In this technical blog, we will look at the past performance of the 4-hour Elliott Wave Charts of NZDJPY. In which, the rally from 24 March 2023 low unfolded as an impulse sequence and showed a higher high sequence. Therefore, we knew that the structure in NZDJPY is incomplete to the upside & should extend higher. So, […]

-

Elliott Wave View: EURUSD Remains Bearish in Shorter Cycle

Read MoreEURUSD sequence remains bearish since topping on February 2018. This article and video describes the short term Elliott Wave path for the pair.

-

Low New Zealand Inflation Rate Increases Chance of a Rate Cut

Read MoreNew Zealand CPI (Consumer Price Index) only grew by 0.1% in the three months to March with annual increase of 1.5%. This is well below the 0.3% rate expected by the market. The RBNZ (Reserve Bank of New Zealand) annual inflation target is between 1%-3%. The latest result falls at the lower end of the […]

-

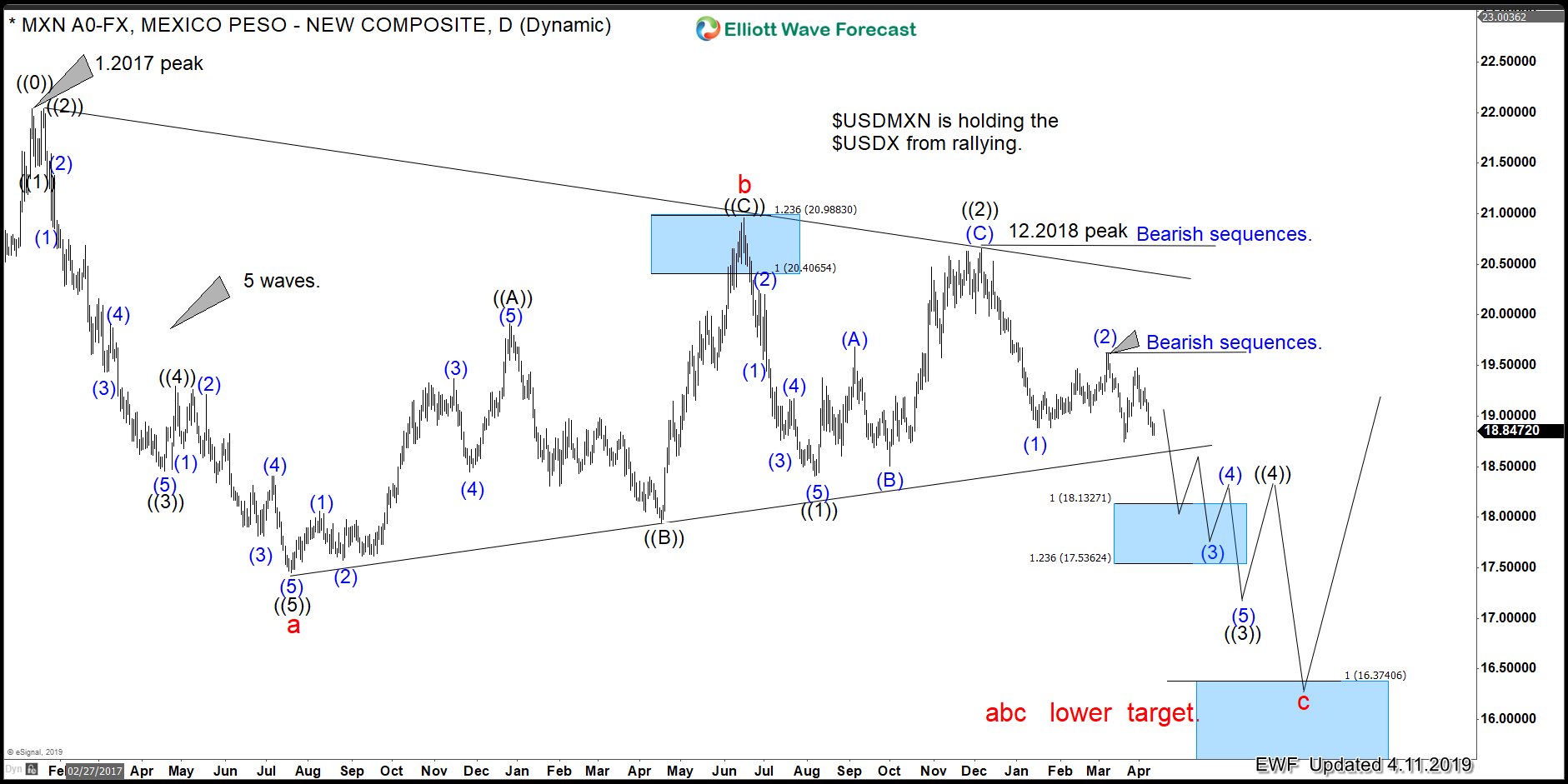

USDMXN Is Holding Down the USDX from Rallying

Read MoreIn today’s blog, we will have a look between the relationship of the Dollar Index and the Mexican Peso. The USDMXN has been trading in the same direction as the Dollar Index and both have peaked in January 2017. As you can see in the following chart below. Dollar Index vs USDMXN 04/11/2019 Weekly Chart […]

-

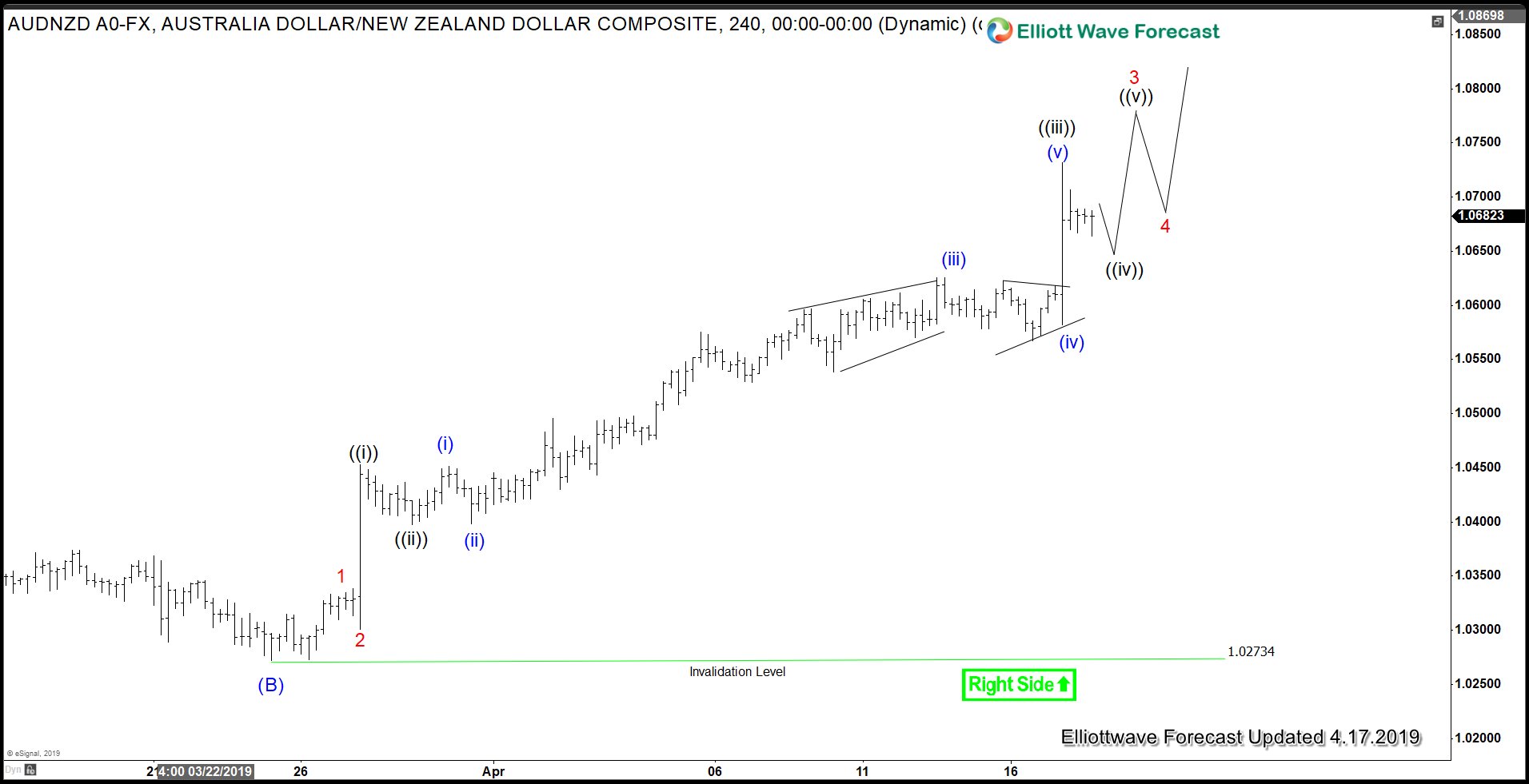

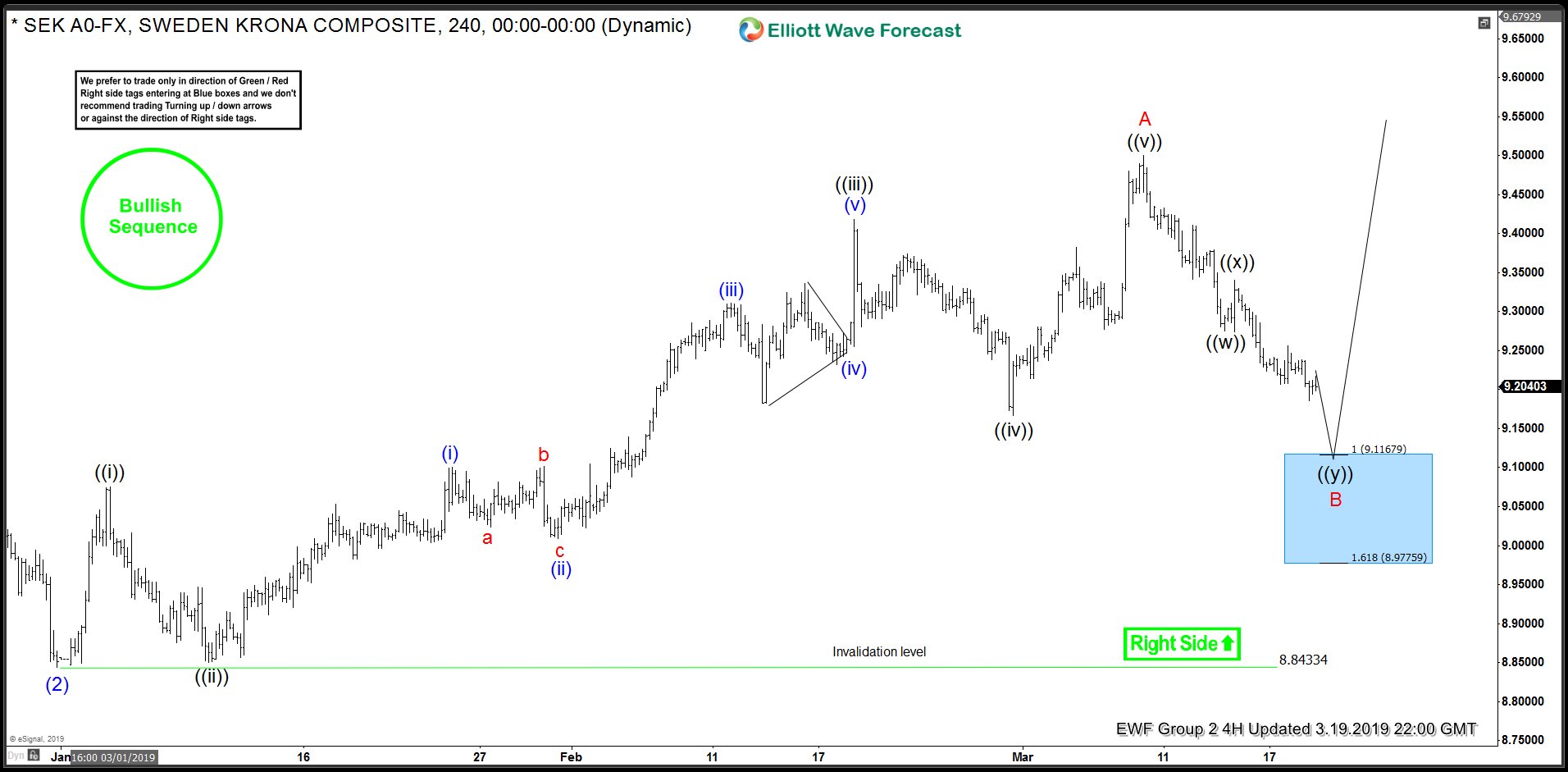

Elliott Wave Analysis: USDSEK Rally From Blue Box

Read MoreWelcome traders, today we will look at a couple of USDSEK pair charts.The following analysis will show how profitable and efficient it can be to trade with our philosophy and basic Elliott Wave analysis. First of all, we start on March 19 2019 with a 4-hr chart presented to our members. At the time, we maintained a […]

-

Bitcoin Jumps Sharply by 23%. Is the Bear Market Over?

Read MoreToday the price of Bitcoin suddenly jumped a massive 23% within 2 hours to reach the highest level in 4 months. The crypto-currency has also added over $14 billion to its market value in the last 24 hours. This ended the consolidation since last December at $3122 and provided relief for the bulls. A large […]

-

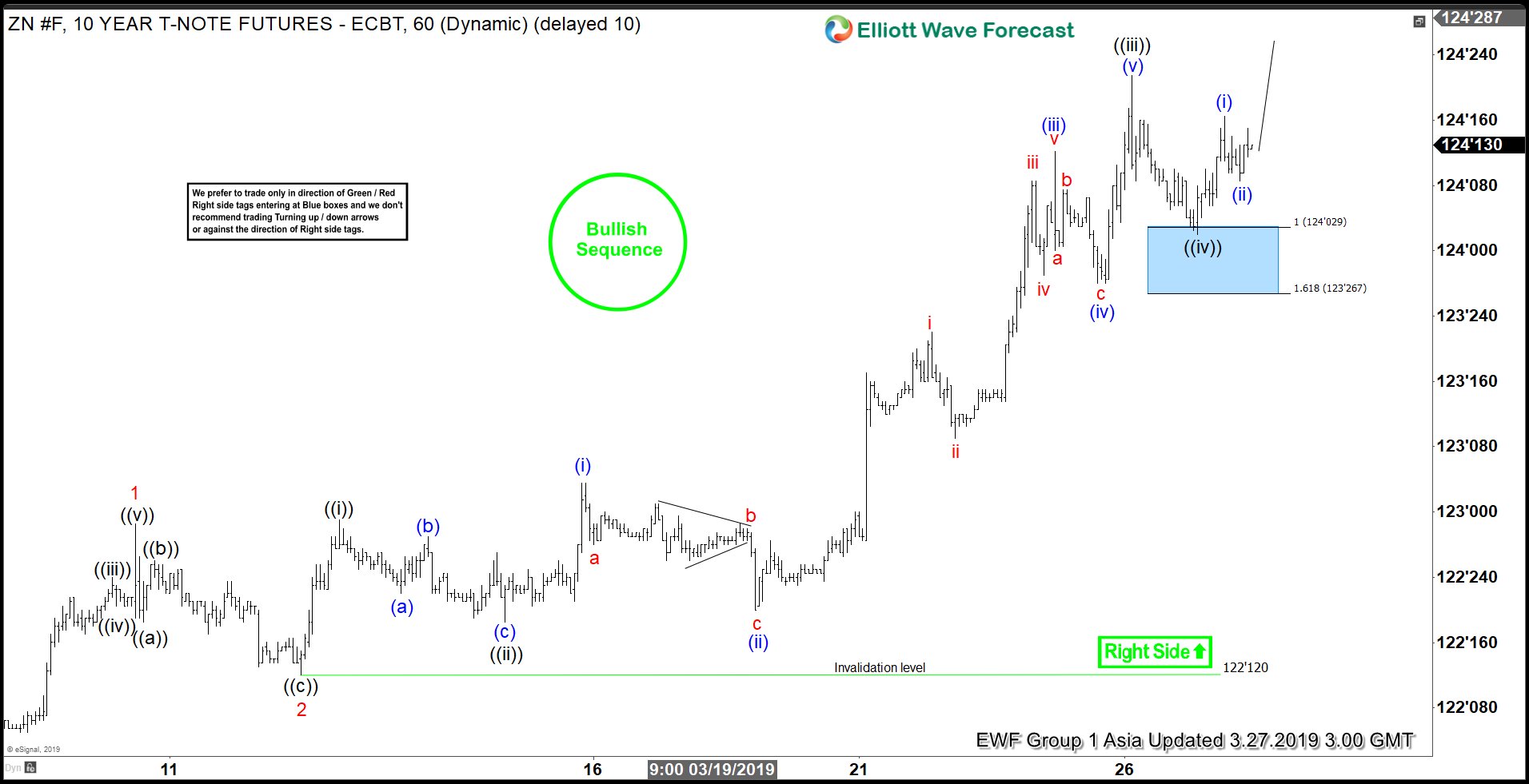

Elliott Wave View: Further Strength Ahead for 10 Year Notes (ZN_F)

Read MoreTen Year Notes (ZN_F) has rallied impulsive from January 18, 2019 low. This article & video explains the short term Elliott Wave path of ZN_F.