In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

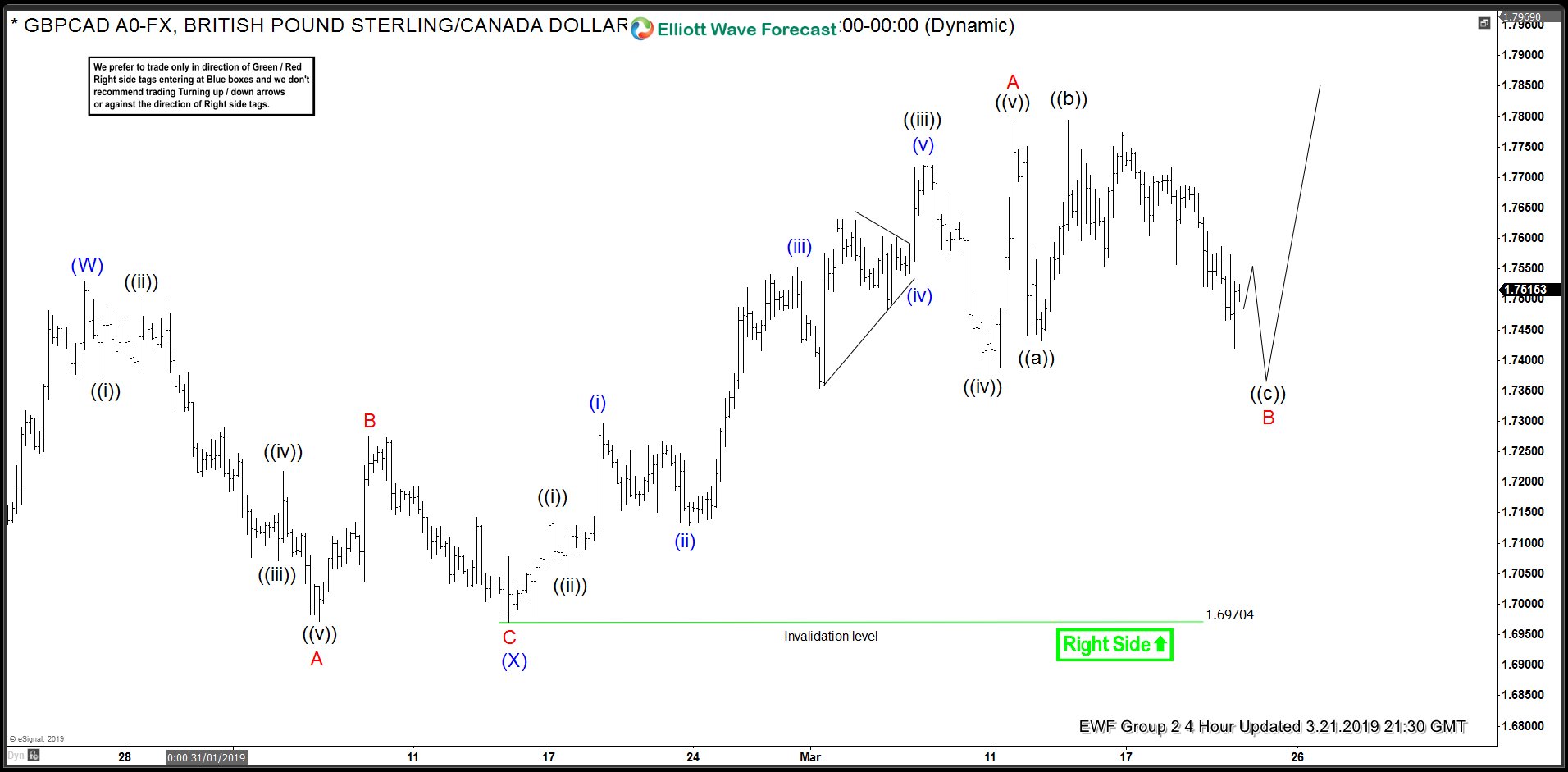

GBPCAD Found Buyers In Blue Box And Rallied

Read MoreHello fellow traders. In this technical blog we’re going to take a quick look at the Elliott Wave charts of GBPCAD. As our members know GBPCAD is showing incomplete bullish sequences in the cycle from the August 15th 2018 low. Break of the 01/25 peak made the pair bullish against the 1.697 pivot. Consequently, we advised […]

-

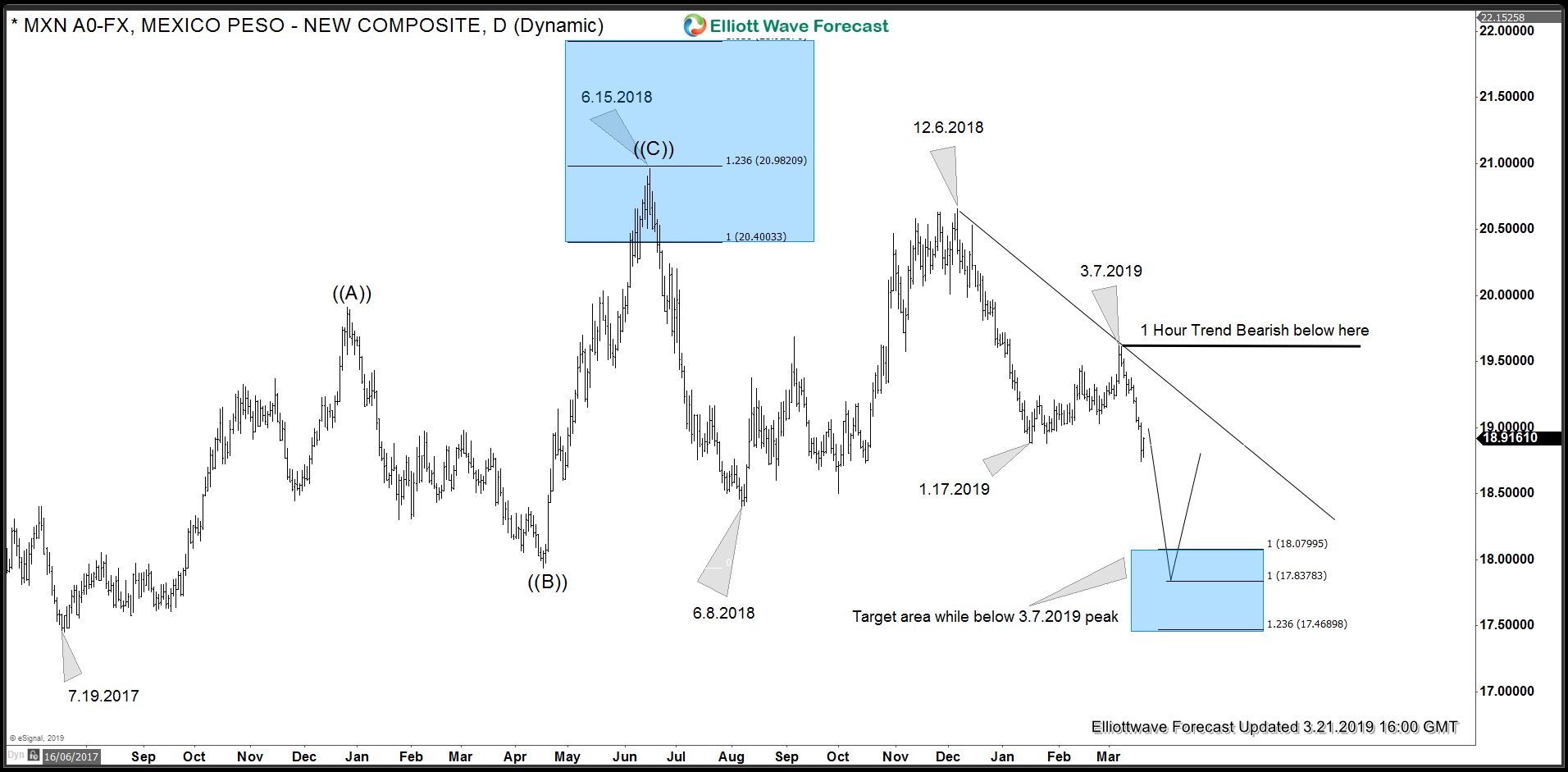

USDMXN Bearish Sequence Calling Extension Lower

Read MoreBack in September 2018, we highlighted that USDMXN Elliott wave analysis suggested bounces should fail below 6.15.2018 peak for extension lower. The bounce did fail below 6.15.2018 peak as pair formed a secondary peak on 12.6.2018 and turned lower. Cycle from 12.6.2018 peak ended on 1.17.2019 and pair bounced to correct the decline from 12.6.2018 peak. […]

-

Fed’s Policy U-Turn Deters Dollar Bulls – US Dollar Weakness Ahead

Read MoreAfter repeated rebuke by President Trump, the Fed has completely capitulated. Following the two-day meeting, the Fed has scaled back their projected interest rates rise to zero this year. This reflects the concern about slowing economic growth, global market uncertainty, financial market volatility, and muted inflation. Below is Fed Chairman Jerome Powell’s press release Powell: […]

-

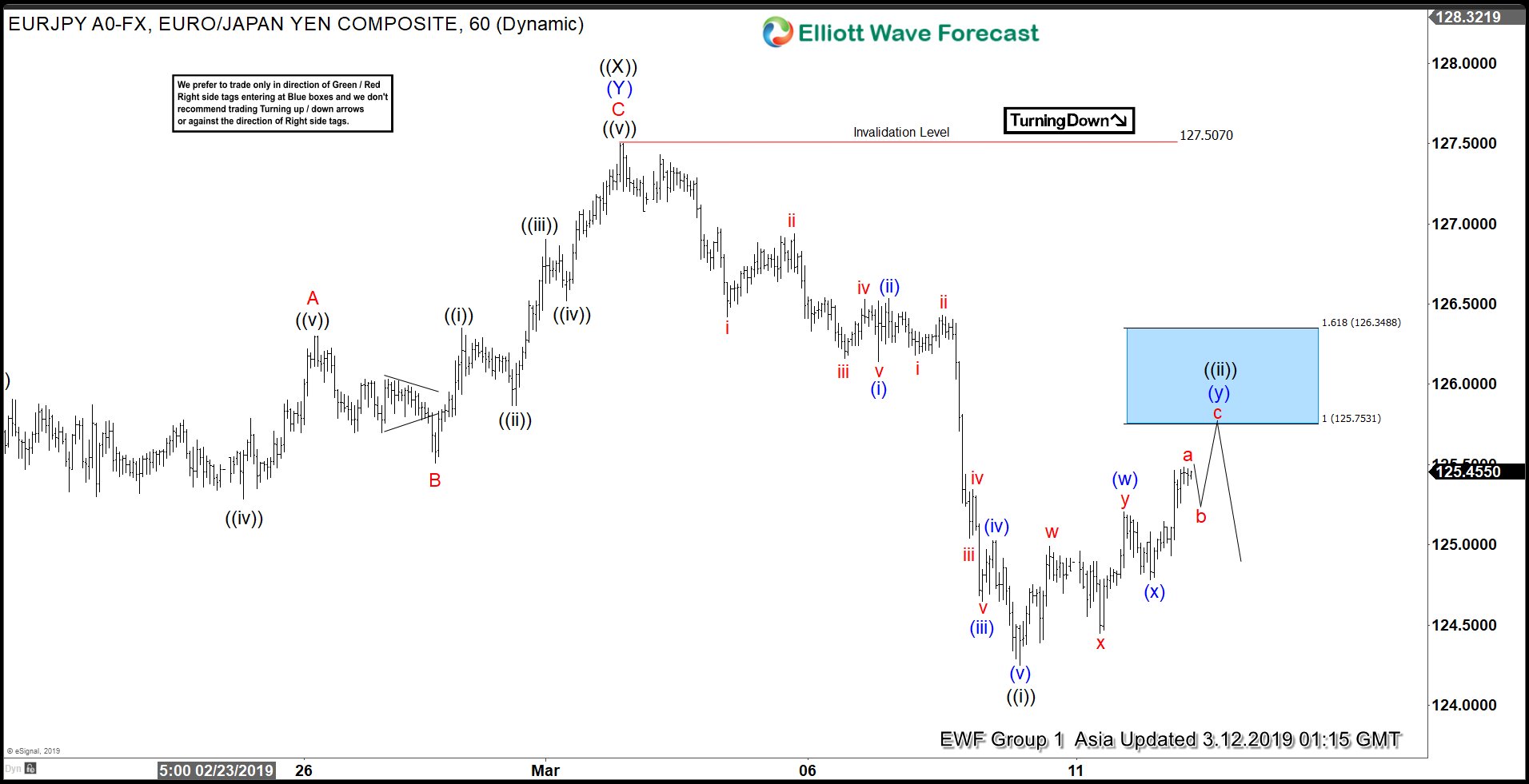

Elliott Wave View: EURJPY Should Extend Lower

Read More$EURJPY has ended cycle from Jan 2019 low, and pair can be in early process of turning lower. This article and video explains the Elliott Wave path.

-

Elliott Wave Analysis: Trading EURGBP with Right Side System

Read MoreIn this blog, I want to share with you some Elliott Wave charts of EURGBP which we presented to our members recently. You see the 1-hour updated chart presented to our clients on the 03/09/19. The higher degree trend of the pair is to the downside. So our members know that the right side is to the downside. […]

-

Elliott Wave View: EURUSD Breaks Down After ECB Meeting. What’s Next?

Read MoreThis article and video explains the short term Elliott Wave path for EURUSD. The pair now shows bearish sequence favoring further downside.