In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

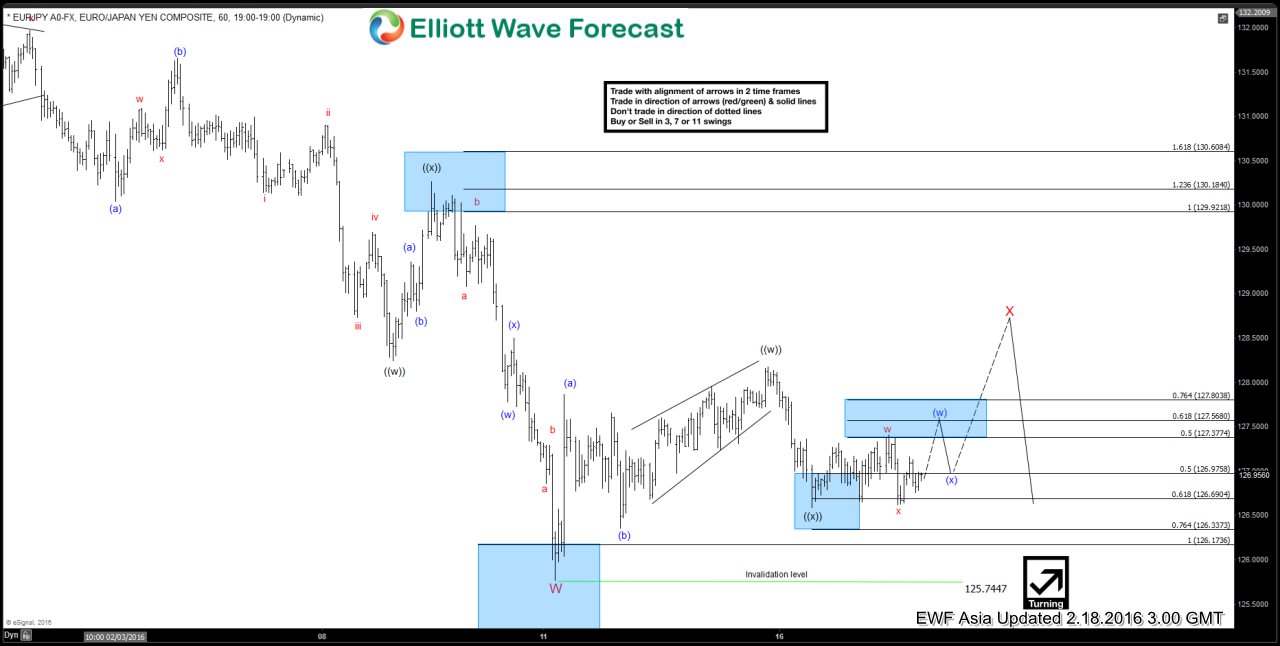

EURJPY Short-term Elliott Wave Analysis 2.18.2016

Read MoreRevised short term Elliottwave structure suggests decline to 125.74 ended wave W. Up from this level, wave X bounce is unfolding in a double three structure where wave ((w)) ended at 128.17, wave ((x)) ended at 126.59 and wave ((y)) of X is in progress. Short term, while pair stays above 126.59, and more importantly above 125.74, […]

-

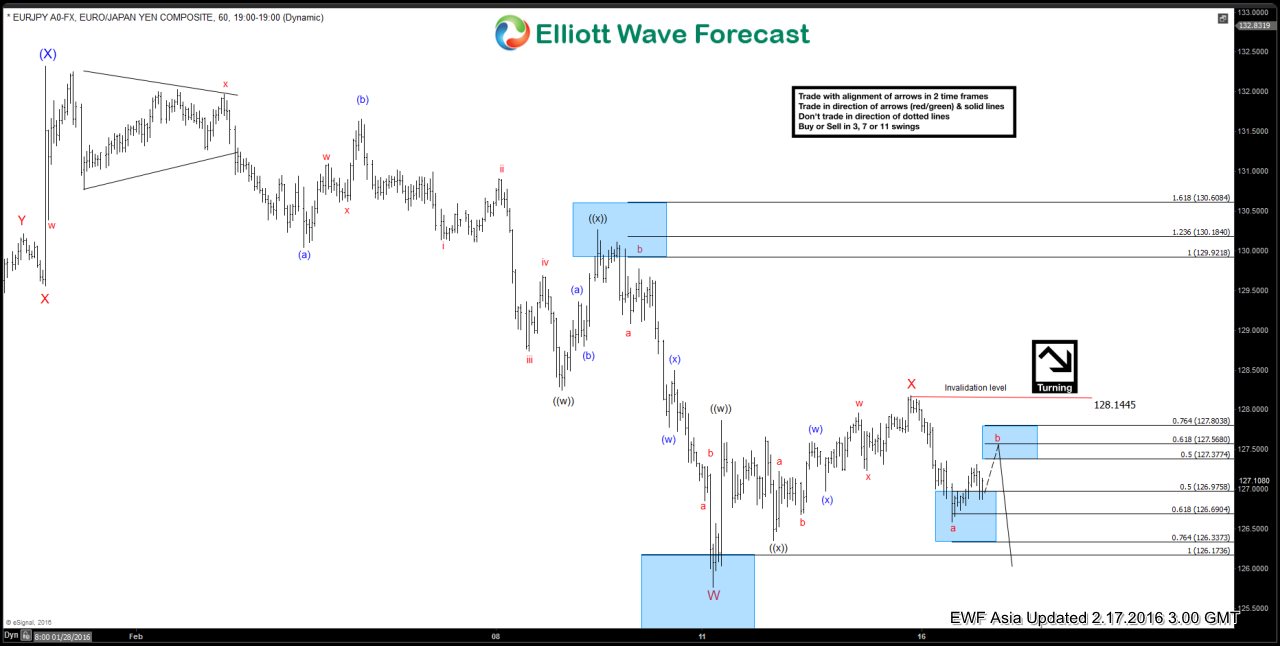

EURJPY Short-term Elliott Wave Analysis 2.17.2016

Read MoreShort term Elliottwave structure suggests decline to 125.76 ended wave W. Up from this level, wave X bounce is unfolding in a double three structure where wave ((w)) ended at 127.87, wave ((x)) ended at 126.358 and wave ((y)) of X has ended at 128.14. Short term wave “b” bounce is now expected to fail below 128.14 […]

-

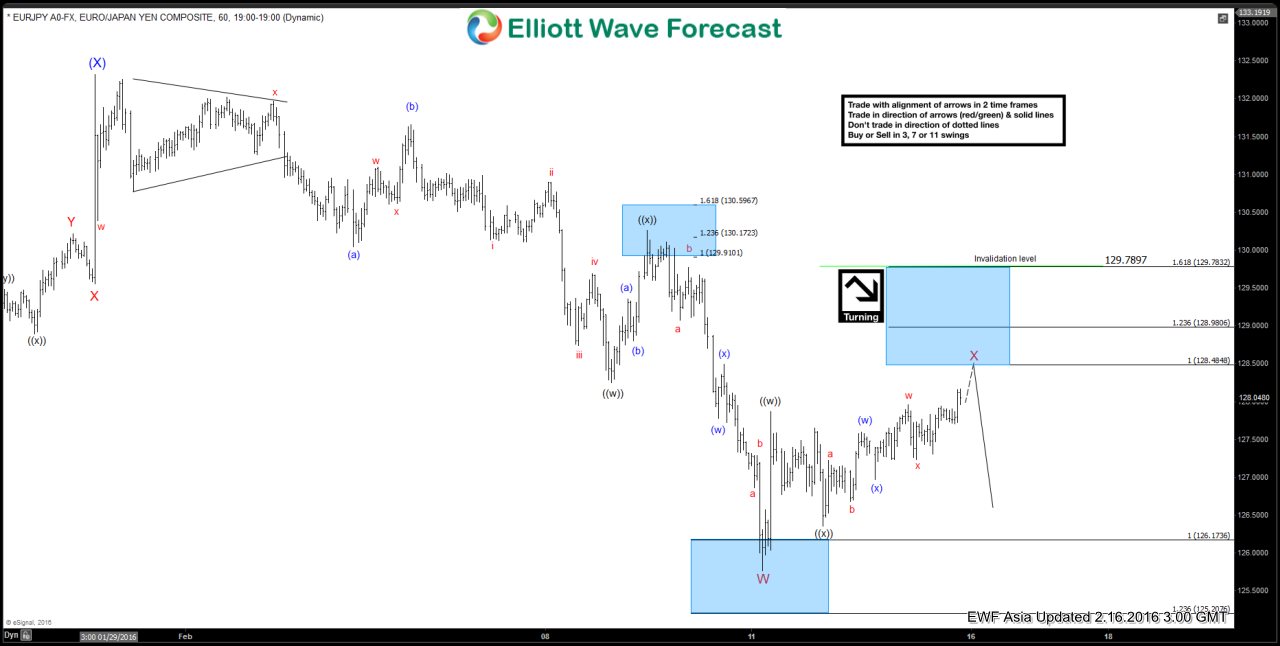

EURJPY Short-term Elliott Wave Analysis 2.16.2016

Read MoreShort term Elliottwave structure suggests decline to 125.76 ended wave W. Up from this level, wave X bounce is unfolding in a double three structure where wave ((w)) ended at 127.87, wave ((x)) ended at 126.358 and wave ((y)) is in progress towards 128.48 – 128.98 area to complete wave X before pair turns lower again. […]

-

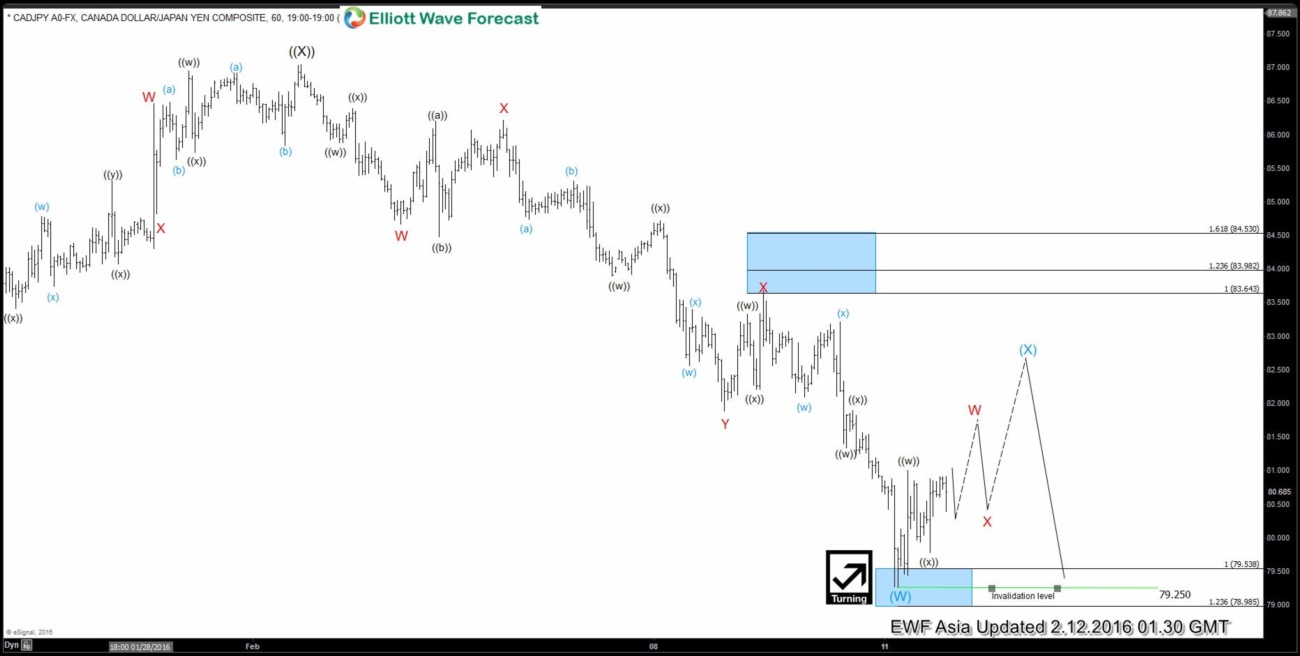

CADJPY Short-term Elliott Wave Analysis 2.12.2016

Read MoreShort term Elliottwave structure suggests wave ((X)) bounce ended at 87.06. Down from this level pair has enough number of swings in place to call a triple three structure completed at 79.25. As this level holds in the dips, pair has scope to put in a 3 or 7 swings bounce in wave (X) which is expected […]

-

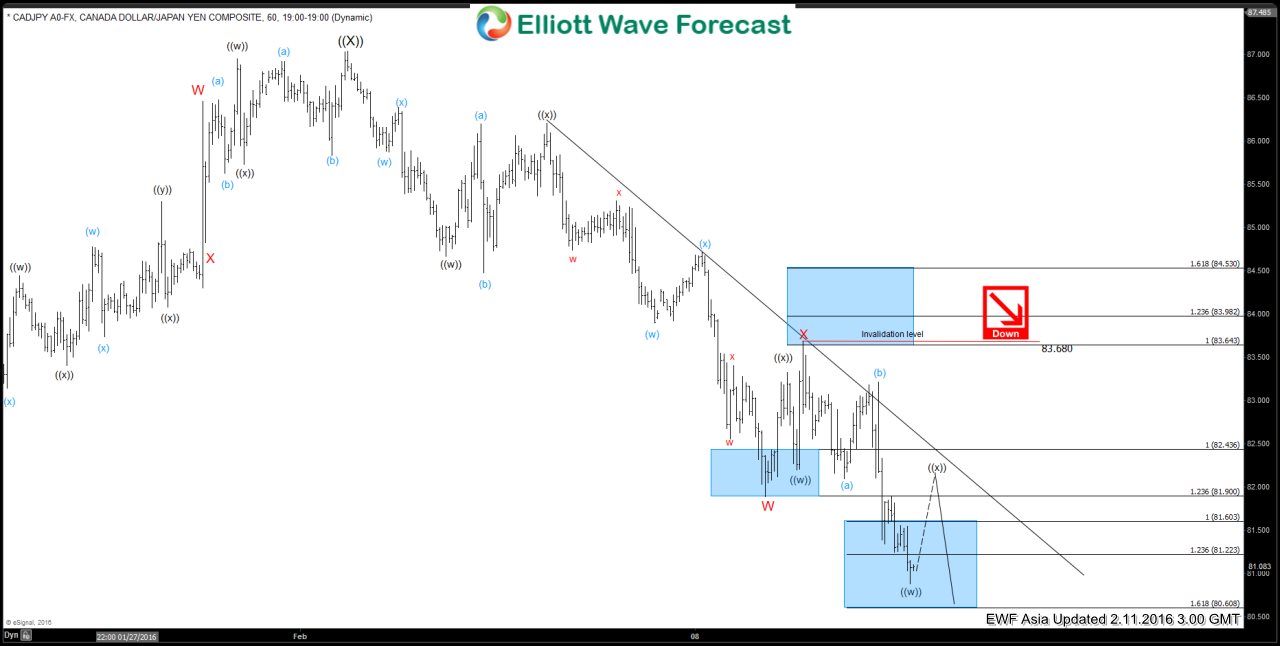

CADJPY Short-term Elliott Wave Analysis 2.11.2016

Read MoreShort term Elliottwave structure suggests wave ((X)) bounce ended at 87.06. Down from this level pair is showing 5 swings down and hence an incomplete sequence, therefore, we like the idea of bounces to fail below 83.68 high for another extension lower. Ideal target on the downside would be 78.54 – 77.32 but we would look […]

-

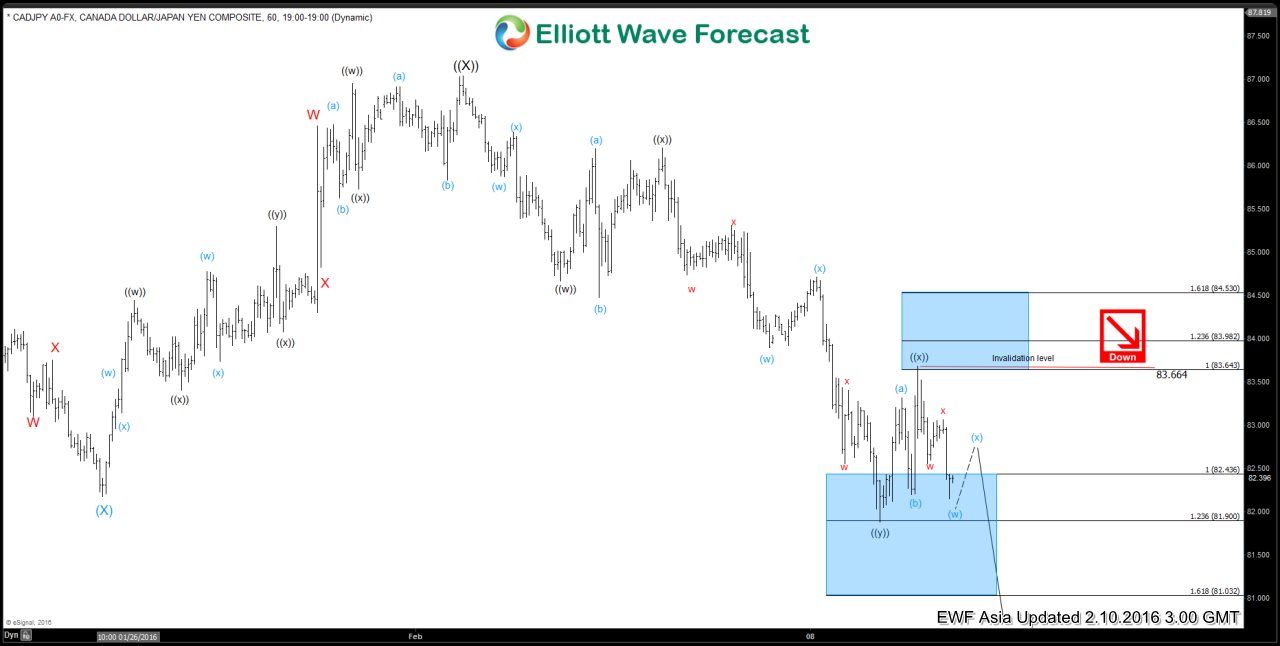

CADJPY Short-term Elliott Wave Analysis 2.10.2016

Read MoreShort term Elliottwave structure suggests wave ((X)) bounce ended at 87.06. From this level, pair turned lower in a triple three structure where wave ((w)) ended at 84.67, wave ((x)) FLAT ended at 86.2, wave ((y)) ended at 81.89 and a bounce in 2nd wave ((x)) is also proposed to be over at 83.66. While below 83.66 […]