In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

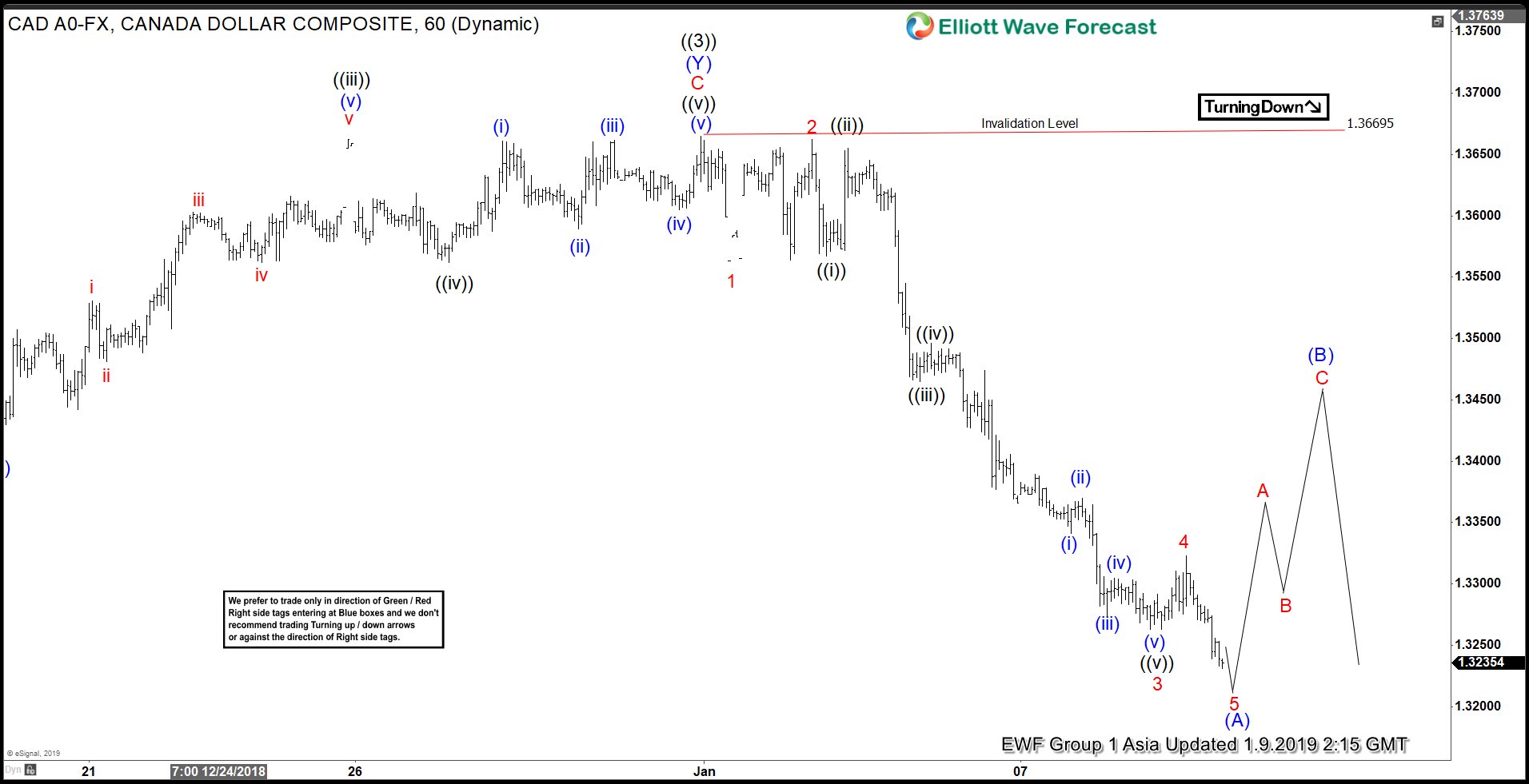

Elliott Wave Analysis: Impulse Move Suggests More Downside in USDCAD

Read MoreShort term Elliott Wave view in USDCAD shows that the decline from 12/31/2018 high (1.3669) is unfolding as a 5 waves impulse Elliott Wave structure. Down from 1.3669, Wave 1 ended at 1.3563, wave 2 ended at 1.3662, wave 3 ended at 1.3263, and wave 4 ended at 1.3323. We can see a momentum divergence […]

-

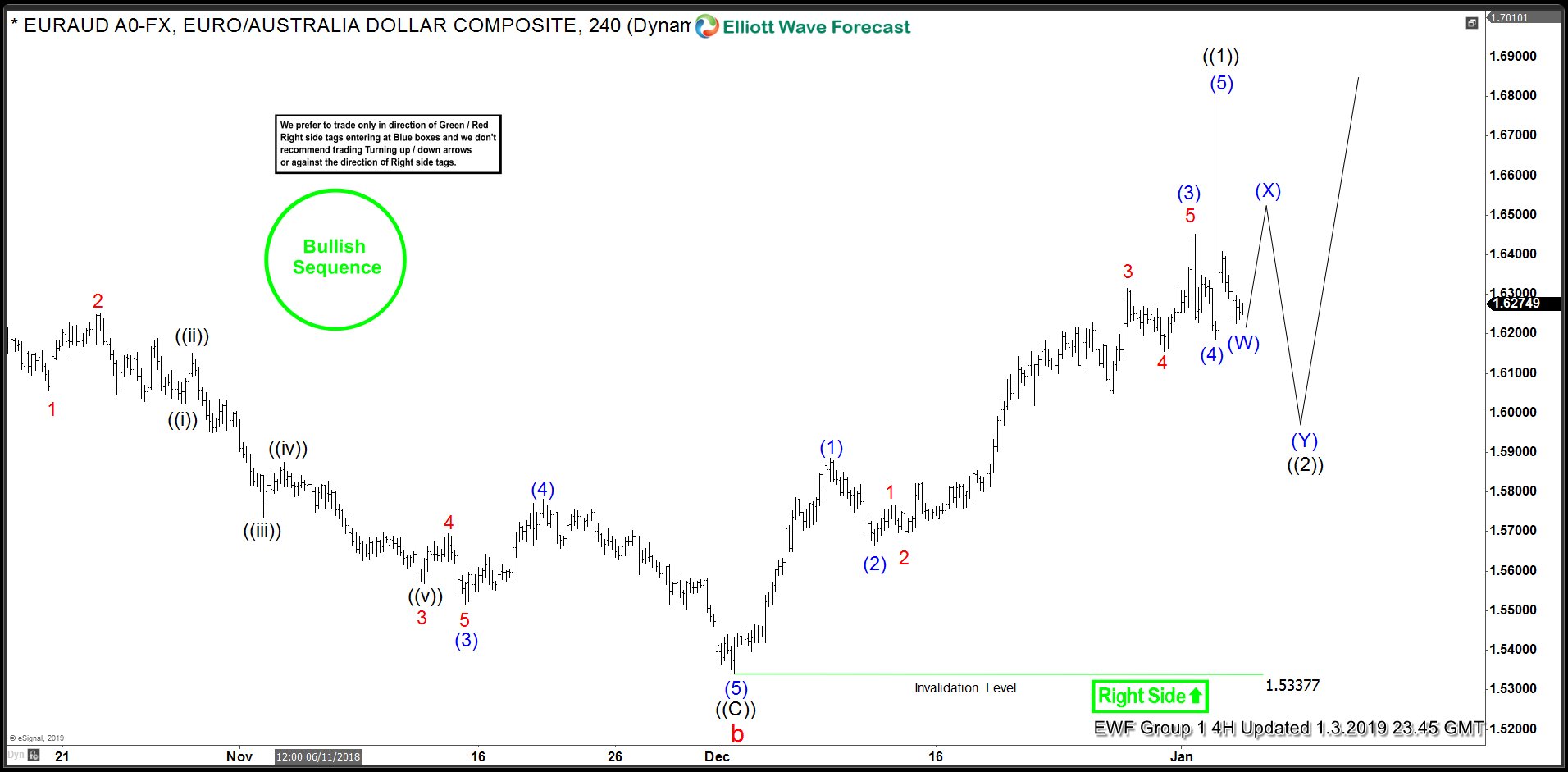

Elliott Wave View: EURAUD Bullish Sequence Favors More Upside

Read MoreElliott Wave view in EURAUD shows that the decline to 1.5337 low ended wave b. Rally from there unfolded as a 5 waves impulsive Elliott Wave structure. Up from 1.5337 low, Wave (1) ended at 1.5886, wave (2) ended at 1.566, wave (3) ended at 1.6453, wave (4) ended at 1.6184, and wave (5) ended […]

-

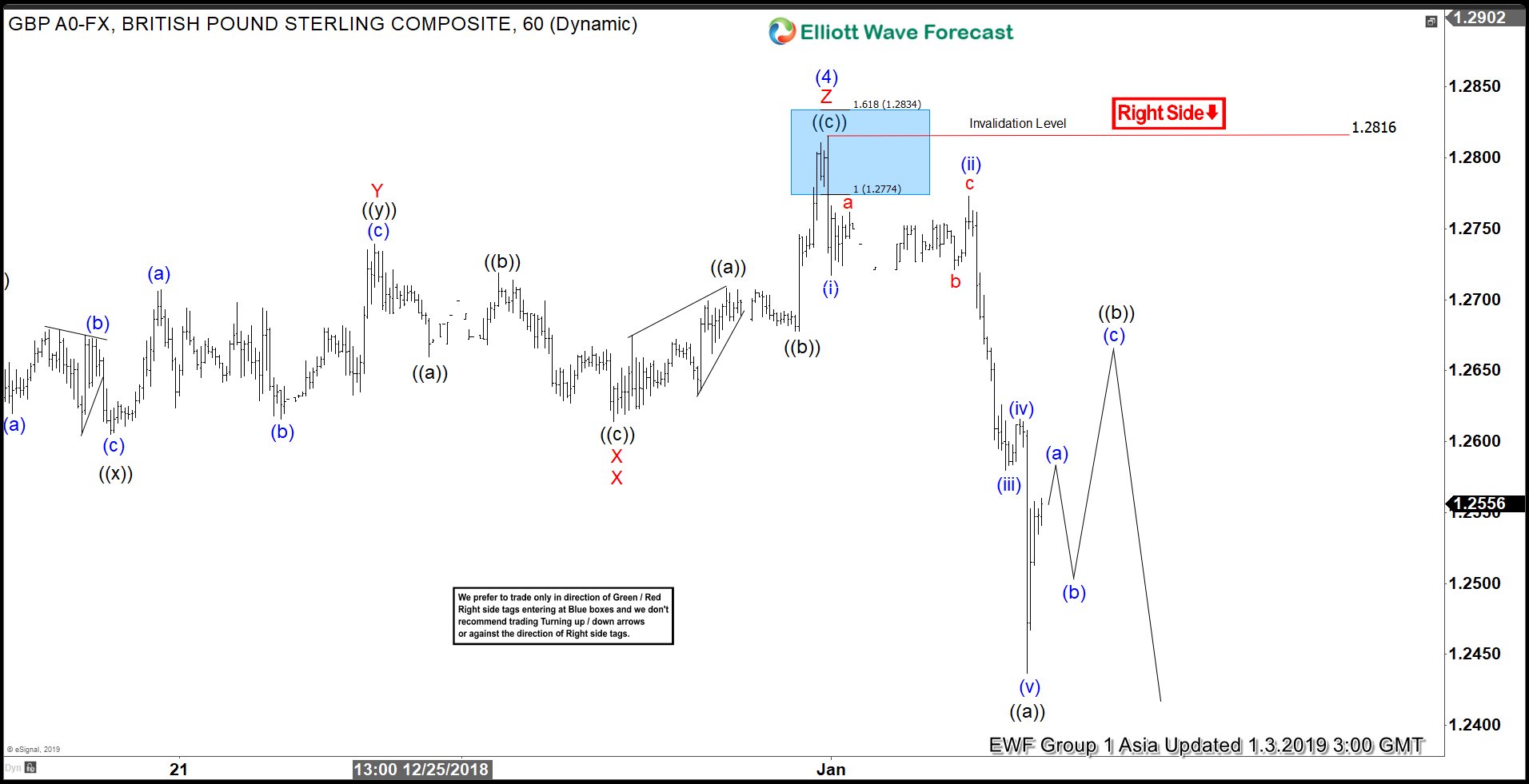

Elliott Wave Analysis: Further Downside Expected in GBPUSD

Read MoreShort term Elliott Wave view in GBPUSD shows that rally to 1.2816 ended wave (4). Internal of that rally unfolded as a triple three Elliott Wave structure. Up from wave (3) at 1.2476 on 12.12.2018 low, Wave W ended at 1.2687 and wave X ended at 1.2528. Rally to 1.2739 then ended Wave Y, second […]

-

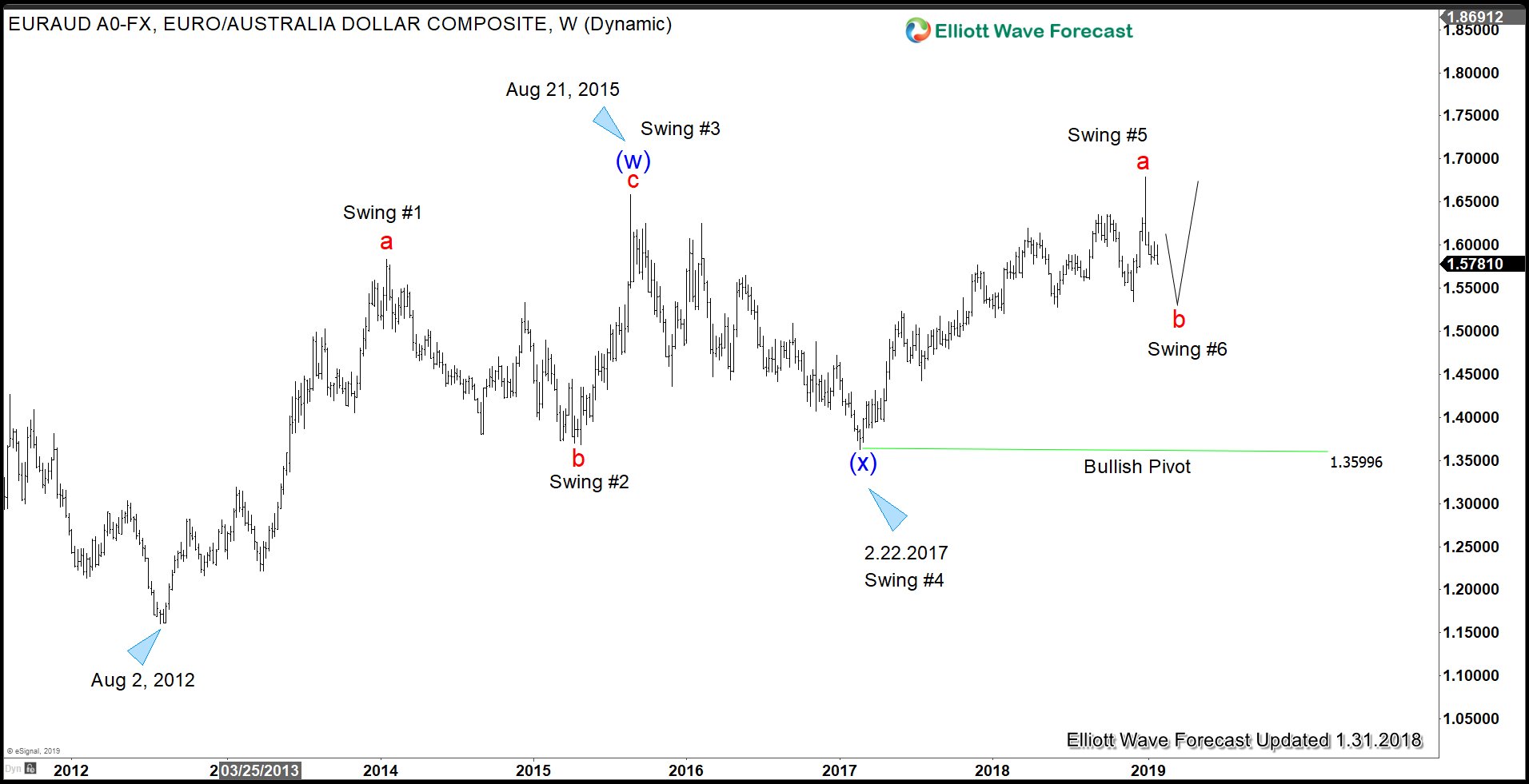

Bullish Outlook in Euro Cross

Read MoreSix years ago in 2012, Euro zone was in the midst of crisis, with bailouts of Greece pushing the Euro to the verge of a collapse. Peripheral European countries like Greece, Portugal, Italy were unable to sell government bonds without offering significant yield. In order to convince international investor, ECB President Mario Draghi back in […]

-

Will Yen Continue to Outperform in 2019?

Read MoreCare to guess what is the best performing major currency in 2018? Chances are you will say that it’s the US Dollar. Although US Dollar is doing pretty well this year, the best performing currency is in fact the Japanese Yen. You can see in the table below that despite the Dollar Index rallying 4.9% […]

-

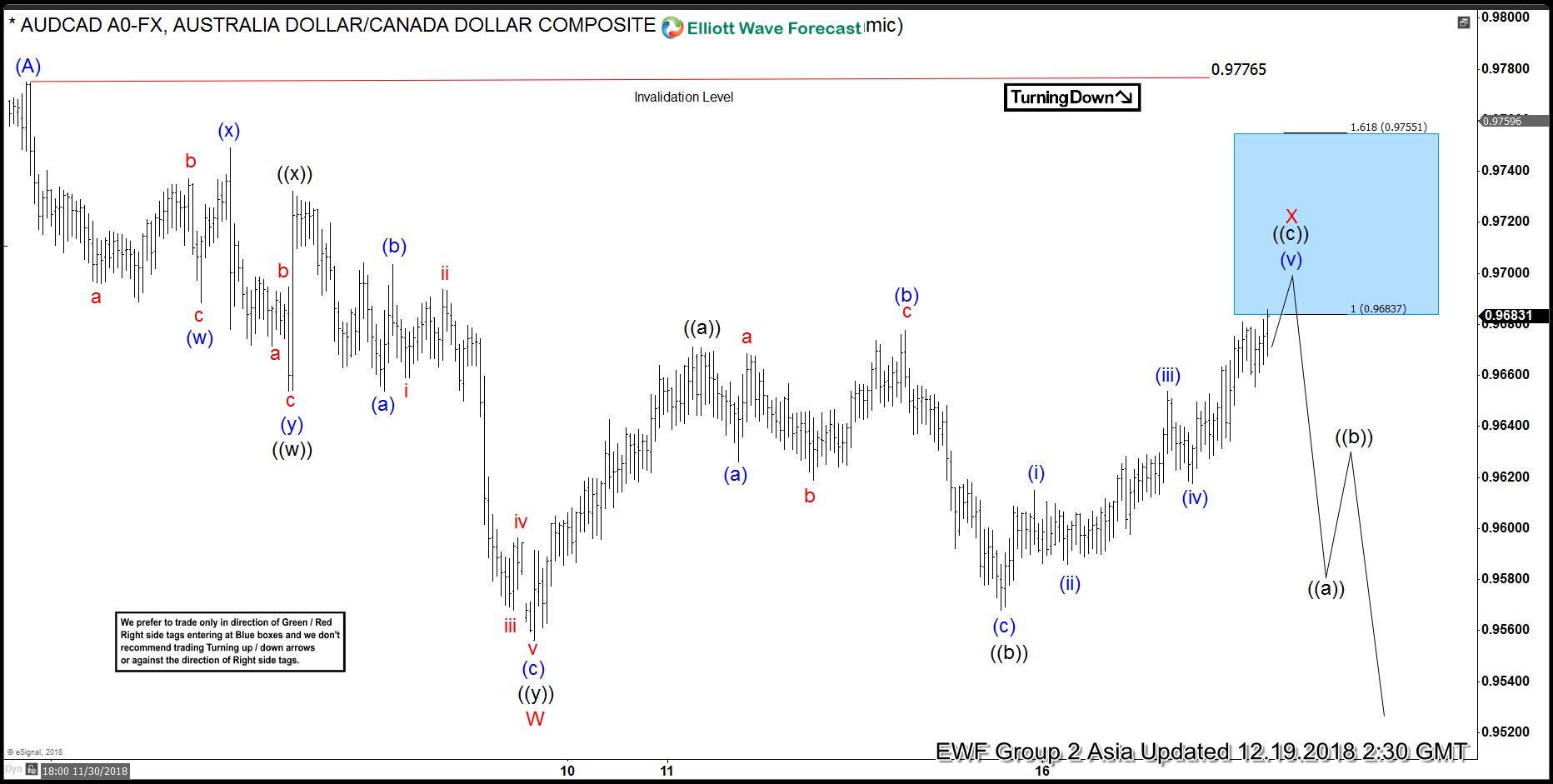

AUDCAD Elliott Wave Analysis: Calling The Reaction From Inflection Area

Read MoreIn this blog, I want to share some short-term Elliott Wave charts of AUDCAD which we presented to our members in the past. Below, you see the 1-hour updated chart presented to our clients on the 12/19/18. Showing that AUDCAD ended the cycle from 12/03/18 peak in red wave W at 12/09/18 low (0.95680). As AUDCAD ended the cycle […]