In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

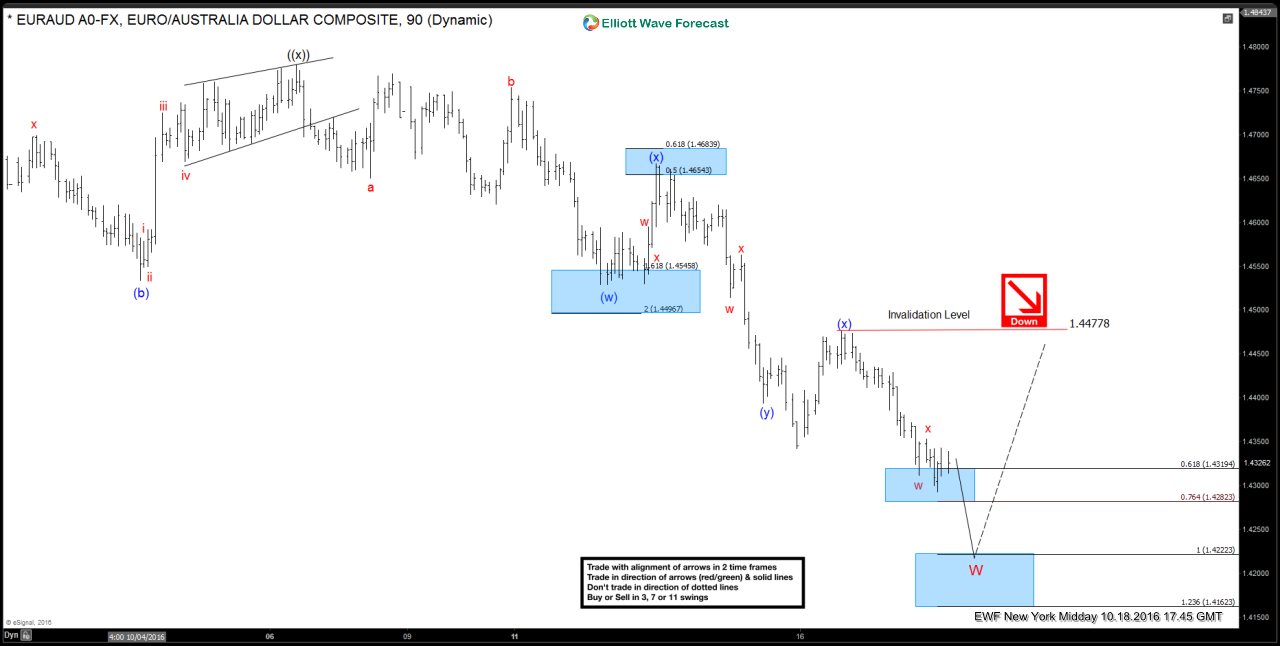

EURAUD Short-term Elliott Wave Analysis 10.19.2016

Read MoreBest reading of Elliott wave cycles suggests EURAUD is in a triple three Elliott wave structure from 10/6 (1.4779) high. Pair has got enough number of swings in place to call the cycle in wave W completed and soon a bounce would be expected to correct the cycle ideally from 9/15 (1.5096) peak and at least from 10/6 (1.4779) […]

-

EURAUD Short-term Elliott Wave Analysis 10.18.2016

Read MoreBest reading of Elliott wave cycles suggests EURAUD is in a triple three Elliott wave structure from 10/6 (1.4779) high. While below 1.4353 and more importantly below 1.4477 high, pair has scope to make another push lower towards 1.4222 – 1.4162 area and then bounce in minimum 3 waves to correct the cycle from 10/6 (1.4779) peak […]

-

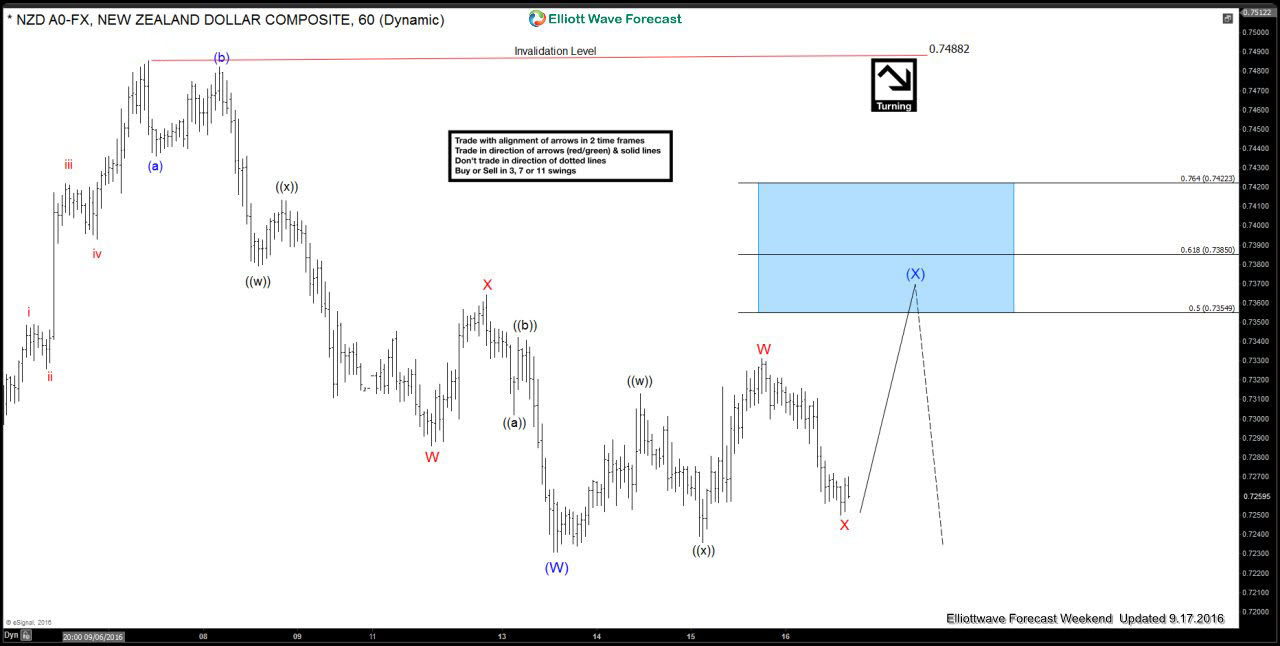

$NZDUSD Elliott Waves forecasting the decline

Read MoreAt the begining of September 2016 $NZDUSD reached daily extreme area at 0.7389-0.7557 and our view was suggesting potential pull back in 3 waves against the January 20th low at least. The pair found sellers at the mentioned technical area and made top on September 7th ( 0.74882 peak) and since then it traded lower. […]

-

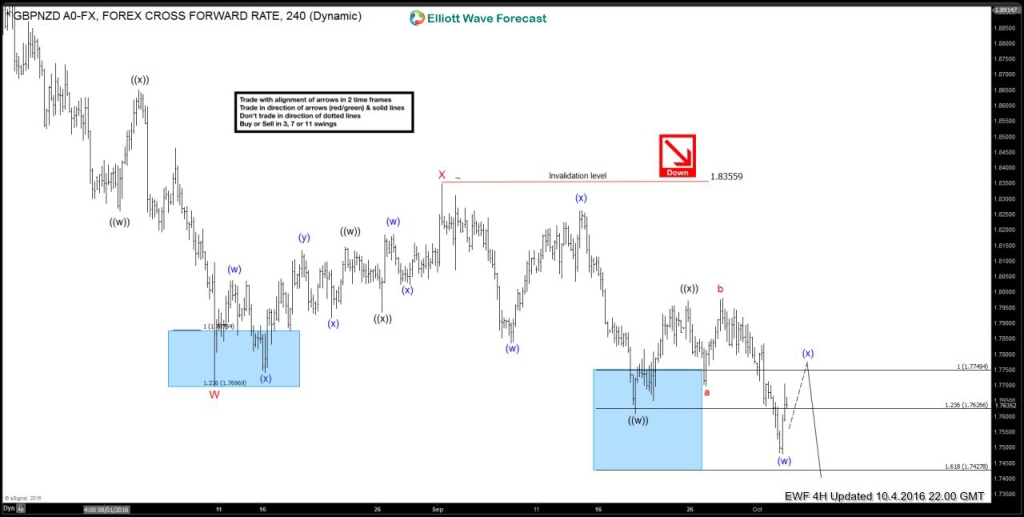

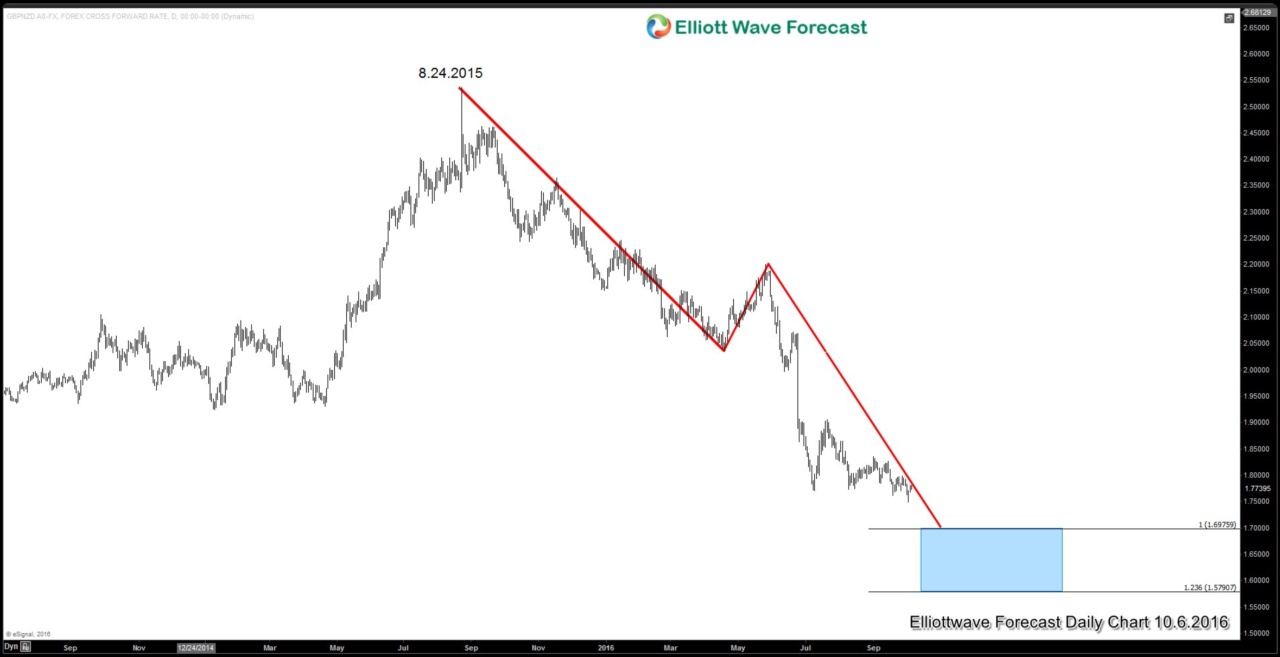

$GBPNZD: Calling lower based on Elliott Wave Swing Sequence

Read MoreIn this technical blog we are going to take a quick look at $GBPNZD 4 hour chart from October 4th 2016. Pair from July 21 2016 peak was following a lager Elliott wave bearish cycle for ideal downside target area at 1.70, Also from September 1st 2016 peak (1.83559) pair was forming a lower lows […]

-

$FTSE Short-term Elliott Wave Analysis 10.7.2016

Read MoreShort term Elliott wave count suggests that pullback to 6640.3 at 9/15 ended wave (X). The rally from there is unfolding as a double three where wave (w) ended at 6899.5, wave (x) ended at 6728.5, and wave (y) of ((w)) is proposed complete at 7091. Near term, while bounces stay below 7091.5, expect the Index to […]

-

Fear of Hard Brexit and Poundsterling

Read MoreSince the Brexit vote in June, Poundsterling has fallen 13% against the U.S. dollar and it is now worth 22% less than a year ago. Today the pound worths around $1.27 while a year ago it was worth $1.55. The currency was further under pressure this week after the U.K Prime Minister Theresa May provided more […]