In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Bitcoin Elliott Wave Analysis Looking for Short Term Recovery

Read MoreBitcoin Elliott Wave Analysis in the short term is showing an interesting corrective structure suggesting a recover to take place after it finishes the current move. The digital instrument is correcting the cycle from 03/18 low in 3 waves as a Zigzag structure which reached the 100% – 161.8% Fibonacci extension area $8093 – $7520 from […]

-

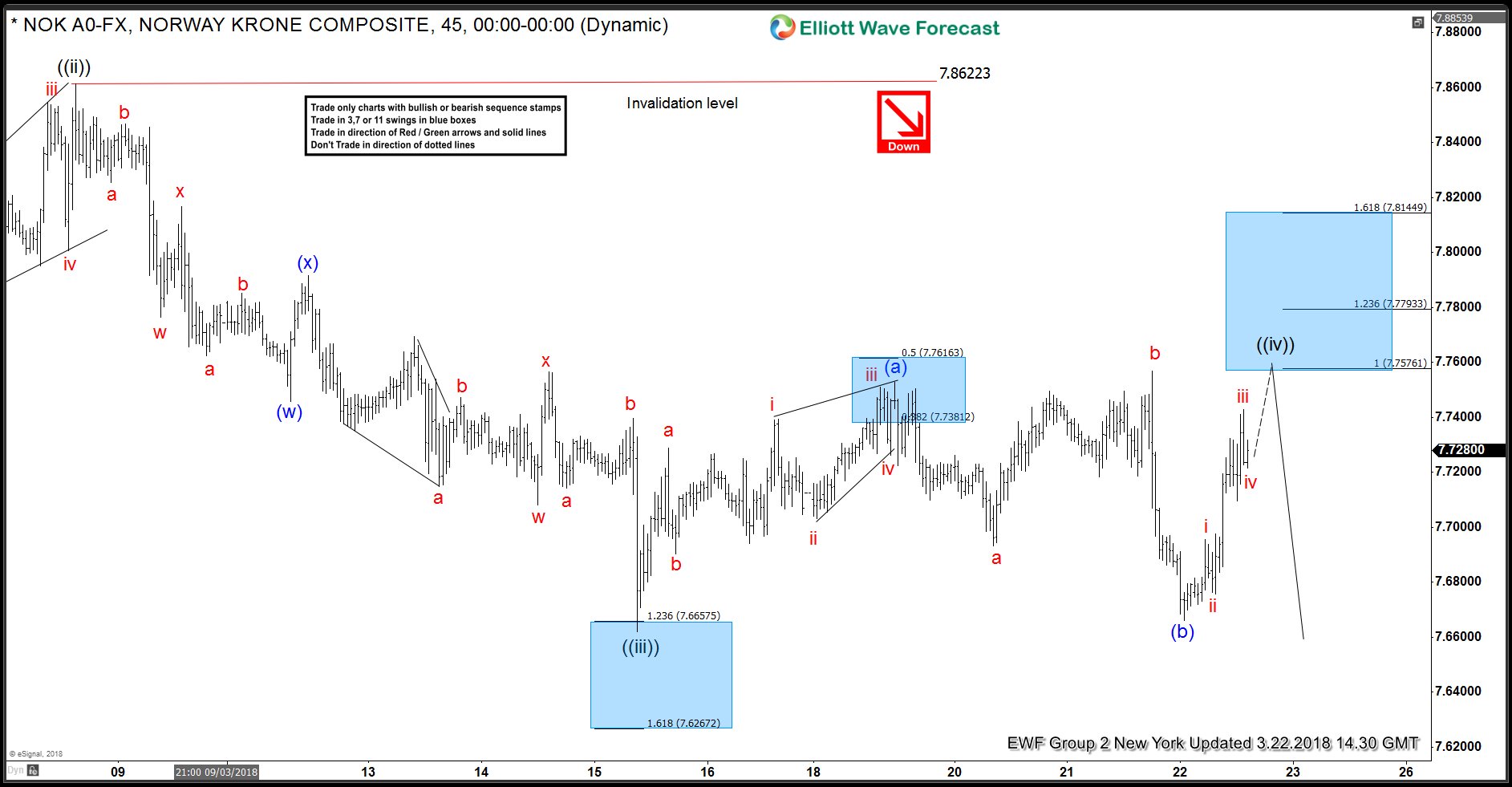

USDNOK Elliott Wave: Calling Extension Lower After The Bounce

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of USDNOK published in members area of the website. In further text we’re going to explain the short term Elliott Wave view. As our members know, the pair has incomplete bearish sequences in 4 Hour […]

-

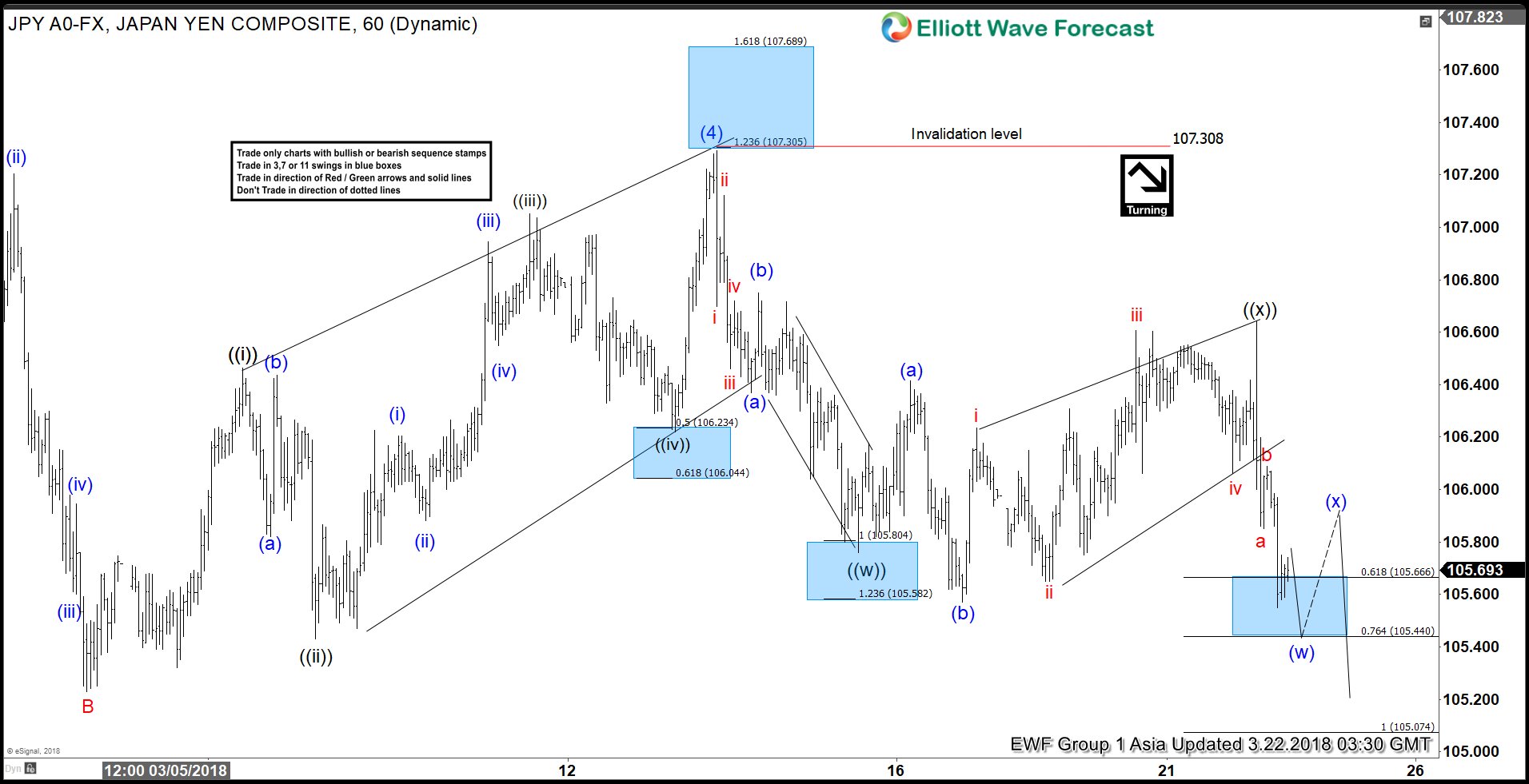

Elliott Wave Analysis: USDJPY Resumes Lower to 104

Read MoreUSDJPY Elliott Wave view suggests that the decline from 11.6.2017 high is unfolding as a 5 waves impulse Elliott Wave structure. Down from 11.6.2017 high (114.73), Intermediate wave (1) ended at 110.84, Intermediate wave (2) ended at 113.75, Intermediate wave (3) ended at 105.55, and Intermediate wave (4) ended at 107.3. Intermediate wave (5) is […]

-

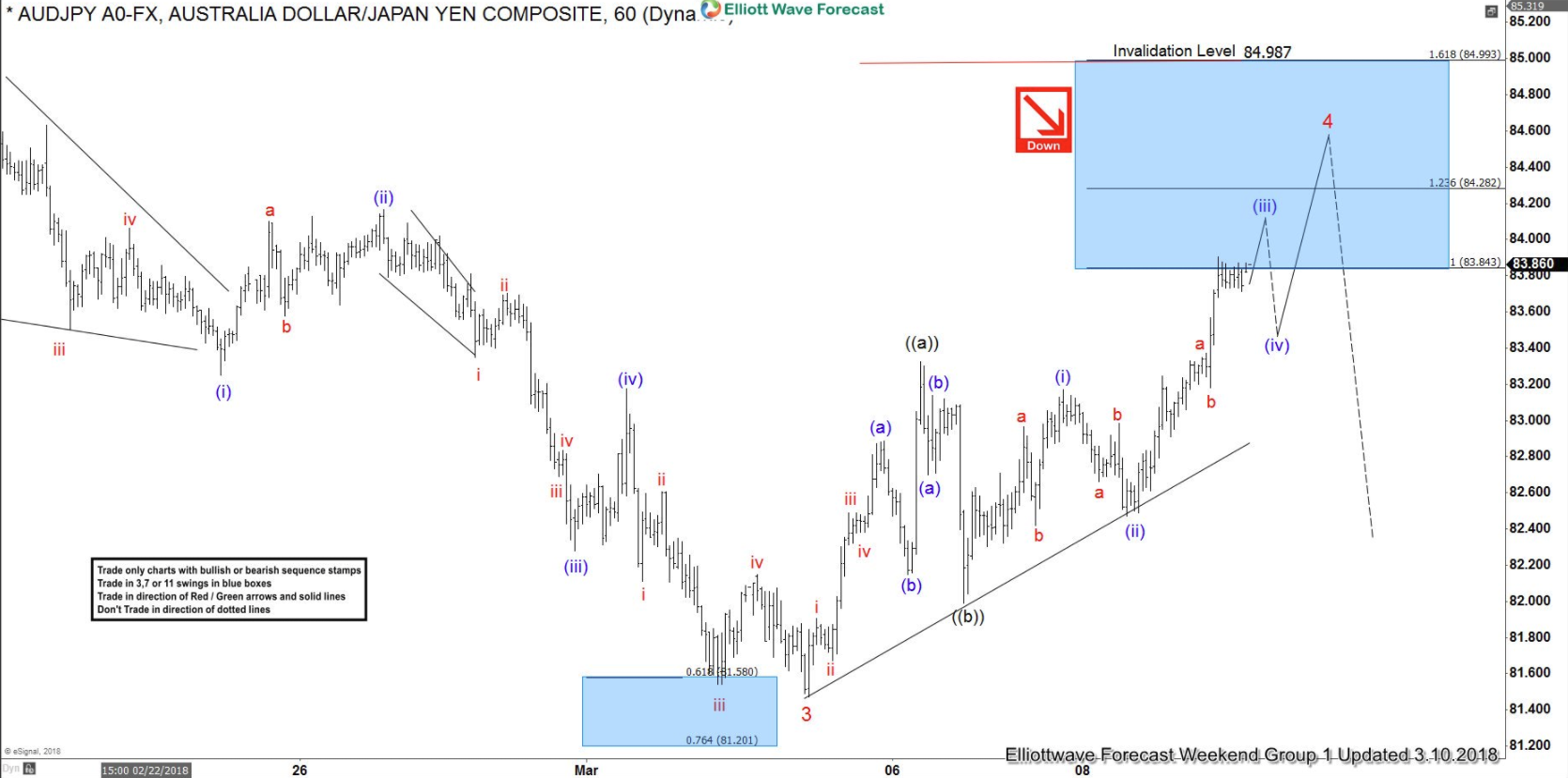

Elliott Wave Analysis: AUDJPY Calling the Decline

Read MoreIn this blog, we will have a look at some past Elliott Wave structures of the instrument AUDJPY. In the chart below, you can see the 1-hour weekend update presented to our members on the 03/10/18. Calling for a double correction in an Elliott Wave Flat correction as the internals from black ((a))-((b))-((c)) proposed to be […]

-

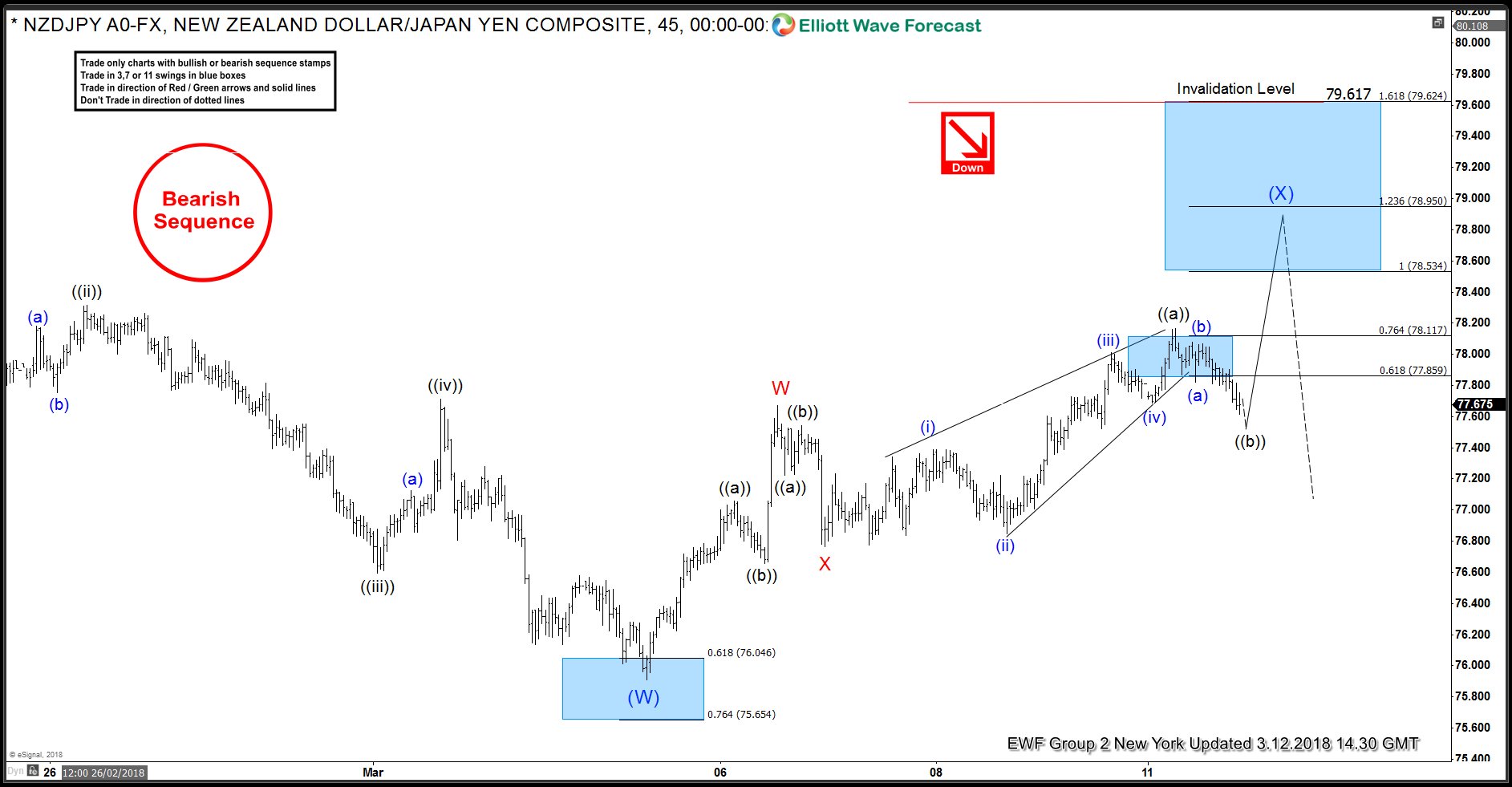

NZDJPY Selling the Elliott Wave bounces

Read MoreIn this Technical blog, we are going to take a quick look at the past Elliott Wave Chart performance of NZDJPY. Which we presented to our clients at elliottwave-forecast.com. We are going to explain the structure and the forecast. As our members know, we were pointing out that the sequence from July 27 2017 peak is incomplete to the downside. Therefore, we advised […]

-

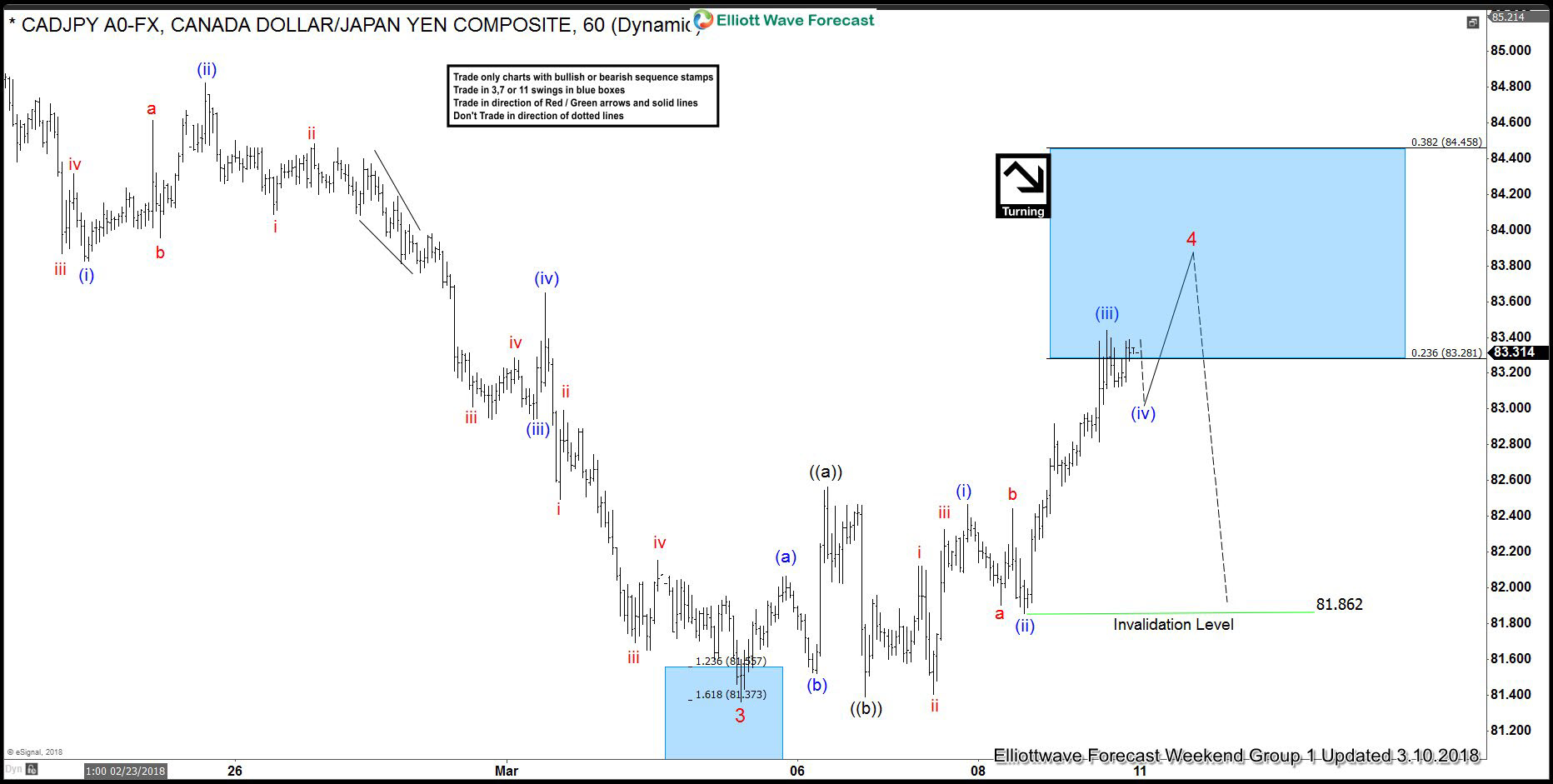

CADJPY Forecasting Decline After Elliott Wave Flat

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the past Elliott Wave charts of CADJPY published in members area of the website. In further text we’re going to explain the short term Elliott Wave view. As our members know, we have been syaing saying that the pair has reached […]