In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Elliott Wave View: US Dollar Index Turning Lower

Read MoreDollar Index (DXY) has started to turn lower and short term rally should fail for more downside. This article and video look at the Elliott Wave path.

-

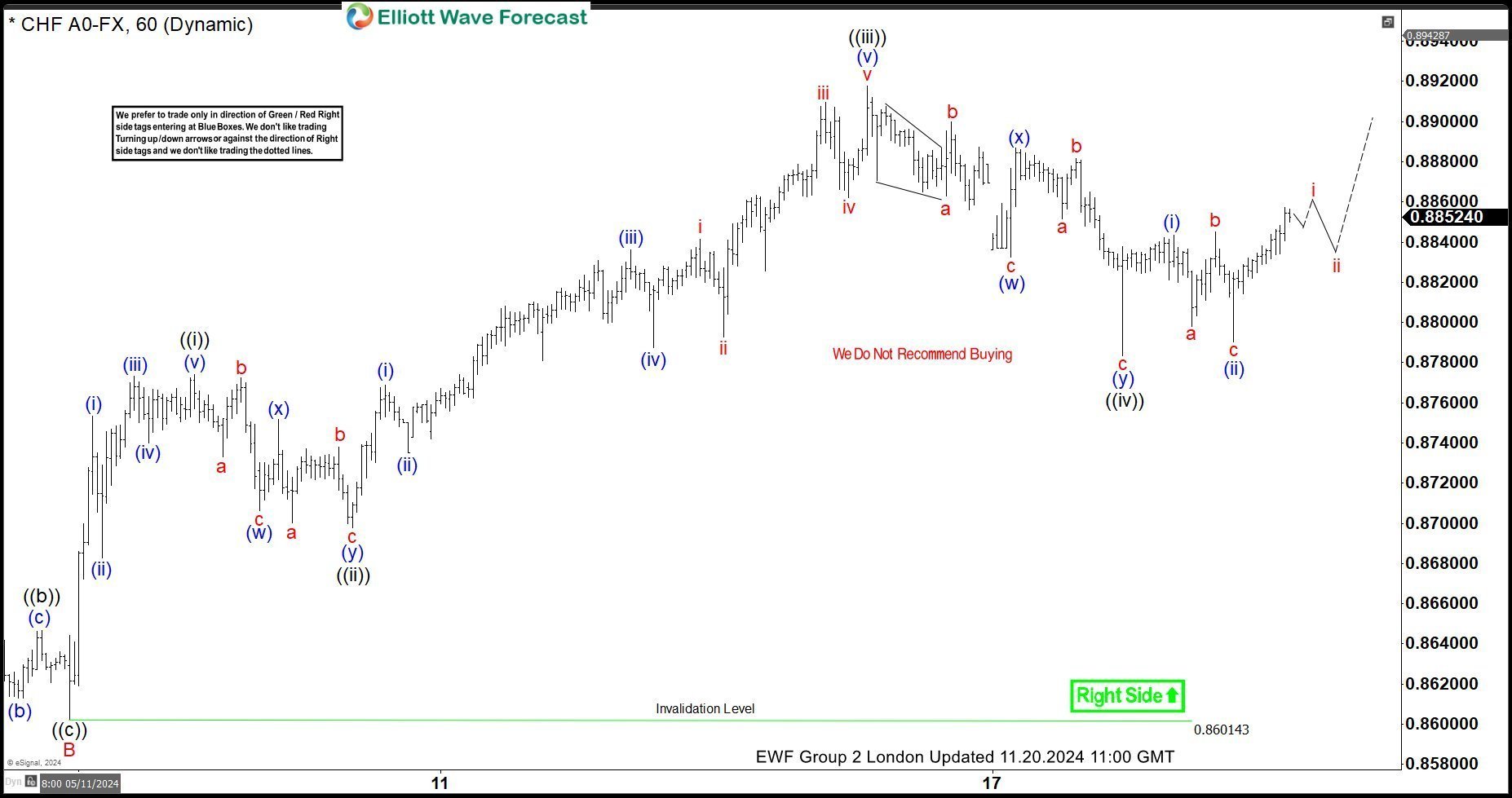

USDCHF Calling the Rally After Elliott Wave Double Three Pattern

Read MoreHello fellow traders. In this technical article we’re going to take a look at the Elliott Wave charts charts of USDCHF Forex pair published in members area of the website. Our members know USDCHF recently made a clear three-wave correction. The pull back completed as Elliott Wave Double Three pattern and made rally toward new […]

-

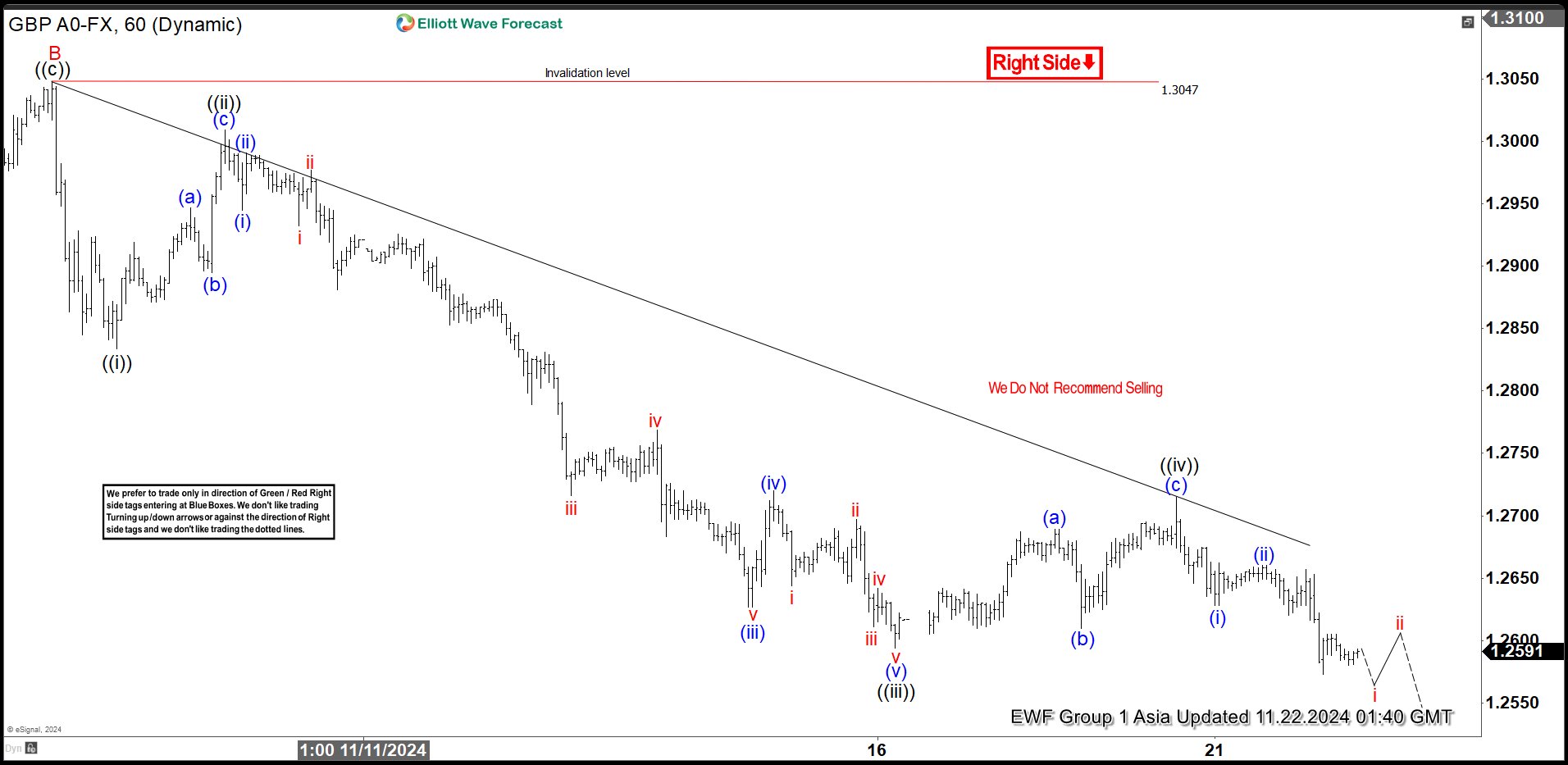

Elliott Wave View: GBPUSD is Approaching Support Zone

Read MoreGBPUSD is looking to extend lower to end cycle from 9.25.2024 high. This article and video look at the Elliott Wave path of the pair.

-

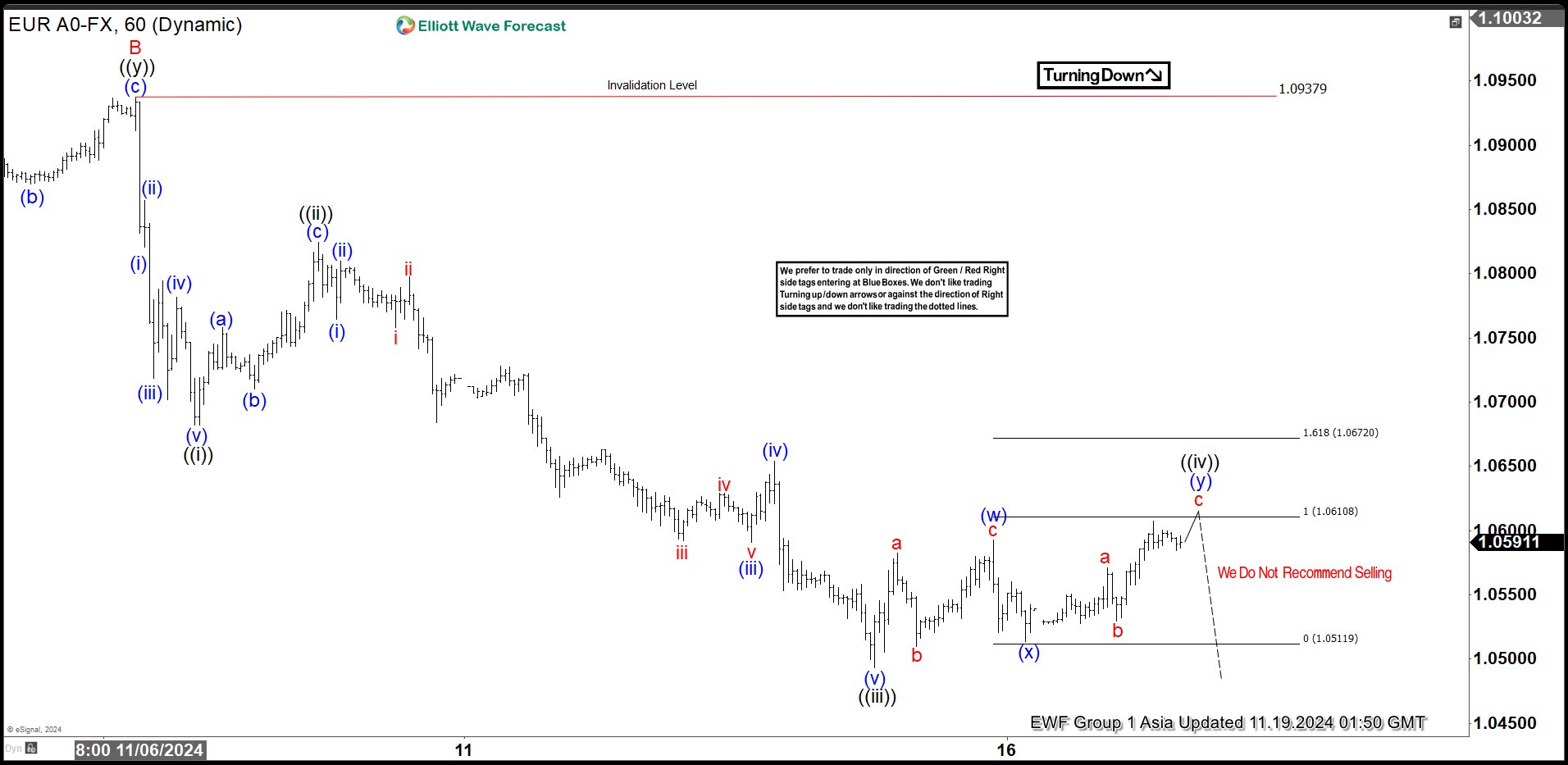

Elliott Wave View Looking Further Downside in EURUSD

Read MoreEURUSD is looking to resume lower to complete cycle from 9.25.2024 high. This article and video look at the Elliott Wave path of the pair.

-

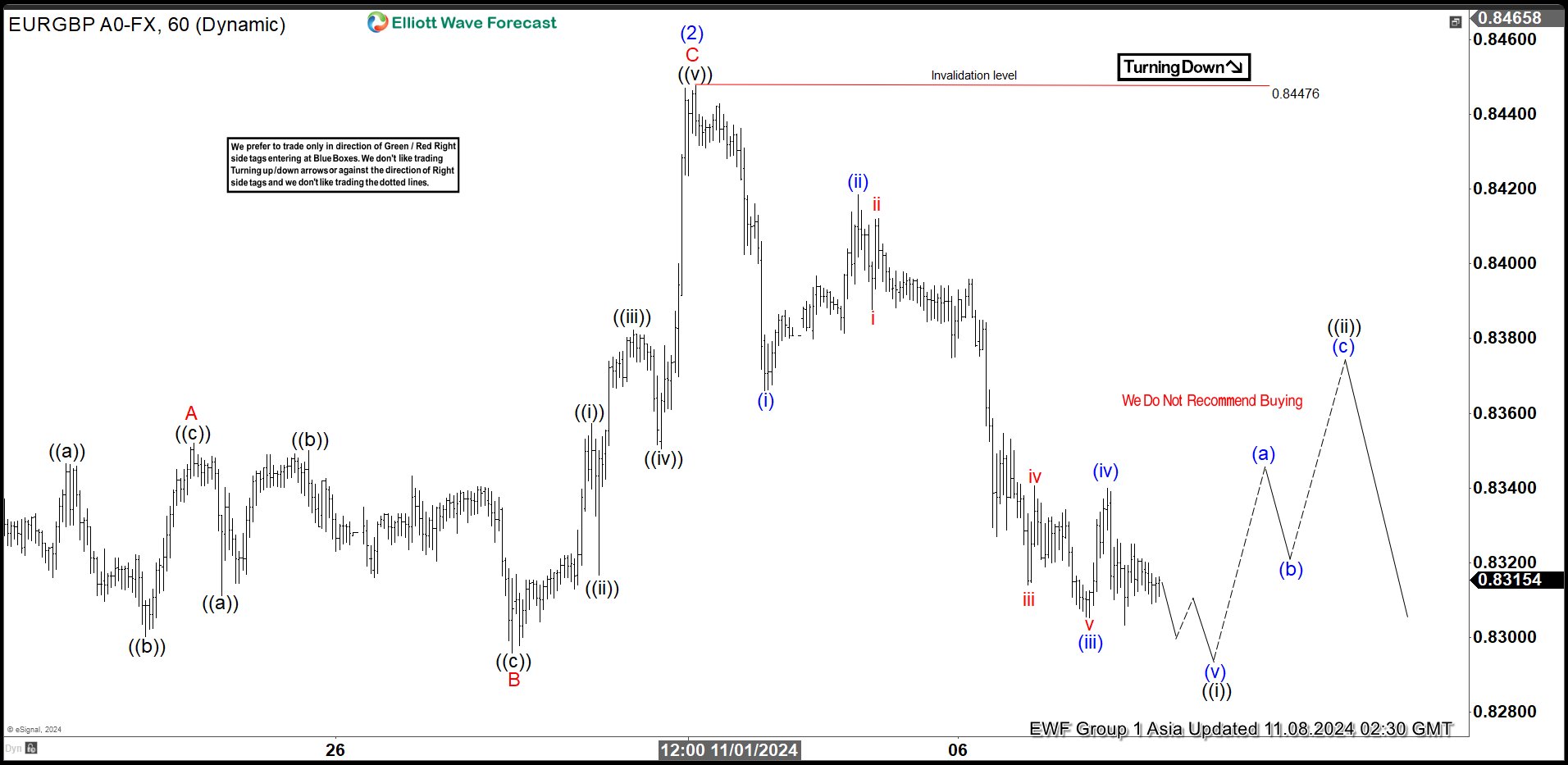

Elliott Wave View in EURGBP Calling for More Downside

Read MoreEURGBP shows 5 swing down from 11.1.2024 high favoring more downside. This article and video look at the Elliott Wave path.

-

Buyers are still in Control on Renminbi (USDCNH)

Read MoreIn the last years, the renminbi made a pause in his attempt to get stronger against USD dollar. In February 2014, renminbi found support at 6.0153 as wave ((III)) and from there it made a perfect zig – zag correction structure to equal legs at 7.1964 high in September 2019. After these 3 swings, USDCNH […]