In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

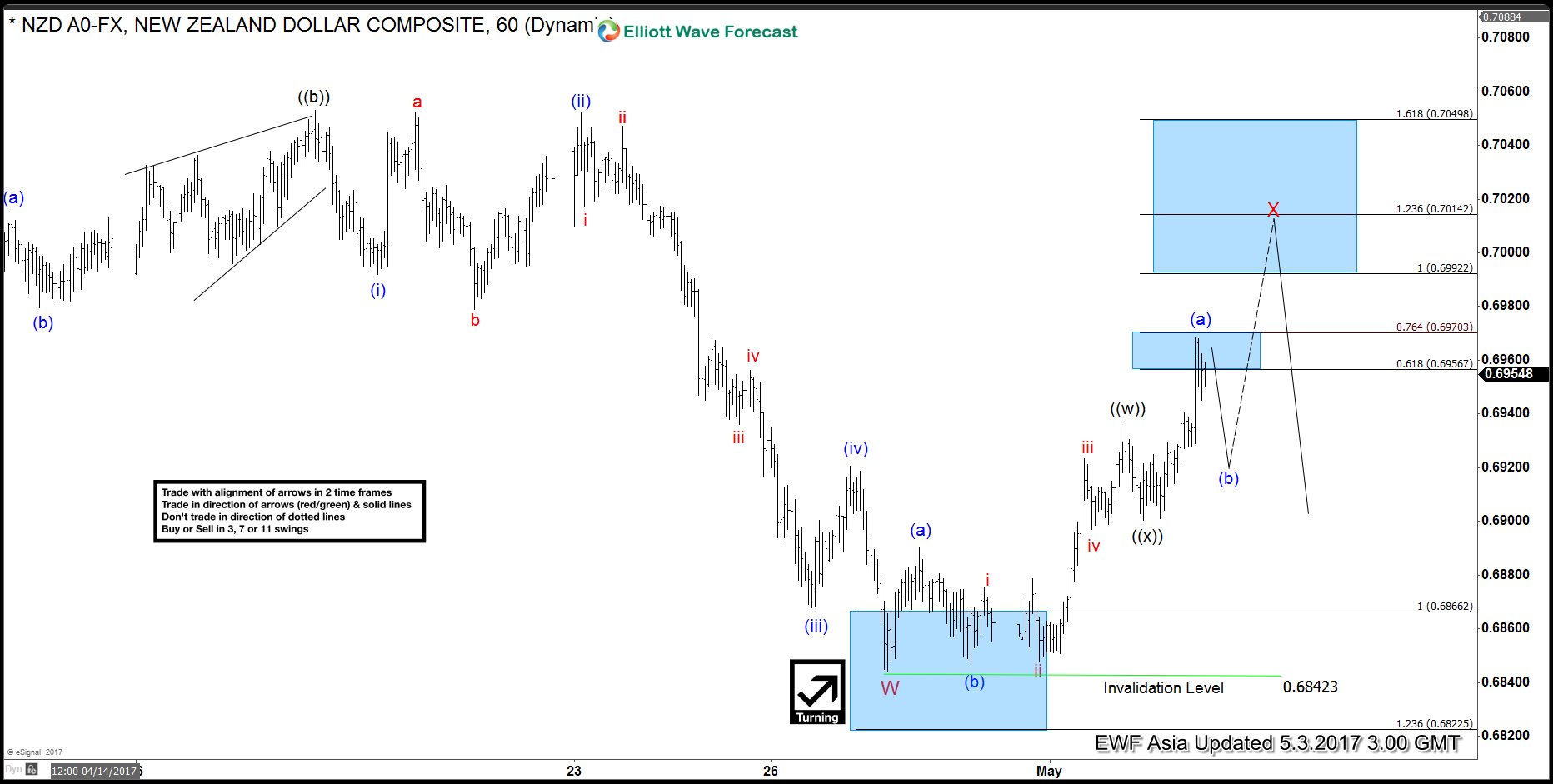

NZDUSD Elliott Wave View: Correction in progress

Read MoreShort term Elliott Wave view in NZDUSD suggests the decline to 0.6844 low ended cycle from 3/21 high in Minor wave W. Pair is currently correcting cycle from 3/21 high in 7 or 11 swing in Minor wave X before the decline resumes. The rally from 4/27 low (0.6844) is unfolding as a double three Elliott Wave structure […]

-

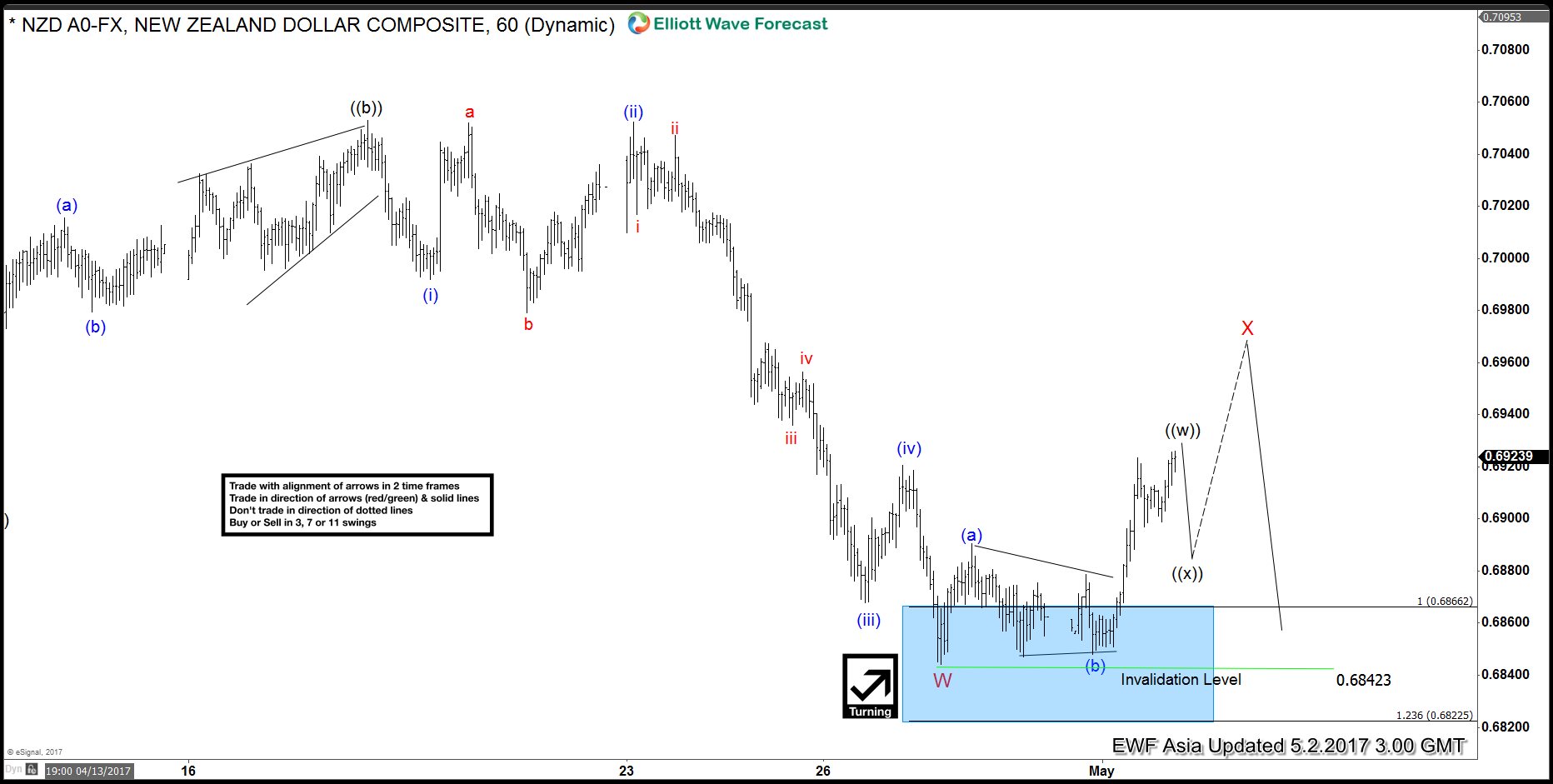

NZDUSD Elliott Wave View: More downside

Read MoreShort term Elliott Wave view in NZDUSD suggests the decline to 0.6844 low ended cycle from 3/21 high in Minor wave W. Pair is currently correcting cycle from 3/21 high in 3, 7, or 11 swing in Minor wave X before the decline resumes. The rally from 4/27 low (0.6844) looks to be unfolding as a double […]

-

NZDUSD Incomplete Elliott Wave Sequence

Read MoreNZD USD is showing 5 swings down from 2/6/2017 (0.7375) which means it’s an incomplete Elliott wave sequence and calls for another swing lower to complete 7 swings down from 2/6/2017 (0.7375) peak. First 3 swings completed on 3/9/2017 (0.6886) and bounce to 3/21/2017 (0.7091) was the 4th swing. Pair has since made a new low below […]

-

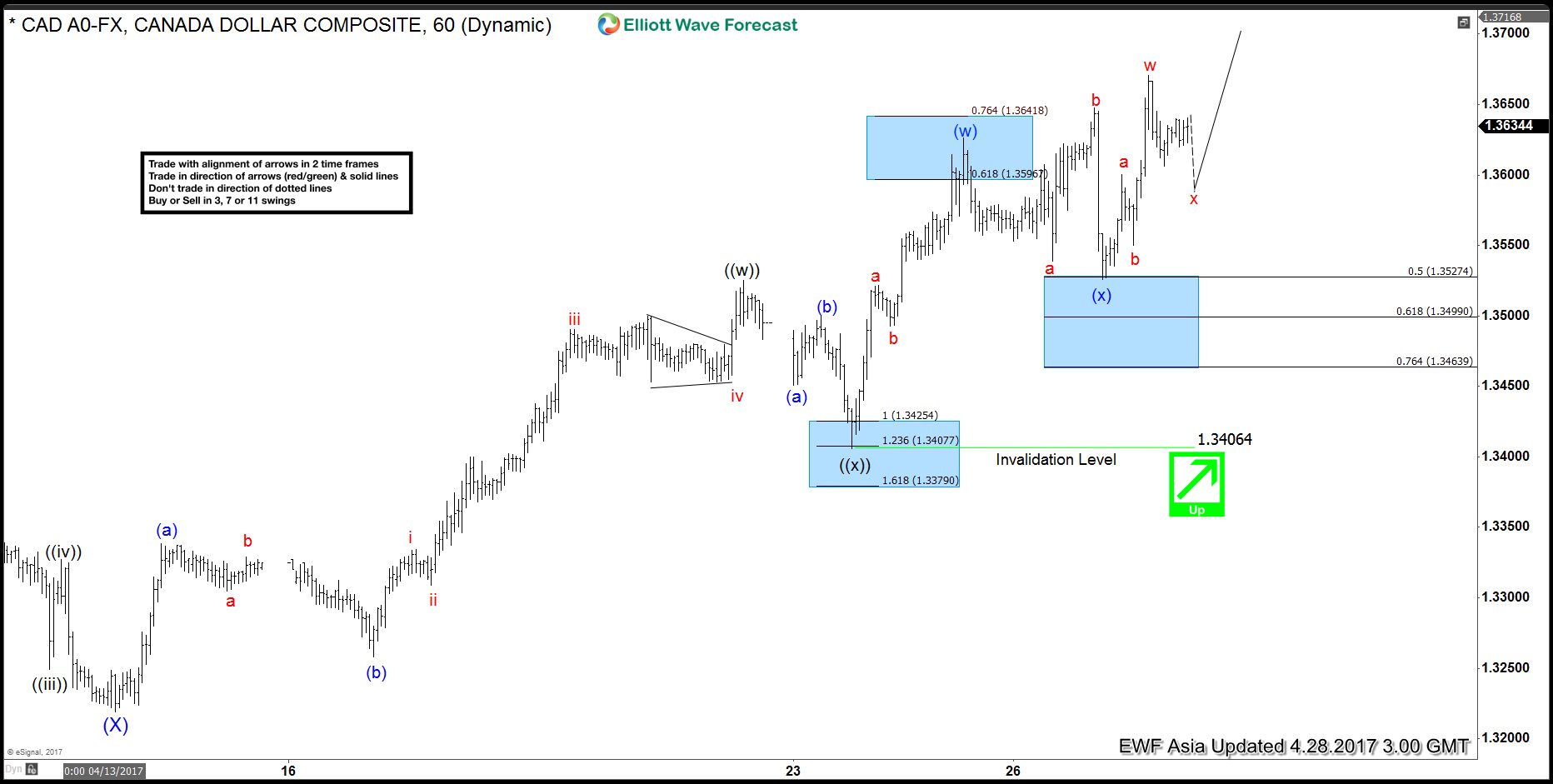

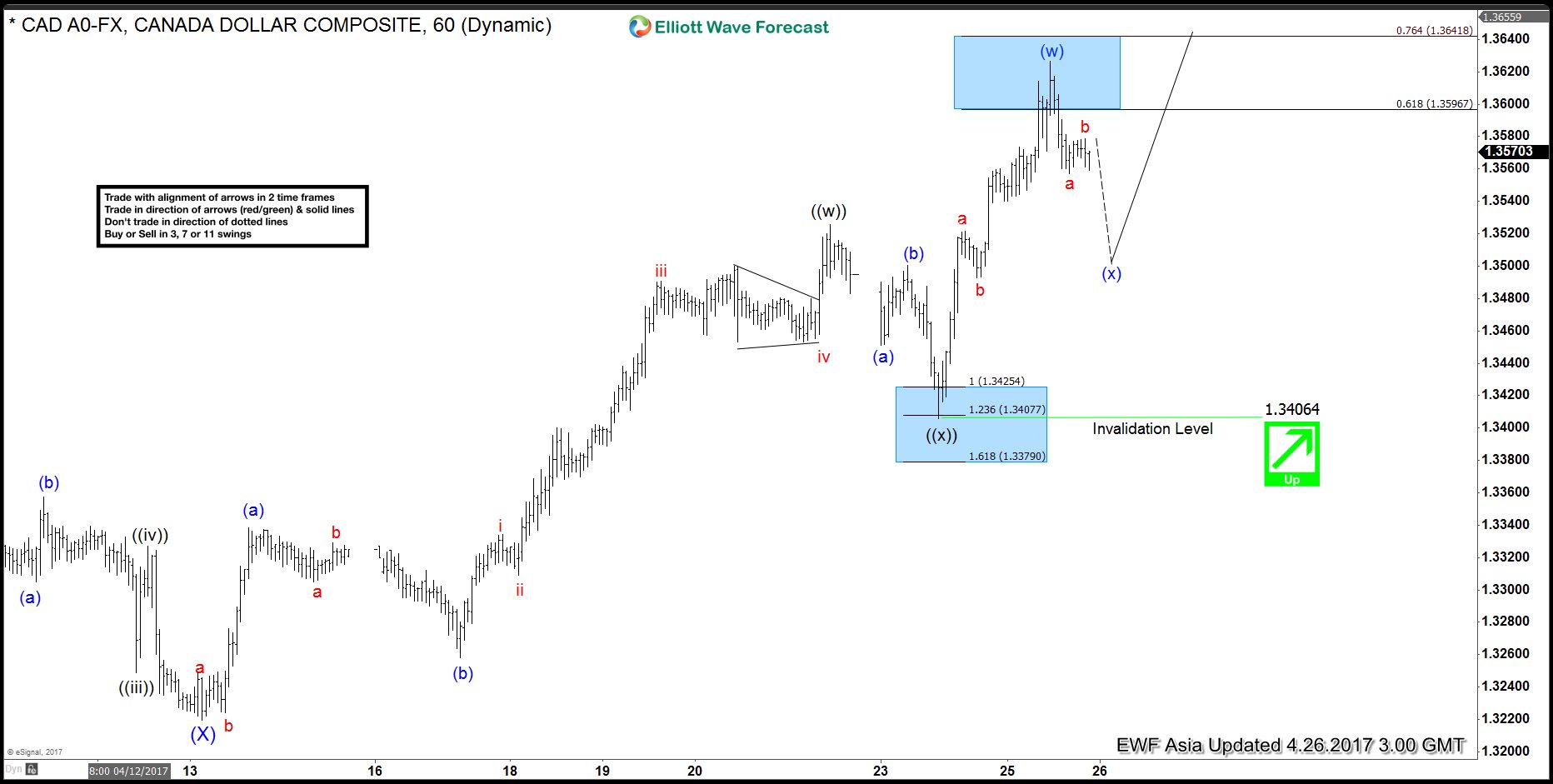

USDCAD Elliott Wave View: Extending Higher

Read MoreShort term Elliott Wave view in USDCAD suggest the decline to 1.322 ended Intermediate wave (X). The rally from there is unfolding as a double three Elliott Wave structure where Minute wave ((w)) ended at 1.3525 and Minute wave ((x)) ended at 1.3406. Minute wave ((w)) is subdivided as a Flat Elliott wave structure where Minutte […]

-

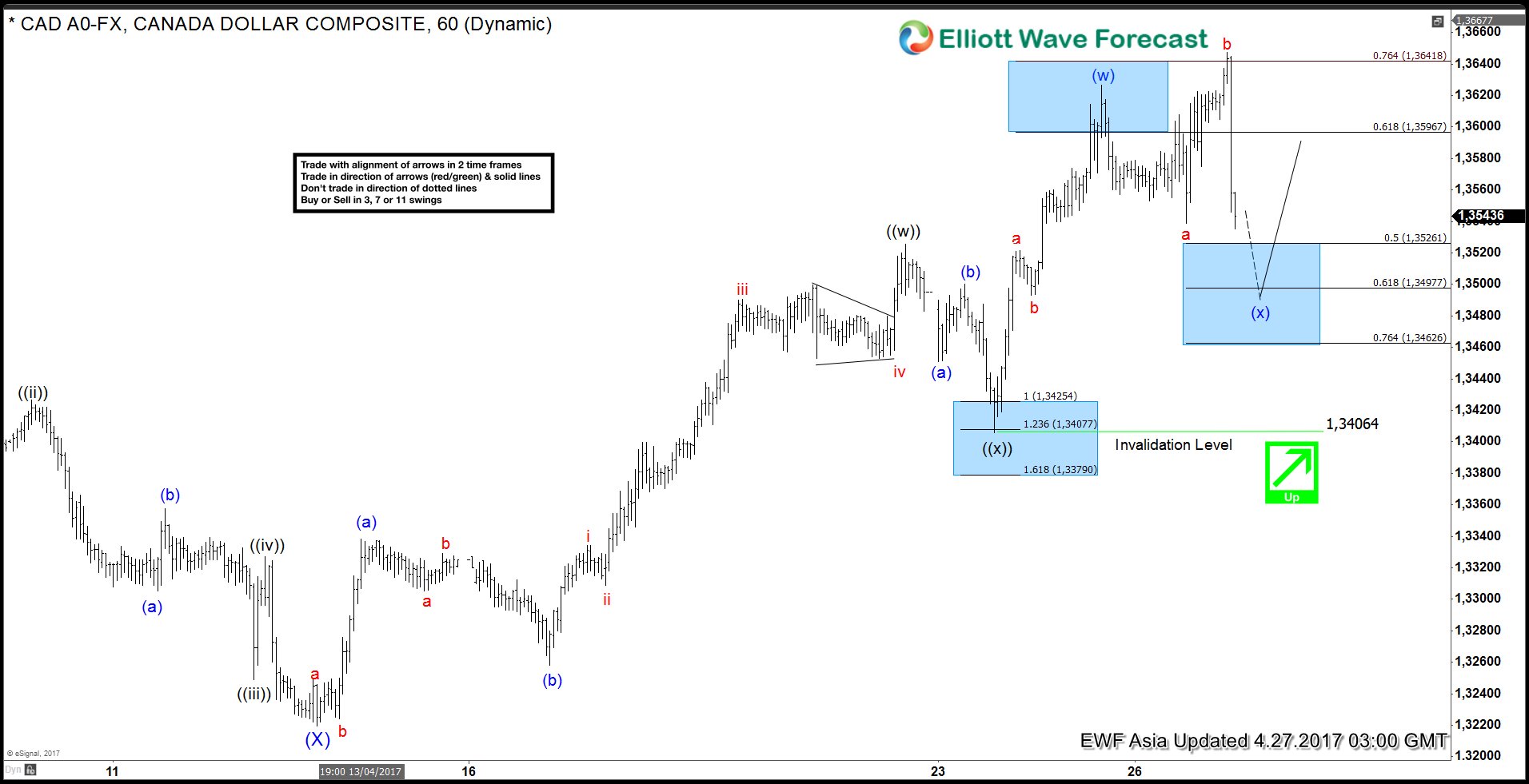

USDCAD Elliott Wave View: Flat correction

Read MoreShort term Elliott Wave view in USDCAD suggest the decline to 1.322 ended Intermediate wave (X). The rally from there is unfolding as a double three Elliott Wave structure where Minute wave ((w)) ended at 1.3525 and Minute wave ((x)) ended at 1.3406. Minute wave ((w)) is subdivided as a Flat Elliott wave structure where Minutte […]

-

USDCAD Elliott Wave View: More Upside

Read MoreShort term Elliott Wave view in USDCAD suggest the decline to 1.322 ended Intermediate wave (X). Revised view suggests that the rally from there is unfolding as a double three Elliott Wave structure where Minute wave ((w)) ended at 1.3525 and Minute wave ((x)) ended at 1.3406. Minute wave ((w)) is subdivided as a Flat Elliott […]