggests decline to 86.35 ended wave 3. From this level, wave 4 bounce is unfolding as a running triangle where wave ((a)) ended at 87.4, and wave ((b)) can still extend to as low as 86.3 before turning higher in further consolidation in wave ((c)). Any bounce is now expected to fail below wave ((a)) […]