In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

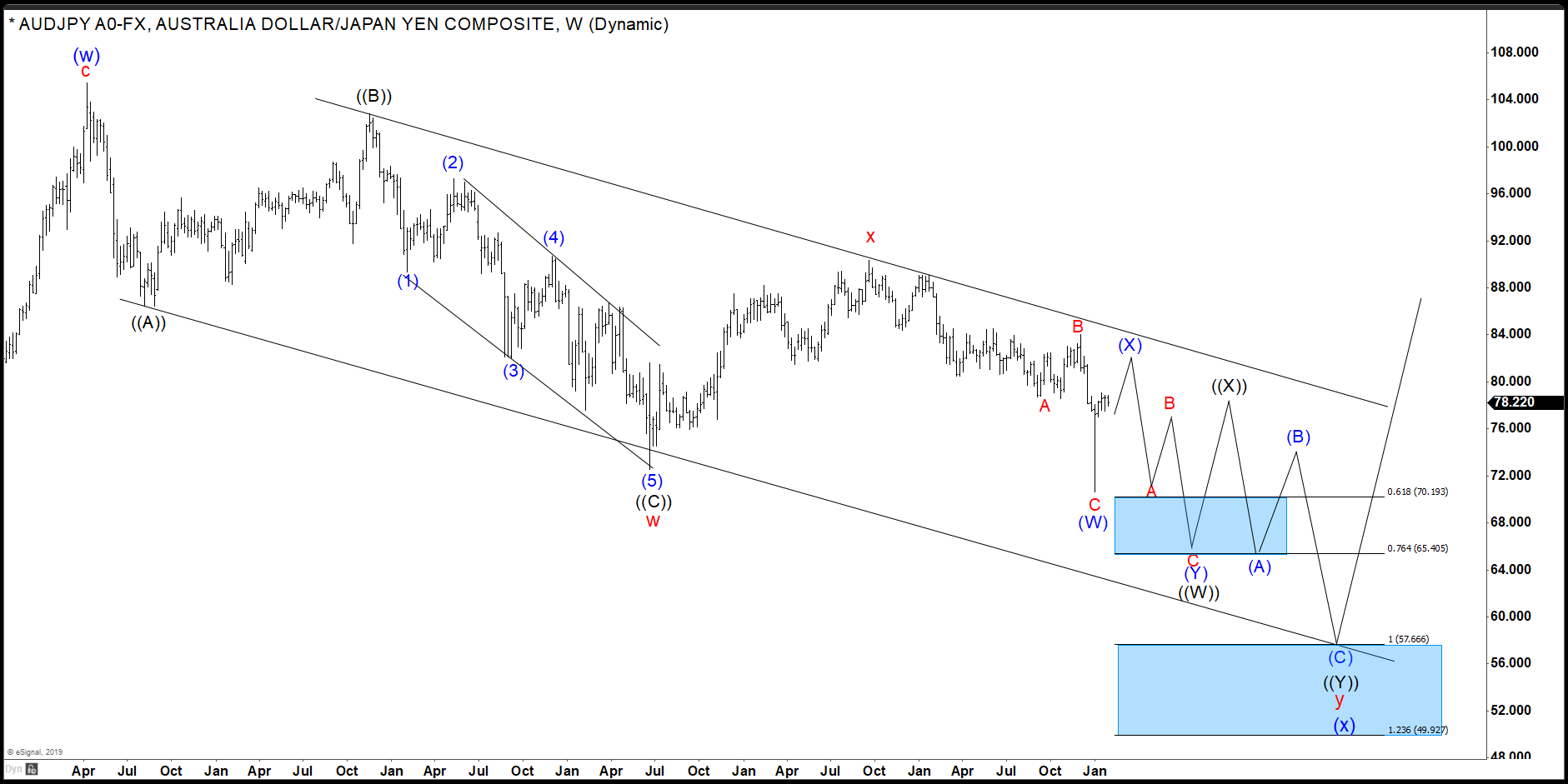

Yen Strength to Channel AUDJPY Lower

Read MoreOver the next few weeks Japanese Yen strength should drive prices of AUDJPY lower within a downward sloping channel. The current incomplete Elliott Wave structure also supports this expectation of further downside. In this article we’ll explore the basics of the current wave structure and its parallel channel. This combined analysis charts a great area […]

-

Elliott Wave Analysis: The Right Side Of A Choppy GBPUSD Price Action

Read MoreSay what you want about Brexit news or president Trump news, we only care about the chart! Our analysis and decisions do NOT depend on news but solely on what we refer to “the right side of the market”. Traders, today we will look at a couple of GBPUSD charts. The following analysis will show you […]

-

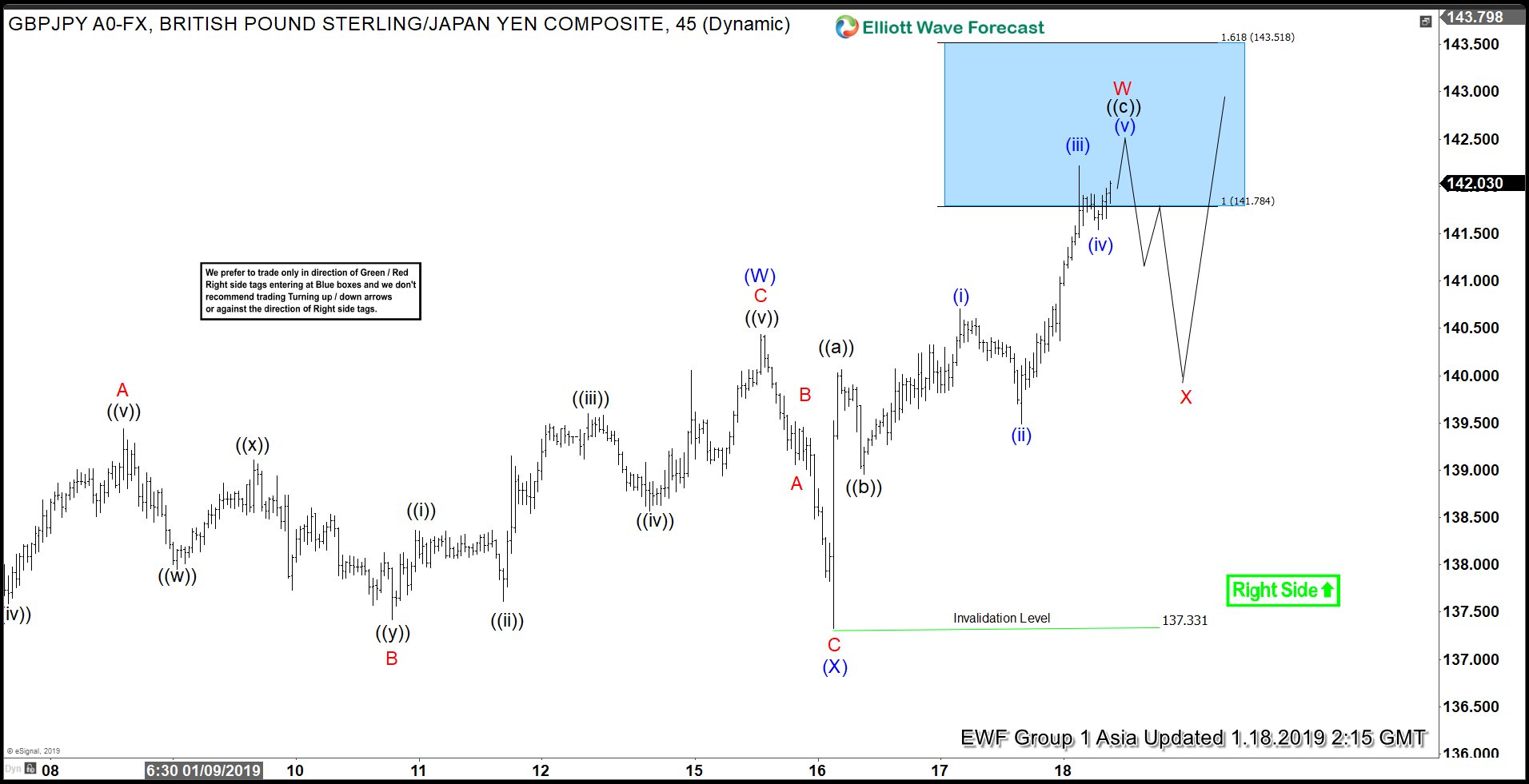

Elliott Wave view in GBPJPY favors upside bias

Read MoreThis article and video explains the short term technical path of GBPJPY using Elliott Wave. The pair has a short term bullish sequence from 1/3/2019 low, favoring further upside. We provide the invalidation level, alternative view and also target for the move higher.

-

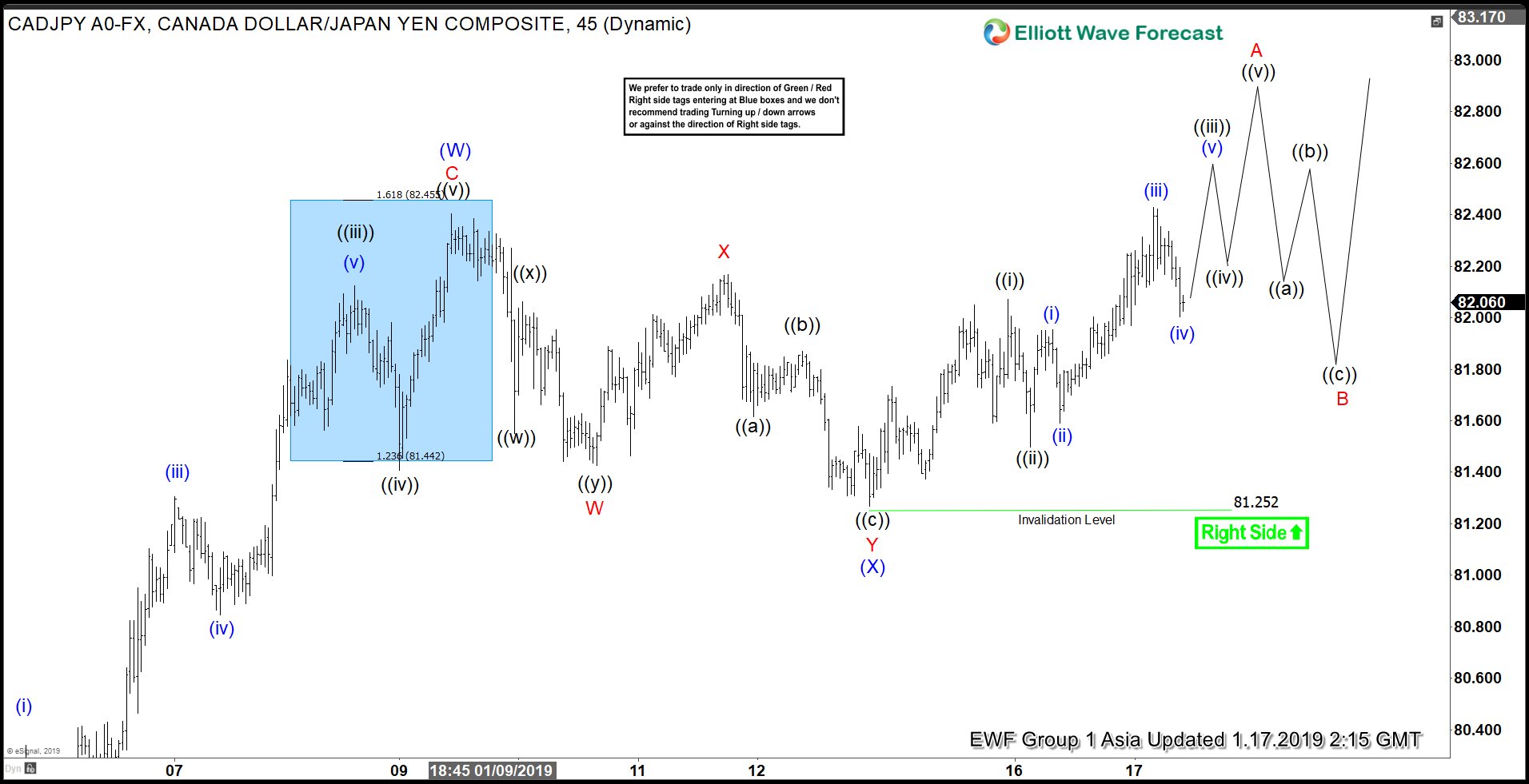

Elliott Wave View: CADJPY Starts Next Bullish Leg

Read MoreThe article and video explains the near term path for CADJPY using Elliott Wave Theory. It explain why the pair should remain supported & gives the next potential target as well as the invalidation level and alternate view.

-

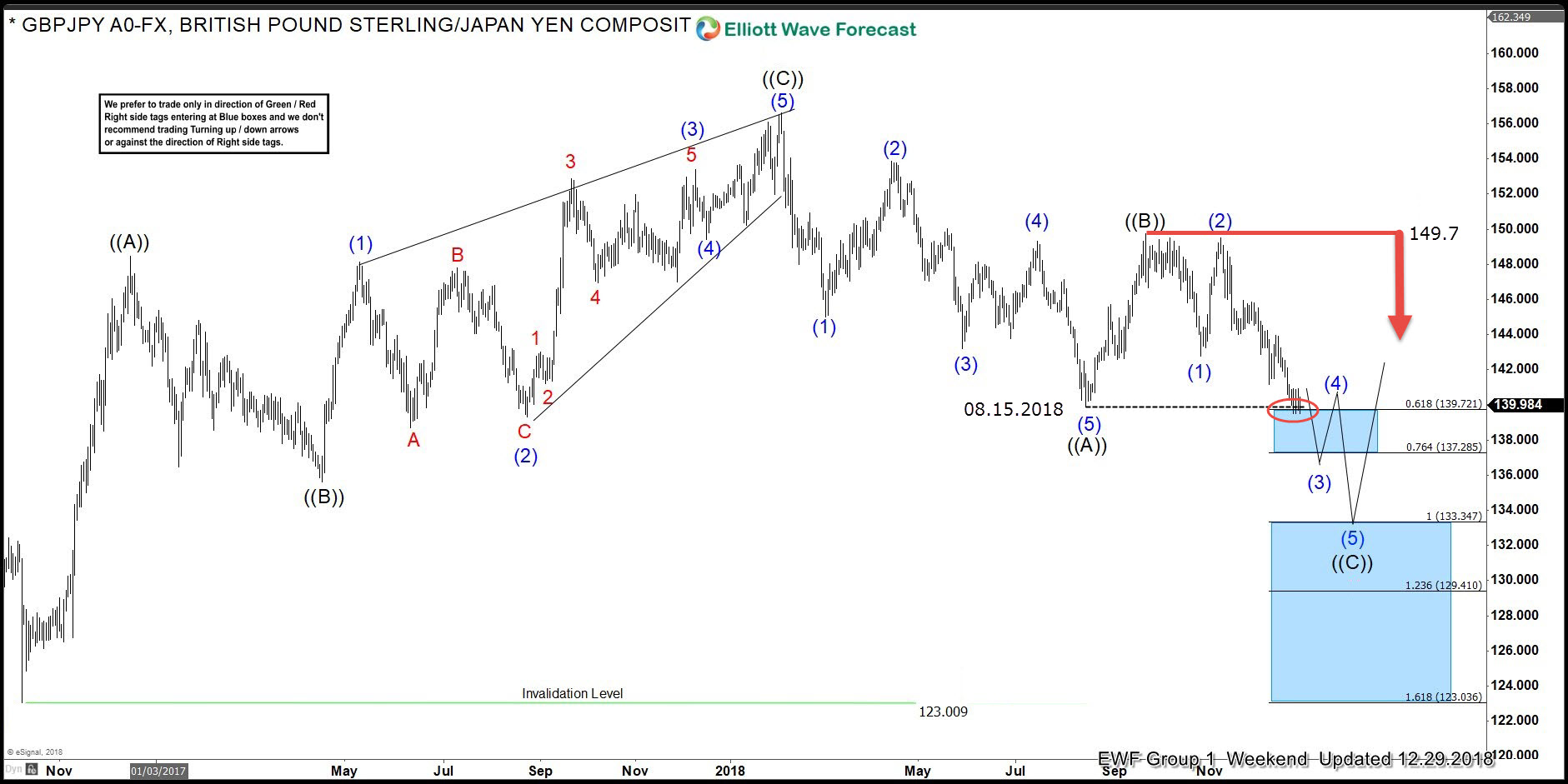

GBPJPY Reached The Extreme Area Lower And Bounced

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPJPY, published in members area of the website. As our members know, the pair had incomplete bearish sequence in the cycle from the January 28th peak. The Elliott wave structure had been calling for further […]

-

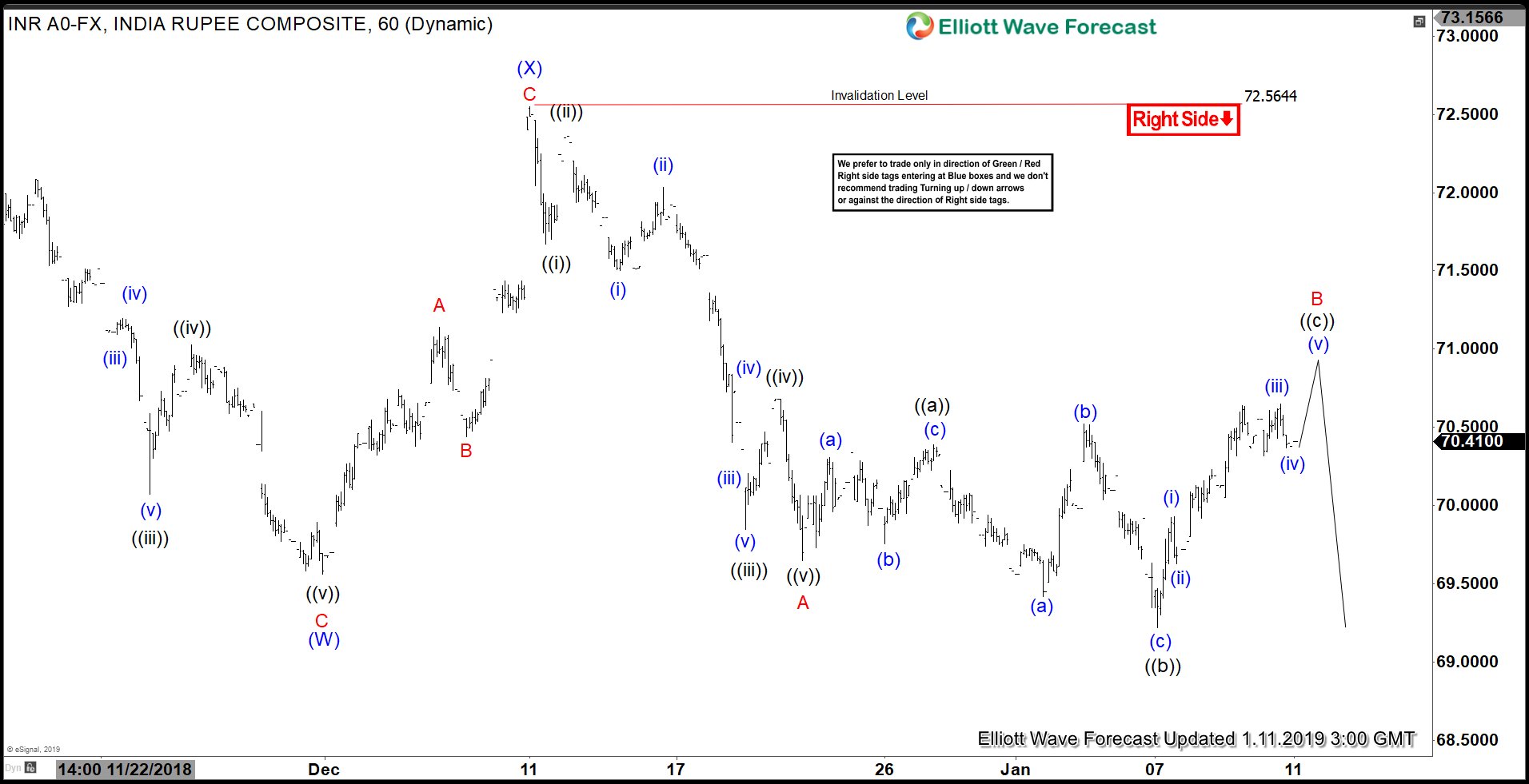

Elliott Wave View: Indian Rupee (USDINR) Should Turn Lower

Read MoreIndian Rupee (USDINR) is showing a bearish sequence from 10/11/2018 high. Elliott Wave analysis favors further downside in the pair as far as bounces stay below 12/11/2018 high. This article and video provides the future path of the pair as well as the inflection area.