In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Elliott Wave Analysis : AUDJPY Correction Near Complete

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave W ended at 88.44 and Minor wave X ended at 89.68. Minor wave Y is unfolding also as a double three Elliott Wave structure. […]

-

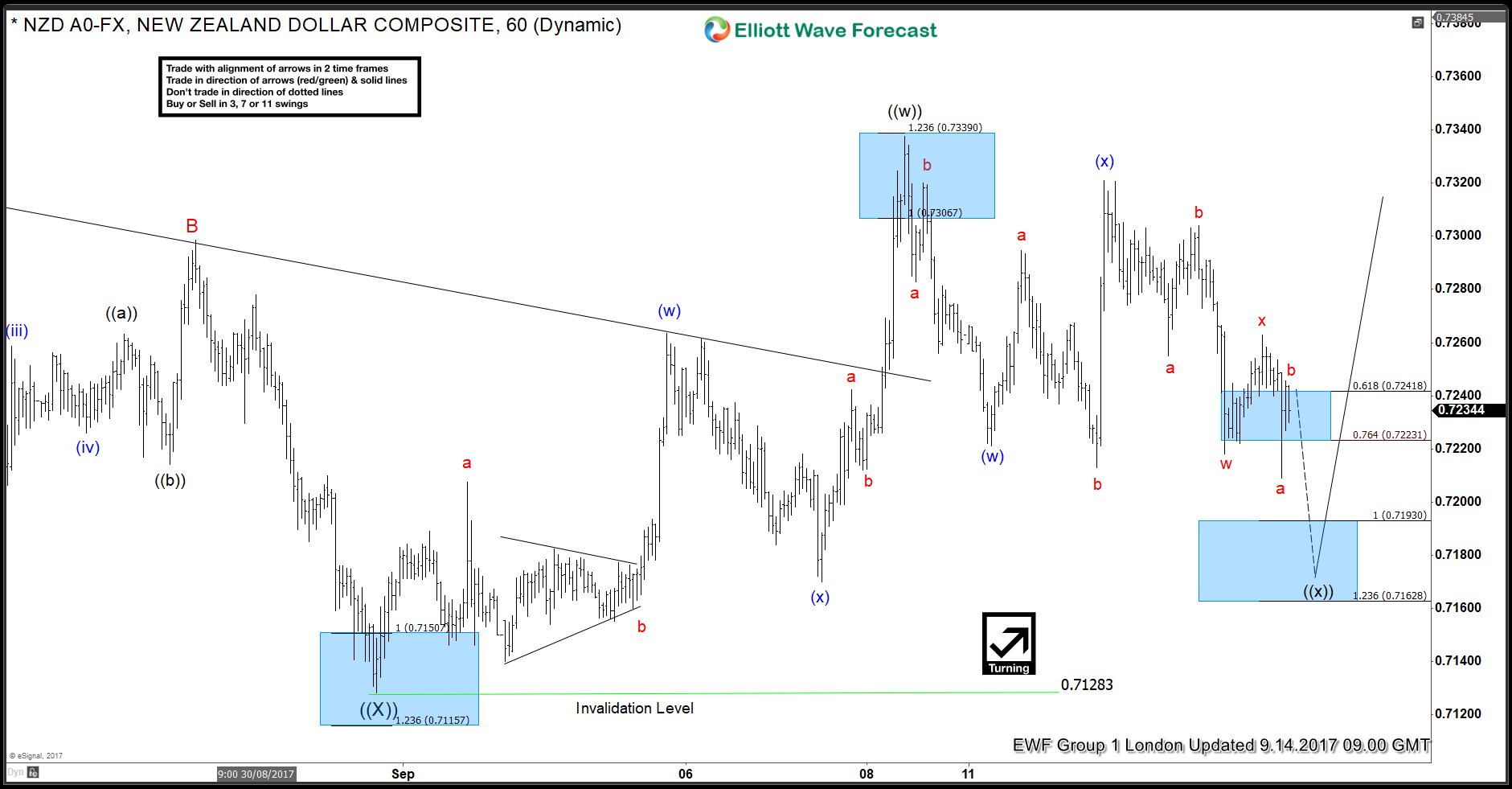

NZDUSD forecasting the path and buying short term dips

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of NZDUSD published in members area of www.elliottwave-forecast.com. In further text we’re going to count the swings, explain the Elliott Wave view and trading strategy. NZDUSD Elliott Wave 1 Hour Chart 09.14.2017 Back then we were […]

-

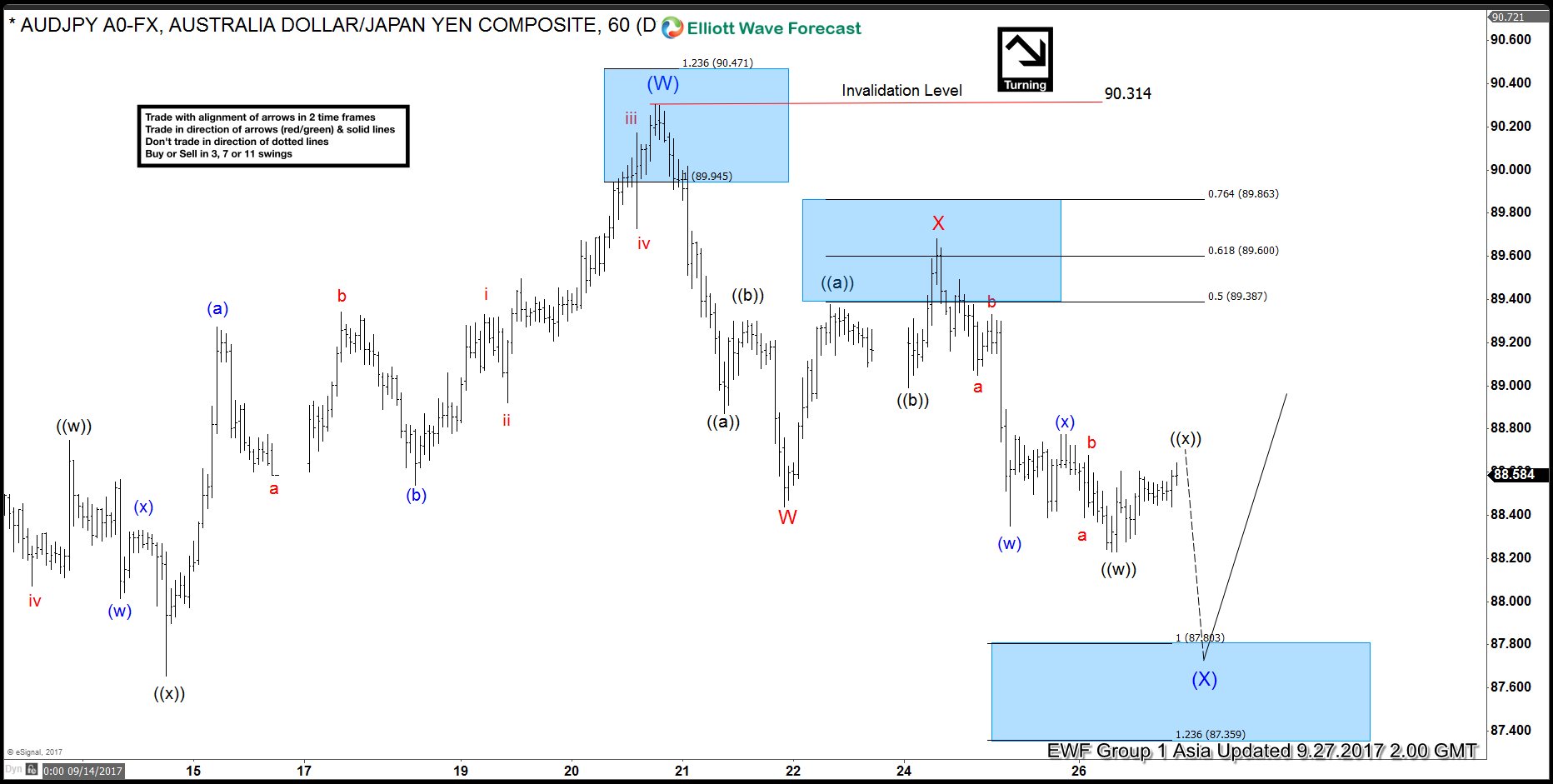

Elliottwave View: AUDJPY Correction in Progress

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave (W) ended at 88.44 and Minor wave (X) ended at 89.68. Near term, while bounces stay below 90.31, expect pair to extend lower towards 87.36 […]

-

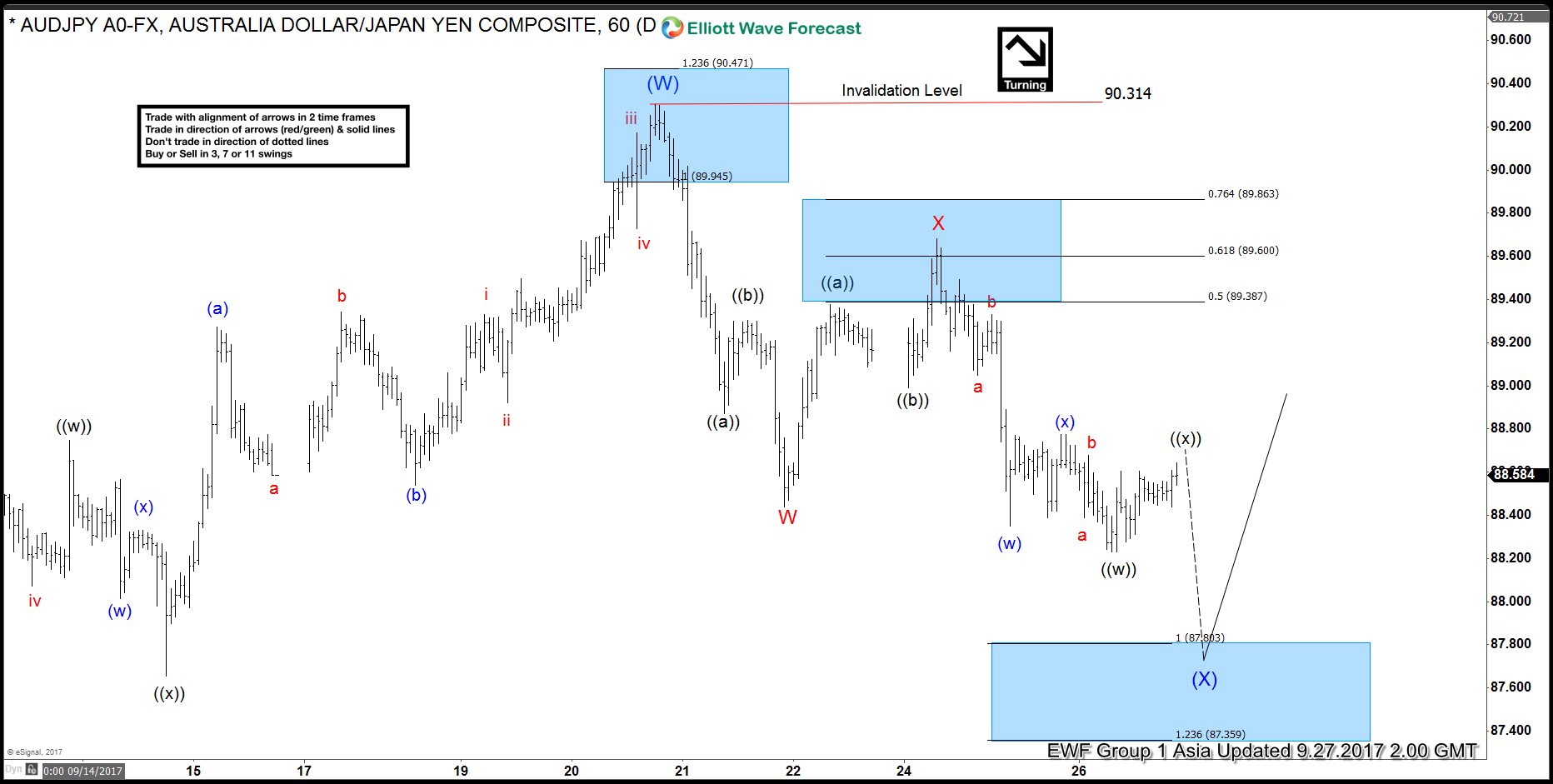

Elliottwave View: AUDJPY Doing a Correction

Read MoreAUDJPY Short Term Elliott Wave view suggests that the rally to 90.31 ended Intermediate wave (W). Intermediate wave (X) pullback remains in progress as a double three Elliott Wave structure. Down from 90.31, Minor wave (W) ended at 88.44 and Minor wave (X) ended at 89.68. Near term, while bounces stay below 90.31, expect pair to extend lower towards 87.36 […]

-

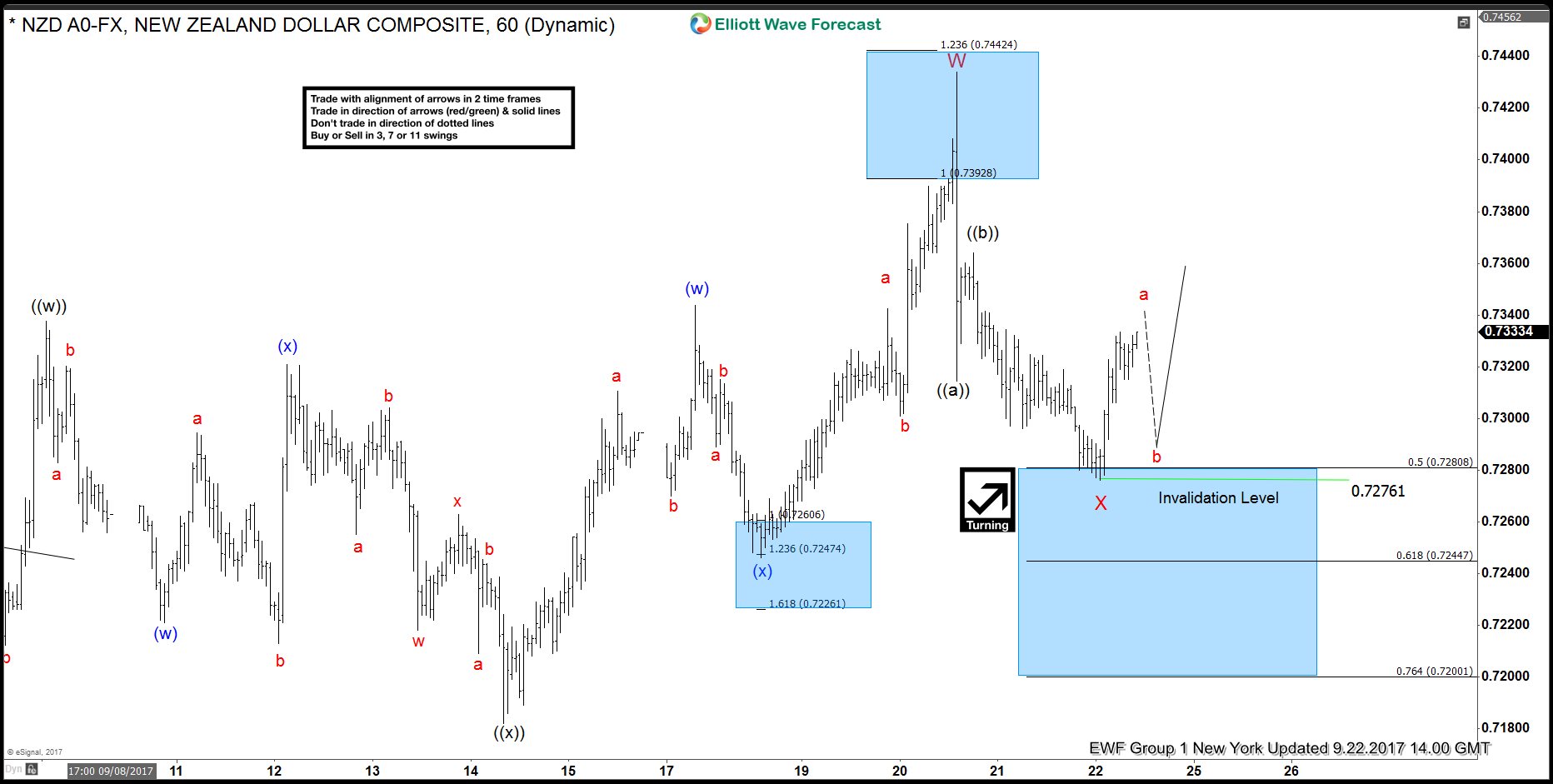

NZDUSD Elliott Wave View: Resuming Higher

Read MoreNZDUSD Short Term Elliott Wave view suggests the rally from 8/31 low unfolded as a double three Elliott Wave structure and ended with Minor wave W at 0.7434. Up from 8/31 low (0.7127), Minute wave ((w)) ended at 0.7337, Minute wave ((x)) ended at 0.7182, and Minute wave ((y)) of W ended at 0.7434. Minor […]

-

Cryptocurrencies Short Term Update 09.21.2017

Read MoreCryptocurrencies: Bitcoin & Ethereum Short Term Analysis The leading cryptocurrencies BTCUSD & ETHUSD rallied up from 09/15 low in a 3 waves Zigzag structure which ended wave (1) as part of an expected 5 waves diagonal to the upside. Both instruments is now doing a short term pullback in wave (2) as a double three toward equal legs area ($3740 […]