In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

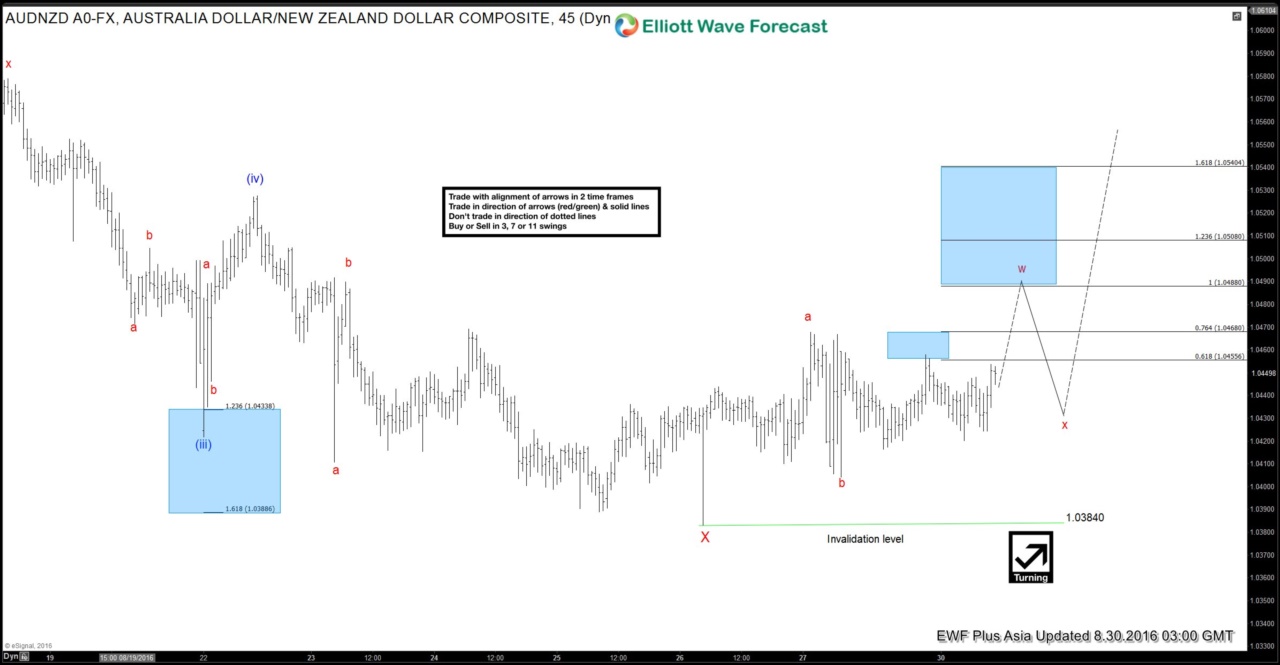

$AUDNZD Short-term Elliott Wave Analysis 8.30.2016

Read MorePreferred Elliott wave count suggests that decline to 1.0384 on 8/26 ended wave X. While pair remains above the level, expect further upside to 1.0488 – 1.051 area to complete wave w before ending the cycle from 8/26 low. Afterwards, a pullback in wave x is expected to take place to correct the rally from 8/26 low […]

-

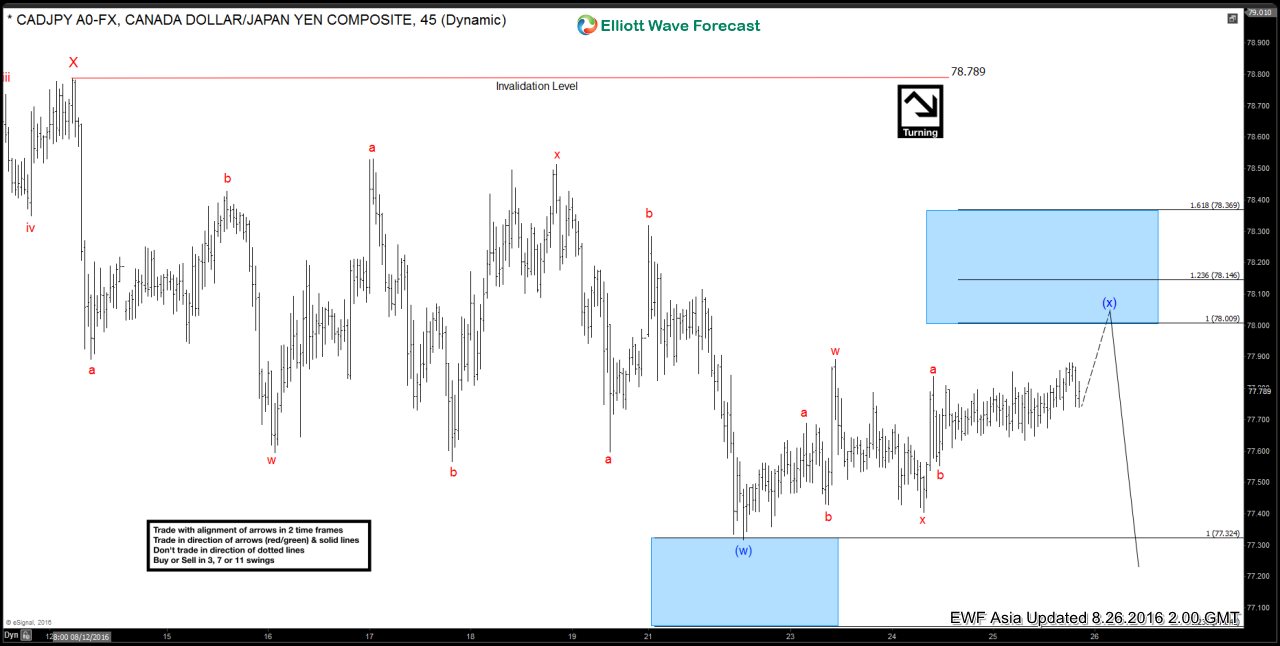

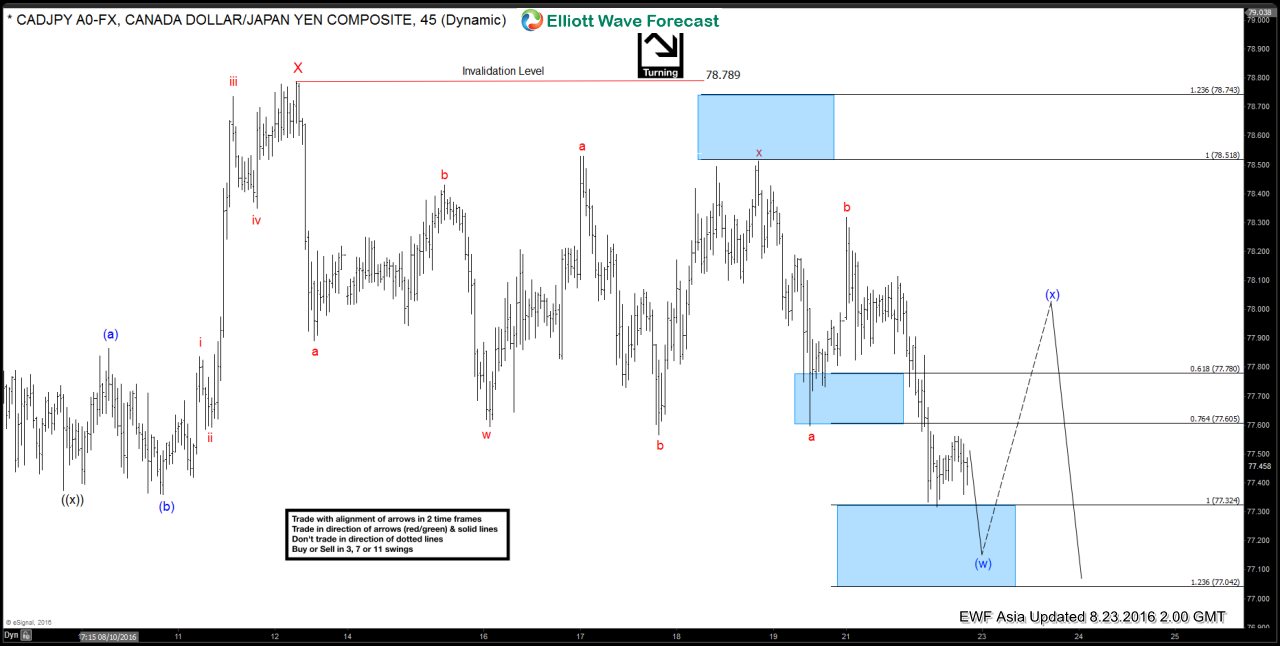

$CADJPY Short-term Elliott Wave Analysis 8.26.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. Wave (x) bounce is currently in progress towards 78 – 78.15 area, then pair is expected to extend lower or at least pullback in 3 waves to correct rally […]

-

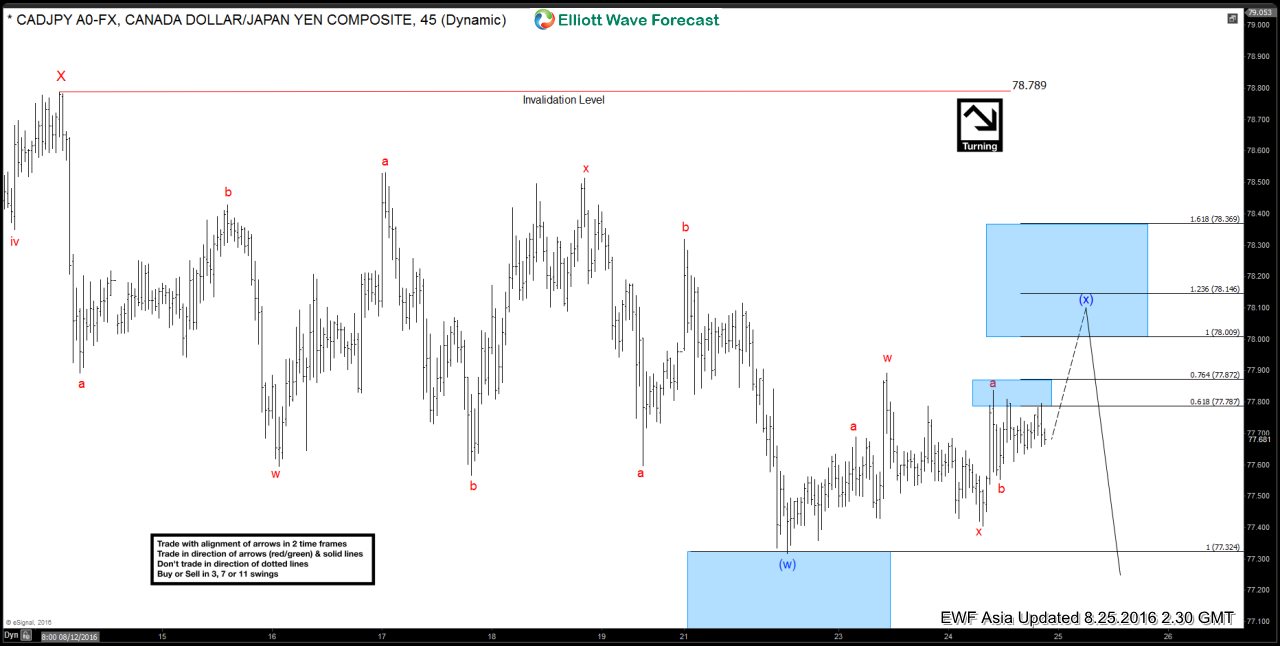

$CADJPY Short-term Elliott Wave Analysis 8.25.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. Wave (x) bounce is currently in progress towards 78 – 78.15 area, then pair is expected to extend lower or at least pullback in 3 waves to correct rally […]

-

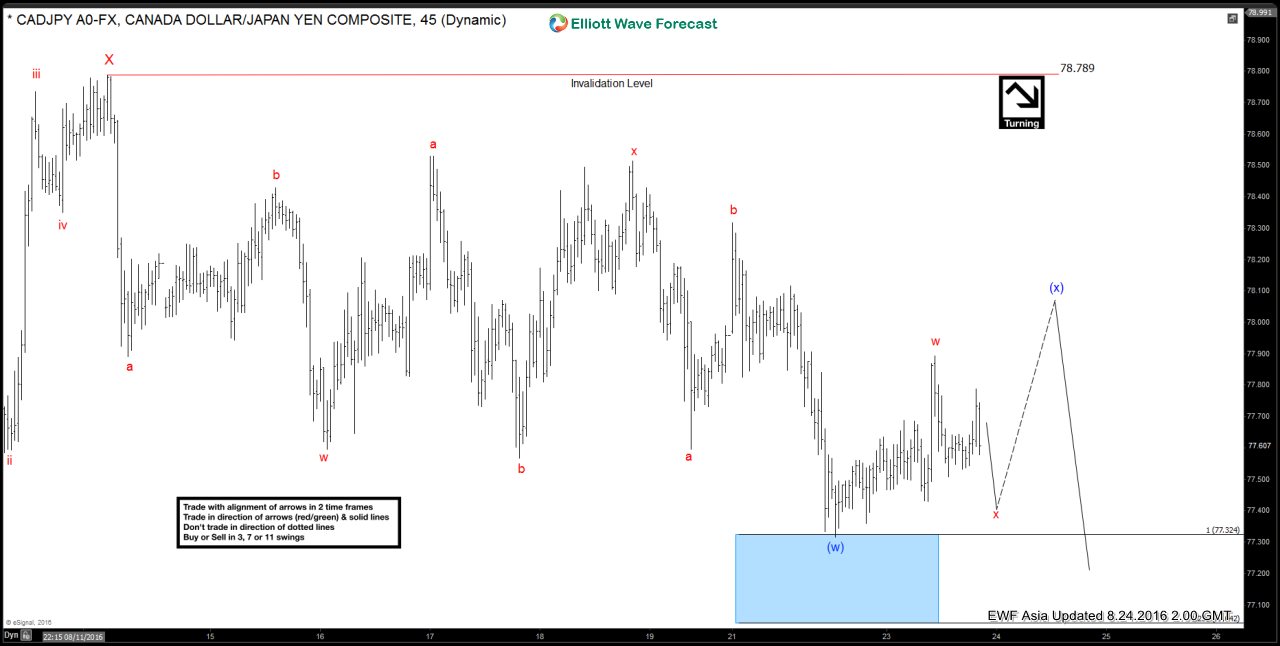

$CADJPY Short-term Elliott Wave Analysis 8.24.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Decline from there is unfolding as a double three where wave (w) is proposed complete at 77.31. While near term wave (x) pullback stays above there, expect the pair to turn higher in wave y of (x) before the decline resumes again. We don’t like buying the […]

-

$CADJPY Short-term Elliott Wave Analysis 8.23.2016

Read MorePreferred Elliott wave count suggests that rally to 78.79 ended wave X. Down from there, there’s enough number of swing and extension to call wave (w) completed. After wave (w) is confirmed over, likely from 77 – 77.3 area which it has already reached, then it should bounce in wave (x) before pair resumes lower again. We don’t […]

-

$AUDUSD Short-term Elliott Wave Analysis 8.19.2016

Read MorePreferred Elliott wave count suggests that rally to 0.776 ended wave ((w)) and wave ((x)) pullback is proposed complete at 0.7673. Rally from there is unfolding as a double three where wave w ended at 0.7723 and while wave x pullback stays above 0.7606, expect pair to resume higher. A break below 0.7606 suggests pair can extend lower to 0.7566 – […]